Updated 4/13/25

AbbVie Inc. (ABBV) stands out as a well-established pharmaceutical company delivering consistent income and long-term growth potential. With a forward dividend yield of 3.75% and 11 consecutive years of dividend increases, it continues to prioritize shareholder returns while navigating the post-Humira landscape. Its expanding portfolio—driven by strong performances from Skyrizi, Rinvoq, and a growing neuroscience segment—has helped offset biosimilar pressures. Led by newly appointed CEO Robert Michael, AbbVie is leaning into pipeline development and strategic acquisitions. Despite recent stock volatility, cash flow remains strong, supporting both its dividend and future investments.

Recent Events

AbbVie’s story lately has revolved around navigating life after Humira’s exclusivity. As expected, biosimilar competition is chipping away at what used to be a major revenue stream. But that’s just one side of the coin. On the other side, we’re seeing new stars rising in its portfolio. Drugs like Skyrizi and Rinvoq are quickly becoming the backbone of future growth, with management projecting over $27 billion in combined revenue from those two by 2027. That’s not just plugging a hole—it’s building a new engine.

The company also isn’t shy about acquisitions. It recently announced deals to acquire Cerevel Therapeutics and ImmunoGen, moves that strengthen its neuroscience and oncology businesses. These aren’t just growth for growth’s sake—they’re calculated steps toward diversifying future cash flows.

Financially, AbbVie is holding strong. Revenue climbed 5.6% year-over-year, and the company is still throwing off serious amounts of cash. Operating margin stands at a healthy 36.7%, while return on equity comes in at a standout 62.3%. With about $20 billion in levered free cash flow over the past 12 months, the dividend continues to look well supported.

Yes, debt remains high—around $68 billion. But it’s a manageable load given how much cash AbbVie pulls in. They’ve proven they can handle it while still delivering steady income to shareholders.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.75%

💸 Forward Dividend Rate: $6.56 per share

📅 Next Dividend Date: May 15, 2025

⚠️ Payout Ratio (Trailing): 259.41%

🕒 Ex-Dividend Date: April 15, 2025

📊 5-Year Average Yield: 3.99%

🧾 Trailing Dividend Rate: $6.29

🔁 Dividend Frequency: Quarterly

These numbers point to a dividend that’s not just generous, but consistent. The kind of income that dividend-focused investors can plan around.

Dividend Overview

AbbVie’s dividend isn’t just a feature of its stock—it’s part of its identity. A 3.75% forward yield puts it well above the broader market average, and it’s been making these payouts like clockwork. The next dividend’s coming in May, and those holding shares by the April 15 ex-dividend date will be in line to receive it.

Even more compelling is AbbVie’s low volatility. With a beta of 0.54, it tends to move less than the market overall. That can be a comfort for those looking for stability alongside their income.

Now, the raw payout ratio might look concerning at first—over 259% based on trailing GAAP earnings. But that doesn’t tell the whole story. Non-cash accounting items like amortization of intangible assets make the official earnings number less reflective of what’s really going on. Look at cash flow instead: AbbVie generated nearly $19 billion in operating cash flow over the past year. That’s what’s funding the dividend.

In short, the dividend is covered—not just by accounting trickery, but by real dollars coming through the door.

Dividend Growth and Safety

One of the most attractive parts of AbbVie’s dividend story is its growth track record. Since its split from Abbott, it has raised its dividend every single year. That’s 11 straight years of increases, with a five-year average growth rate over 8%. That’s the kind of history that builds trust.

Last year, the company bumped up the dividend by 4.7%. While not as large as past hikes, it’s a smart move considering the company’s recent acquisitions and investment in new product lines. Management is clearly balancing shareholder rewards with long-term business strength.

Even with a chunky dividend, AbbVie still keeps the lights on just fine. Free cash flow supports the payouts, and even though debt is high, the company has plenty of room to maneuver. The current ratio, which is just 0.66, shows that short-term liquidity is tight, but this is a company that knows how to operate in a lean, capital-efficient way.

There’s something reassuring about the predictability here. Despite changing drug portfolios, shifting regulatory environments, and big-ticket M&A deals, AbbVie keeps the dividend flowing. For dividend investors, that level of consistency is worth its weight in gold.

The bottom line? AbbVie continues to deliver for those who prioritize income, all while reshaping itself for a future beyond its legacy blockbuster. This isn’t a flashy growth stock, but for investors who appreciate steady payouts backed by real cash flow, it’s one that deserves a close look.

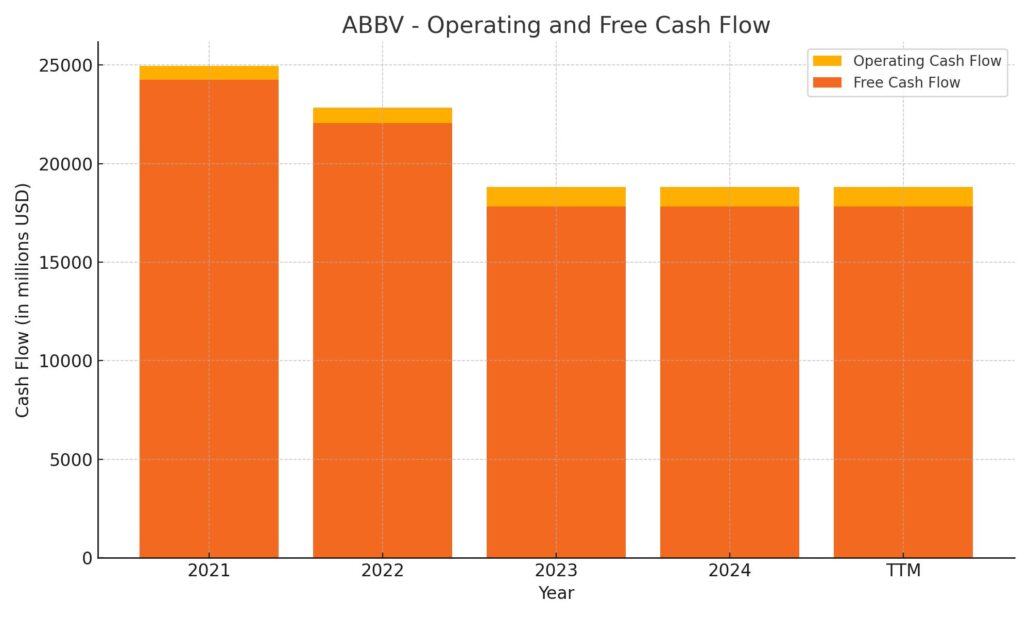

Cash Flow Statement

AbbVie’s trailing twelve-month cash flow tells a story of robust operational strength coupled with aggressive investment activity. The company generated $18.8 billion in operating cash flow, a solid figure that highlights its ability to consistently convert revenue into real, usable capital. After subtracting $974 million in capital expenditures, free cash flow came in at $17.8 billion—still strong, though lower than in prior years. This supports ongoing dividends and leaves room for strategic reinvestments, even with declining contributions from legacy products.

Where the shift is most visible is in investing cash flow, which came in at a sharp negative $20.8 billion. That reflects AbbVie’s capital allocation toward acquisitions and pipeline expansion, marking a clear pivot into growth areas like neuroscience and oncology. On the financing side, the company paid down $14.6 billion in debt but also raised nearly $22 billion through new issuances, showing a deliberate reshuffling of its capital structure. With a final cash position of $5.5 billion, down from $12.8 billion the year prior, AbbVie has leaned heavily into spending—but with a purpose. The cash flow profile shows a mature, cash-rich business deploying resources for long-term positioning, even as it maintains a commitment to shareholder returns.

Analyst Ratings

📉 AbbVie has recently seen a mix of analyst actions, reflecting a nuanced view of its current position and future prospects. Goldman Sachs downgraded the stock to Neutral from Buy, adjusting the price target to $194. This change was influenced by the belief that the market has already priced in the growth potential of key drugs like Skyrizi and Rinvoq. Additionally, concerns were raised about the aesthetics division facing challenges due to economic pressures and increased competition in the injectable market.

📈 On the other hand, Morgan Stanley maintained its Overweight rating and slightly increased the price target to $241, pointing to confidence in AbbVie’s robust pipeline and consistent execution. Wells Fargo also kept an Overweight rating, raising its target from $210 to $240, citing strong momentum in immunology and oncology segments.

💬 Currently, the consensus among analysts leans toward a positive outlook, with an average price target around $210.71. That suggests there’s still room for upside from current levels, especially if AbbVie continues to show resilience in its core franchises while successfully executing on newer therapies and pipeline developments.

Earning Report Summary

AbbVie ended 2024 on a strong note, showing the kind of steady performance that gives investors a reason to stay tuned. In the fourth quarter, the company pulled in $15.1 billion in revenue, up about 5.6% compared to the same time last year. Full-year revenue came in at $56.3 billion. Adjusted earnings per share for the year landed at $10.12, which, while slightly down from the previous year, still came in above expectations. That’s a solid result considering the company is navigating a major shift in its product mix.

Immunology Carries the Torch

Humira’s long-anticipated decline continues, with Q4 sales dropping 49% as biosimilars grab more market share. That hit was expected, but the good news is that AbbVie’s newer drugs are more than pulling their weight. Skyrizi saw a huge 58% jump in sales to $3.78 billion for the quarter, and Rinvoq wasn’t far behind, growing 46% to $1.83 billion. These two are fast becoming the new backbone of AbbVie’s immunology segment, and management is confident they’ll be key growth drivers moving forward.

Strength Beyond Humira

It wasn’t just immunology doing the heavy lifting. The neuroscience division posted nearly 20% growth, pulling in $2.5 billion in revenue thanks to strong demand for treatments like Botox Therapeutic and Vraylar. Oncology results were more mixed—Venclexta climbed 11%, while Imbruvica took a slight step back, down 6%. Meanwhile, the aesthetics side of the business had a bit of a rough patch. Sales in that segment dropped by just over 5%, pressured by softer demand in both the U.S. and China.

Leadership’s Take on the Quarter

AbbVie’s new CEO, Robert Michael, struck a confident tone about where the company is headed. He pointed to strong execution across their growth platforms and the momentum in their pipeline. According to him, 2024 wasn’t just about managing through Humira’s loss of exclusivity—it was also about laying the foundation for what comes next. With key regulatory wins, promising clinical data, and some well-timed acquisitions, AbbVie seems to be playing the long game.

Guidance for the Year Ahead

Looking toward 2025, the company expects adjusted earnings to fall between $12.12 and $12.32 per share. That kind of guidance reflects a certain level of optimism—not just about the newer therapies, but about AbbVie’s ability to manage through the shifts in its portfolio. Leadership has also suggested that they’re on track for high single-digit revenue growth through the end of the decade.

All in all, the most recent quarter showed a company in transition, but not one that’s losing its footing. The growth in newer segments is starting to outweigh the losses in legacy ones, and AbbVie’s focus on innovation, cash flow, and execution seems to be paying off.

Chart Analysis

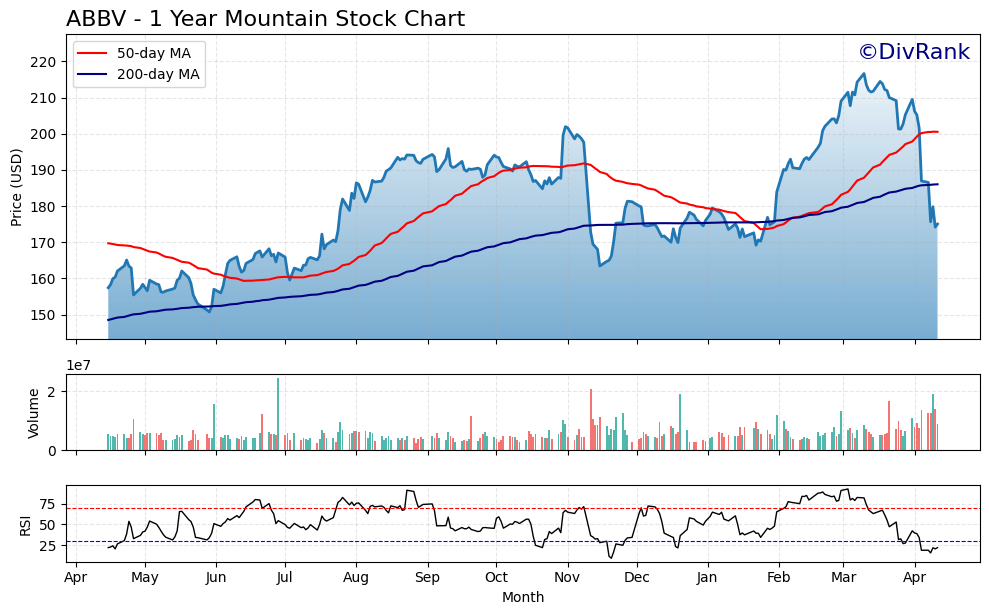

AbbVie (ABBV) has had a dynamic run over the past year, and this chart paints a pretty clear picture of how sentiment has shifted over time. There’s a strong uptrend that held from mid-2023 into early 2024, but the recent breakdown tells a different story. Let’s break it down a bit more closely.

Price and Moving Averages

For much of the last 12 months, ABBV followed a healthy trend, particularly from May through December. Price moved steadily above the 200-day moving average, which is a longer-term signal of strength. That upward slope in the 200-day MA through the winter suggested ongoing positive momentum. The 50-day moving average turned bullish around late July, pushing above the 200-day in what’s often seen as a technical confirmation of trend.

But things have changed recently. The 50-day line has flattened and started to curve down, while price sharply broke beneath both the 50- and 200-day moving averages. That kind of move usually indicates growing weakness or at least a pause in the upward momentum. The quick drop in April stands out, especially considering how the stock had been trending steadily just weeks before.

Volume

There’s an uptick in volume during the recent drop, which adds weight to the price action. Heavier volume on down days tends to show stronger conviction from sellers, rather than just profit-taking or random volatility. This wasn’t a quiet pullback—it looks like investors stepped aside or exited positions more aggressively. Earlier in the year, volume during upward moves was solid but less aggressive, showing a more gradual accumulation.

RSI

The relative strength index has slid into oversold territory as of early April. That dip below 30 is usually a sign that selling pressure has pushed too far too fast. It’s worth watching closely here—RSI alone doesn’t mean a bounce is guaranteed, but combined with price action, it can hint at short-term exhaustion. If the RSI recovers while price stabilizes, that could open the door to a potential reversal, but so far it hasn’t shown signs of firming up.

Overall Look

The chart shows a stock that had strong long-term support for most of the past year, but has recently run into pressure that’s breaking down some of that structure. Price breaking beneath key moving averages and a sharp dip in RSI suggest this isn’t just a blip—it’s a shift in tone. The fundamentals might still be there, but from a chart perspective, the momentum has definitely cooled off.

This isn’t the time for chasing rallies. It’s more about watching closely for signs of stabilization, especially around the $170 area, which has seen prior support. If the stock can hold there and rebuild, that might mark the end of this short-term weakness. Otherwise, further downside can’t be ruled out just yet.

Management Team

AbbVie’s leadership has seen a key shift recently with Robert A. Michael stepping into the CEO role in early 2024. Michael has been with the company in various executive positions for years, having also worked within Abbott Laboratories before AbbVie became its own entity. His deep familiarity with the business and strategic direction gives the company continuity as it moves into a new era post-Humira.

The broader executive team brings a balanced mix of scientific, commercial, and financial experience. Roopal Thakkar, M.D., serves as Chief Scientific Officer and plays a central role in the company’s research and development efforts. Scott T. Reents, the Chief Financial Officer, helps guide the company’s financial discipline during an important investment phase. Jean-Michel Dautrain oversees global commercial operations and is responsible for ensuring AbbVie’s therapies reach markets efficiently across geographies. Together, this leadership group continues to focus on growth while navigating a fast-changing healthcare landscape.

Valuation and Stock Performance

As of April 2025, AbbVie’s stock trades around $175, giving the company a market cap close to $310 billion. Over the last year, the stock has had its share of ups and downs, ranging from a low near $153 to a high of $218. Some of the volatility has been tied to broader market shifts, but part of it reflects changing expectations around AbbVie’s future cash flows now that Humira is no longer its primary engine.

On valuation, opinions are mixed. The trailing price-to-earnings ratio appears elevated when compared to peers, but that number is skewed by some one-time items and non-cash charges. The forward P/E looks more reasonable, especially considering the company’s strong pipeline and consistent free cash flow generation. The average analyst price target is currently hovering around $210, which implies there’s still some upside if execution remains strong.

Risks and Considerations

While AbbVie is in a solid position overall, there are several risks worth being mindful of. The most obvious is the loss of market exclusivity for Humira, which has already started to show up in earnings. Biosimilar competition in the U.S. and abroad will continue to pressure sales. The company’s next-generation immunology drugs, Skyrizi and Rinvoq, are growing quickly, but they’re also facing increasingly competitive markets. Continued growth will require flawless execution and possibly more regulatory wins.

There’s also the macro environment to consider. Any shifts in U.S. healthcare policy, especially around drug pricing or import tariffs, could affect revenue and profit margins. On the balance sheet, AbbVie carries a significant amount of debt, largely tied to acquisitions. Interest rate increases make that debt more expensive to service. The company still generates strong free cash flow, but it does put a spotlight on capital allocation going forward.

Final Thoughts

AbbVie finds itself in an important phase. The transition away from a Humira-dominated portfolio is well underway, and newer drugs are picking up steam at a promising pace. The recent leadership changes appear to be smooth, and the company remains focused on strengthening its pipeline while also managing operational and financial complexity.

While there are headwinds, especially on the competitive and regulatory front, AbbVie’s diversification efforts across immunology, oncology, and neuroscience give it multiple levers to pull. With a mix of steady cash flow, strong product launches, and a clear leadership vision, the company appears positioned to evolve through this next chapter with confidence.