Updated 4/14/25

A. O. Smith (AOS) is a global leader in water heating and treatment solutions with a strong presence across North America, China, and India. The company has a track record of delivering consistent financial performance, supported by a disciplined management team, strong free cash flow, and a commitment to shareholder returns. Over the past year, the stock has pulled back from its highs, trading near $64 with a forward dividend yield of 2.11%. Despite softer demand in China and headwinds in North America, A. O. Smith continues to increase its dividend and invest in long-term growth areas like water purification. With 30 consecutive years of dividend increases, a conservative payout ratio, and a stable balance sheet, the company remains positioned to weather short-term volatility while continuing to return capital to shareholders.

Recent Events

Over the past year, A. O. Smith’s stock has taken a bit of a hit, dropping about 24% from its 52-week high of $92.45 to its current range in the mid-$60s. It’s a move that reflects broader economic pressures more than anything company-specific. A cooling real estate market in China and softening demand in certain segments have led to a 7.7% drop in revenue and a 20.1% decline in earnings growth year over year.

Even so, A. O. Smith has continued to deliver where it matters most to dividend-focused investors—raising its dividend without missing a beat. The company isn’t trying to dazzle anyone with huge swings or splashy news. It’s sticking to what it does best and quietly rewarding long-term shareholders who value consistency over headlines.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.11%

💵 Annual Dividend Rate: $1.36 per share

🔄 Payout Ratio: 35.81%

📊 5-Year Average Dividend Yield: 1.72%

📆 Next Dividend Date: May 15, 2025

⏳ Ex-Dividend Date: April 30, 2025

📉 Consecutive Years of Dividend Increases: 30

Dividend Overview

A. O. Smith’s current yield of 2.11% might not turn heads on its own, but there’s more here than meets the eye. That yield is actually above its five-year average of 1.72%, largely due to the recent dip in share price. The company hasn’t cut its dividend—in fact, it’s been doing the opposite. That bump in yield is an opportunity for investors who prioritize growing income streams.

The payout ratio of just under 36% offers plenty of room for future increases. It’s a level that suggests management is balancing shareholder returns with ongoing investments in the business. More importantly, this dividend isn’t being paid out of hope or borrowed funds—it’s backed by real cash flow. Over the past twelve months, A. O. Smith generated $390 million in free cash flow, giving it more than enough room to cover its $1.36 per share dividend.

That cash strength adds a layer of confidence. When a company generates consistent cash like AOS does, investors can breathe a little easier knowing the dividend is more than just a line item—it’s a genuine priority.

Dividend Growth and Safety

This is where the company stands out. A. O. Smith has raised its dividend every year for three decades. That kind of consistency is rare and signals a long-term commitment to rewarding shareholders. Over the past five years, dividend growth has averaged in the double digits—solid numbers for a company this size and maturity.

And even with that growth, the payout ratio has remained steady, hovering around the mid-30% range. That tells you management isn’t overextending. They’re raising the dividend at a sustainable pace, not just to make a splash but because they can.

The balance sheet also plays a big role in dividend safety. AOS carries just $228.5 million in total debt, which is modest given its $9.26 billion market cap. Cash on hand is a healthy $276 million, giving the company a solid financial cushion. The debt-to-equity ratio is low at just over 12%, and liquidity remains strong with a current ratio of 1.55. There’s no red flag here, just sound financial stewardship.

Then there’s profitability. With a 28.63% return on equity and a 13.53% return on assets, A. O. Smith is clearly getting strong results from its investments. This efficiency feeds directly into its ability to sustain and grow its dividend over time.

One more thing that quietly supports the dividend is the company’s habit of buying back shares. It’s not flashy, but it reduces the share count over time, which helps keep dividend costs manageable and boosts earnings per share. That, in turn, reinforces dividend sustainability.

For investors who value stable, growing income, A. O. Smith continues to look like a well-run, dependable option—especially during a time when many companies are cutting back.

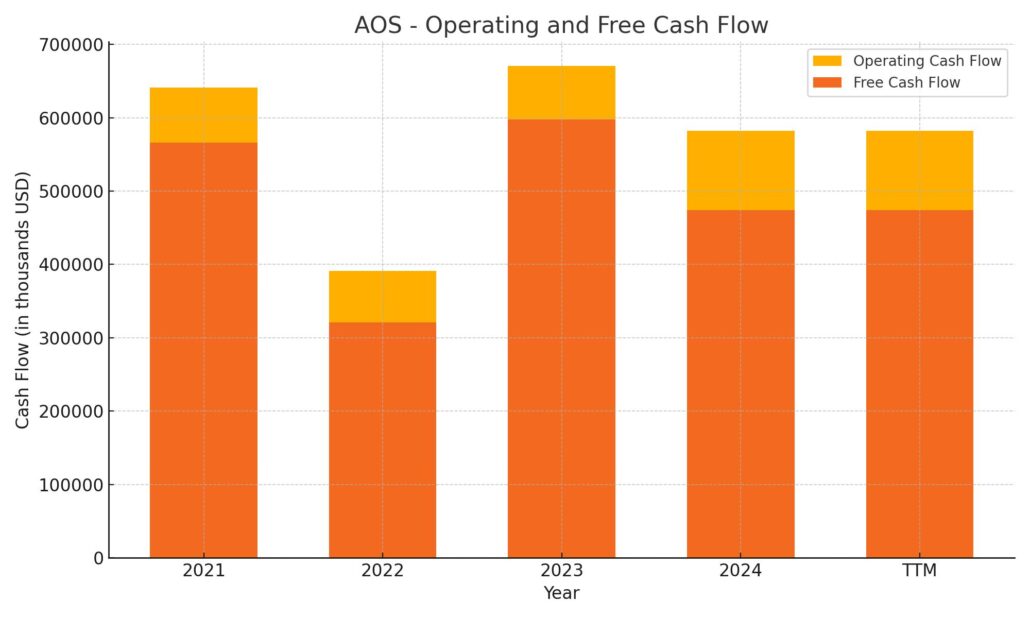

Cash Flow Statement

A. O. Smith’s cash flow profile over the trailing twelve months reflects a disciplined and consistent operation. The company generated $581.8 million in operating cash flow, a slight dip from the previous year’s $670.3 million but still comfortably in line with historical averages. Capital expenditures came in at $108 million, leaving the company with $473.8 million in free cash flow—plenty of cushion to fund dividends, buybacks, and any opportunistic investments.

On the financing side, outflows totaled $408.4 million, primarily due to continued share repurchases, which accounted for $305.8 million. This marks another year of A. O. Smith using its cash to return value to shareholders. The company’s cash position has decreased over time, with $239.6 million remaining at the end of the period, down from $339.9 million a year earlier. Despite that, the current cash balance remains adequate given the company’s low debt and consistent cash generation.

Analyst Ratings

📈 A. O. Smith (NYSE: AOS) has seen a few shifts in analyst sentiment lately, reflecting the balance between its long-term strengths and near-term pressures.

⬆️ In January 2025, Oppenheimer upgraded AOS from “Market Perform” to “Outperform,” pointing to the company’s strong fundamentals and resilience in a softer demand environment. The price target was adjusted to $84 from a previous $88—not a huge jump, but enough to signal growing confidence in the company’s recovery path.

➖ UBS took a more cautious approach, keeping its “Neutral” rating while trimming its price target from $80 to $74. Their rationale centered around some lingering concerns over international exposure and macroeconomic softness, particularly in China.

📉 Citigroup echoed similar caution. They maintained a “Neutral” stance and lowered their target slightly to $73 from $78, signaling a wait-and-see attitude as the company works through some short-term challenges.

✅ Stifel Nicolaus, meanwhile, reaffirmed its “Buy” rating but scaled back its price target from $90 to $84. They highlighted strong cash flow and shareholder-friendly capital allocation but noted that broader market sentiment may keep a lid on upside for now.

🎯 The current consensus 12-month price target across covering analysts sits around $75.50, with the highest estimate at $84 and the lowest at $60. Overall, the stock carries a “Hold” consensus, indicating analysts expect performance in line with the market.

Earning Report Summary

Slower Finish to the Year

A. O. Smith wrapped up 2024 with results that came in a bit lighter than expected. Revenue for the fourth quarter hit $912 million, which marked an 8% drop compared to the same stretch a year ago. Earnings followed suit, with adjusted EPS slipping to $0.85 from $0.97. The softness was mostly tied to a drop in water heater sales in North America and continued pressure in the Chinese market—two themes that have been dragging on performance for a few quarters now.

North America, which is A. O. Smith’s biggest market, saw sales fall 7%. Lower water heater volumes were the main reason, although there was some good news too—boiler sales were up 7%, giving a bit of a lift to the segment. Operating margins in this region slipped slightly, landing at 22.4%, down from 23.5%, which isn’t unexpected given the volume headwinds and some continued investments being made on the strategic side.

International Story Still Developing

Outside the U.S., results were mixed. Sales in the Rest of World segment dropped 9%, mostly due to the ongoing slump in China. That market continues to be a challenge, and it weighed on margins as well—adjusted operating margin dropped to 8.1%, compared to 11.5% the year before. On a brighter note, India was a standout performer, showing an 11% gain in local currency sales. The demand there continues to build, and management sees it as a real growth engine moving forward.

Staying on Solid Ground

Despite the choppy top-line numbers, A. O. Smith’s financial position remains solid. The company generated $581.8 million in operating cash flow and delivered $473.8 million in free cash flow. That kind of cash strength gave them the flexibility to return nearly $500 million to shareholders through dividends and stock buybacks.

A notable move in the quarter was the completion of their acquisition of Pureit, a water purification business. It’s a strategic expansion that builds on A. O. Smith’s position in global water treatment, a space they’ve been leaning into more over the past few years.

What’s Next

Looking ahead, management struck a steady tone. They’re guiding for earnings per share in the $3.60 to $3.90 range for 2025 and expect sales to be relatively flat to slightly up. The U.S. market should remain stable, India is expected to continue growing, and China will likely stay bumpy for a while longer.

The overall focus is still on expanding product offerings, keeping a healthy balance sheet, and making the most of opportunities in water treatment. While the quarter wasn’t a home run, the company is clearly positioning itself for longer-term resilience.

Chart Analysis

Price Trend and Moving Averages

The chart for AOS over the past year shows a steady downtrend that began in late October. The 50-day moving average (red line) crossed below the 200-day moving average (blue line) in early November, forming a death cross—a classic signal of bearish momentum. Since then, the price has remained below both moving averages, with the 50-day acting as firm resistance. The latest price action in early April shows a short-term bounce from recent lows, but the broader trend is still pointing downward.

This prolonged slide, from highs above $90 down into the low $60s, has eroded a lot of the prior year’s gains. However, this can sometimes present a window for those looking for undervalued opportunities, especially when the underlying business fundamentals remain intact.

Volume Behavior

Volume has remained relatively steady throughout the year, with occasional spikes during periods of sharp moves—both up and down. Notably, there was increased volume during the recent dip in early April, which could suggest capitulation selling or the start of renewed interest at lower levels. Either way, it’s a shift worth watching, especially if it coincides with continued price strength.

RSI and Momentum

The Relative Strength Index (RSI) has spent a good portion of the year in neutral to oversold territory. It briefly approached overbought levels in October and again in February but was quickly pulled back. Most recently, RSI dipped below 30 and then bounced, suggesting the stock was technically oversold and due for a rebound, which aligns with the price lift seen in early April.

The pattern of repeated RSI bounces from below 30 may indicate that downside momentum is slowing, but it hasn’t yet translated into a trend reversal. Without a clear break above the moving averages, it remains more of a short-term recovery within a broader downtrend.

Overall Takeaway

The stock has clearly struggled over the past several months, but the recent bounce, combined with a potential bottoming pattern in RSI and a pickup in volume, makes this a chart worth revisiting in the weeks ahead. Watching how it behaves around the 50-day moving average will offer clues about whether this is just another relief rally or the start of something more constructive.

Management Team

A. O. Smith is led by Kevin J. Wheeler, who currently serves as Chairman and CEO. He’s been with the company since 1994, which gives him deep institutional knowledge and a steady hand at the helm. His leadership style reflects a blend of operational expertise and long-term strategic focus, which has helped guide the company through both steady growth phases and more turbulent periods.

Joining the leadership team more recently is Stephen Shafer, who stepped into the role of President and COO in 2024. He brings a fresh perspective from his previous work at 3M, with a strong background in global operations and product innovation. The team is rounded out by Charles T. Lauber, Executive Vice President and CFO, and James F. Stern, who serves as Executive Vice President, General Counsel, and Secretary. Together, this group maintains a balanced focus on financial strength, operational efficiency, and governance. The board includes a mix of internal leaders and independent directors, helping maintain oversight and strategic direction.

Valuation and Stock Performance

A. O. Smith’s stock is currently trading around $64.50, which puts it well below its 52-week high of $92.45. That decline of roughly 30 percent reflects both broader market pressures and some company-specific headwinds, particularly in international markets like China. Despite the drop, the valuation remains fairly grounded. The trailing price-to-earnings ratio is 17.77, while the forward-looking P/E is slightly lower at 16.86. Both suggest the stock is not stretched by historical standards and could offer reasonable value at these levels.

Looking beyond earnings, the company’s price-to-sales ratio stands at 2.48 and the price-to-book ratio at 4.92—both within normal ranges for its industry. Analyst sentiment has remained relatively neutral, but the consensus 12-month price target is still around $70.42. That implies moderate upside if current conditions stabilize or improve. A. O. Smith also continues to return capital to shareholders through dividends and share repurchases. With a forward annual dividend yield of 2.11% and a payout ratio of just under 36%, it’s clear the company is maintaining a disciplined and sustainable dividend strategy while still investing back into the business.

Risks and Considerations

There are several factors worth watching when it comes to A. O. Smith’s future performance. One of the more prominent risks lies in its exposure to the Chinese market. Slower economic growth and evolving regulatory frameworks in that region can introduce volatility to both sales and margins. While China presents a long-term opportunity, it also adds a layer of uncertainty in the near term.

The North American market, which remains core to the business, is also relatively mature. Growth there is more incremental, and competition is steady. The company needs to continue innovating in areas like energy efficiency and water treatment to stay ahead. Rising raw material costs, labor constraints, and potential supply chain hiccups are also important to monitor. On top of that, fluctuations in global currencies could impact results, especially as the company continues to expand internationally.

Final Thoughts

A. O. Smith has built its business on reliability, both in the products it manufactures and the way it manages operations. The leadership team combines long-standing experience with fresh perspectives, and the balance sheet remains solid. While international markets pose some near-term challenges, they also represent long-term potential. The company’s continued focus on product development, strategic acquisitions like Pureit, and disciplined capital management keeps it on solid footing.

Though the stock has underperformed over the past year, it still reflects a financially sound company with a long history of rewarding shareholders. For those with a long-term view, A. O. Smith’s consistent cash flow, strong operational base, and global presence remain key attributes as it looks to regain momentum in the years ahead.