Updated April 2025

Yum! Brands might bring to mind tacos, fried chicken, and personal pan pizzas, but for dividend-focused investors, there’s something else on the menu—consistent cash returns. Behind the storefronts of Taco Bell, KFC, and Pizza Hut is a franchise-focused business model that’s been quietly building long-term value. While it may not dominate headlines, Yum! steadily delivers for shareholders, especially those who appreciate a dependable dividend with room to grow.

The company’s model, largely franchised and capital-light, allows it to pull in healthy margins while keeping overhead in check. And lately, that model has been paying off.

Recent Events

Yum! has had a solid run over the past year, gaining over 16% and outpacing the broader market. The stock’s now trading near its 52-week high at $161.10. That’s not just market noise—it’s a reflection of strong revenue growth, up 16% year-over-year, and investor confidence in the brand’s stability.

Still, the road hasn’t been completely smooth. Earnings have slipped slightly, down 8.6% compared to the previous year. But it’s worth noting that Yum! has managed to grow through a shifting macro environment and ongoing inflationary pressures. Its focus on franchise operations continues to shield it from the volatility that burdens many operators in the consumer space.

Despite the earnings dip, management’s approach to shareholder returns hasn’t wavered. In fact, their long-standing dividend strategy remains intact and well-supported by strong free cash flow generation. For dividend investors, that’s the kind of consistency that matters more than short-term profit fluctuations.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.79%

💵 Forward Annual Dividend Rate: $2.84

🔁 5-Year Average Dividend Yield: 1.81%

💡 Payout Ratio: 51.34%

📆 Next Dividend Date: March 7, 2025

🚫 Ex-Dividend Date: February 21, 2025

📊 Dividend Growth History: Consistent and reliable

Dividend Overview

The yield might not look particularly high at 1.79%, but that doesn’t tell the whole story. It’s supported by a healthy payout ratio just above 51%, suggesting Yum! is striking a balance between rewarding shareholders and reinvesting for the future.

The real appeal lies in the dependability. Yum! doesn’t need to plow capital into real estate or expensive infrastructure like some of its peers. That leaves more room for generating free cash flow, which is the lifeblood of any dividend. Over the past year, Yum! brought in $1.69 billion in operating cash flow and turned that into $1.16 billion of levered free cash flow.

That’s more than enough to cover its dividends—and gives it breathing room for future hikes. Even though the company carries a good chunk of debt—$12.29 billion at last check—it’s not an immediate concern given the steady cash generation and low capital intensity of its operations.

Yum! also uses share buybacks alongside its dividend to return value to shareholders, a combo that has helped reduce dilution and support earnings per share growth over time. With over 279 million shares outstanding and strong institutional ownership (86.67%), there’s confidence in the stock from large, long-term investors.

Dividend Growth and Safety

This is where Yum! quietly impresses. The company has built a solid track record of dividend growth over the years, reflecting not just performance, but a real commitment to returning capital. It’s not a one-off—it’s a pattern.

The current payout ratio allows for continued increases, and the company’s high-margin, royalty-heavy business model gives it a lot of cushion. Operating margins are strong at over 30%, and it’s generating returns on assets near 25%, which is well above average.

There’s also an important nuance here. Yum!’s book value per share is negative, which might raise eyebrows on paper. But in the context of a franchiser like this, it’s not a red flag. It’s a function of how capital is allocated, and doesn’t reflect a deteriorating financial position. The real focus should be on cash flow—and that’s healthy and growing.

The dividend’s safety looks strong. Even with a temporary dip in quarterly earnings, the business continues to throw off enough cash to keep the dividend rising. The consistency of cash flow, combined with low operational risks due to its franchising model, means Yum! has the kind of stability dividend investors should appreciate.

If you’re the kind of investor who values steady, long-term income over headline-grabbing yields, Yum! Brands offers a quiet but powerful story. It’s not flashy, but it’s steady—and in the dividend world, that can be just as rewarding.

Cash Flow Statement

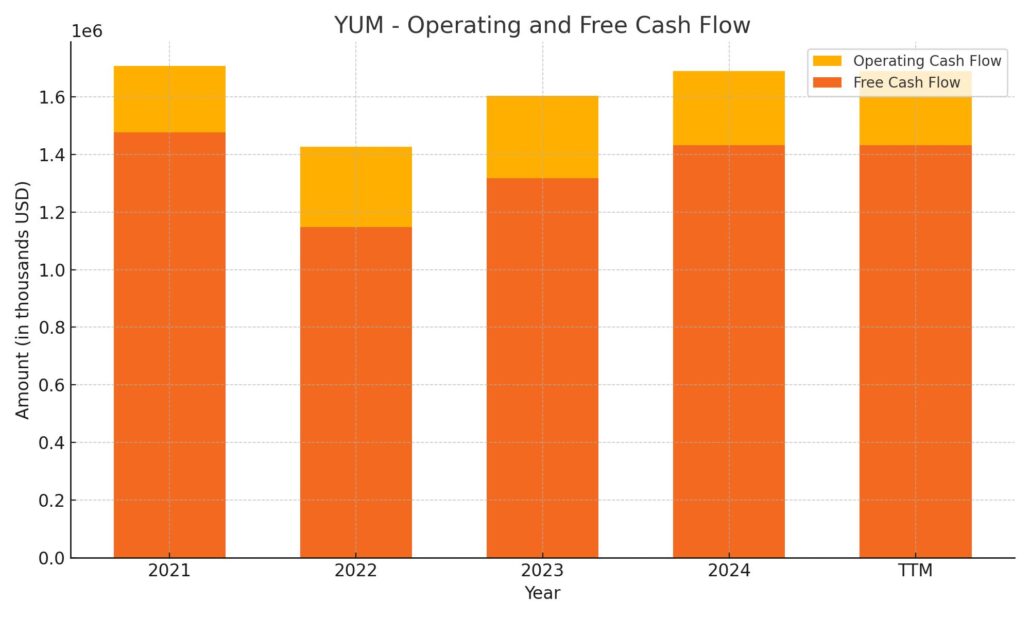

Yum! Brands generated $1.69 billion in operating cash flow over the trailing twelve months, a slight improvement over the prior year. This steady inflow reflects the company’s ability to convert earnings into cash, which is especially important given the franchise-heavy model that minimizes capital intensity. After capital expenditures of $257 million, free cash flow stood at $1.43 billion—strong coverage for dividend payments and share repurchases.

On the financing side, Yum! used $1.16 billion in outflows, driven by debt repayments of $479 million and share repurchases totaling $441 million. This aligns with its capital return priorities, continuing to reward shareholders while also managing its balance sheet. The cash position at year-end came in at $807 million, slightly higher than the prior year, suggesting a stable liquidity cushion despite aggressive capital returns. The business remains comfortably cash-generative, with consistency that supports long-term dividend sustainability.

Analyst Ratings

📈 Yum! Brands, the parent company of KFC, Taco Bell, and Pizza Hut, has recently drawn a mix of reactions from analysts—some upbeat, others a bit more reserved. As of early April 2025, the stock is trading at $161.14, while the average consensus price target from analysts sits around $151.79. That suggests a modest downside from where it stands now, but also highlights how tightly the market is watching this name.

🔼 In March, optimism came from Robert W. Baird, who bumped their price target from $160 to $176 and reaffirmed their “outperform” rating. Their confidence stems from a few key drivers: expected strength in KFC’s international markets and Taco Bell’s continued push for U.S. market share. The analysts see Yum!’s global footprint and franchise model as competitive advantages that should help it weather cost pressures and consumer shifts.

🔽 On the other hand, back in January, Citigroup took a more cautious tone. They downgraded Yum! from “buy” to “neutral” and trimmed their price target from $153 to $141. Their concerns focused on the slower wage growth in the U.S., some operational challenges abroad, and questions about the near-term payoff from Yum!’s tech investments.

🤔 Right now, the stock is sitting in a holding pattern among analysts: 15 rate it as a “hold,” while five are in the “buy” camp. It’s clear Yum! has strong long-term appeal, but there’s a general wait-and-see attitude as analysts weigh macro pressures against brand strength and digital strategy execution.

Earning Report Summary

Yum! Brands just wrapped up its latest earnings season, and there’s a lot to unpack. The fourth quarter of 2024 brought in strong revenue growth, but there were a few soft spots in profitability that caught some attention. Still, if you’re tracking this stock for its consistency and global reach, there were definitely some encouraging takeaways.

Solid Top-Line Growth, Mixed Bottom Line

Revenue for the quarter came in at $2.36 billion, which was a 16% jump from the same time last year. That’s a solid increase and speaks to the brand power across Yum!’s three big names—KFC, Taco Bell, and Pizza Hut. On the flip side, net income slipped about 9% to $423 million, and earnings per share fell slightly to $1.49. However, when you strip out one-time items, adjusted EPS actually climbed 28% to $1.61. That gives a clearer view of the company’s underlying performance, which seems to be trending in the right direction.

Taco Bell Stays Hot

Taco Bell continues to be the star of the portfolio. Same-store sales rose 5% for the quarter, helped along by some savvy menu additions like the $5 Luxe Carvings Box. That low price point clearly hit the mark with value-focused customers, especially in a tight consumer environment. It’s clear that Taco Bell knows its audience and isn’t afraid to innovate to keep them coming back.

KFC Keeps Growing Globally

KFC had another strong year internationally. The brand added over 2,000 new restaurants around the world—making it the second year in a row with that kind of expansion. Even with some market challenges, international same-store sales were still up 1%. That kind of growth tells you KFC’s global footprint isn’t just large—it’s still expanding at a healthy clip.

Pizza Hut Still Finding Its Footing

Pizza Hut had a bit more of a mixed quarter. Same-store sales were down 1%, but that’s actually an improvement compared to the previous quarter’s 4% drop. It’s not back in growth territory yet, but it looks like some of the brand’s adjustments might be starting to gain traction. A turnaround here won’t happen overnight, but the trend is heading in a better direction.

Tech Moves and Dividends

On the tech front, Yum! is investing in its own digital tools, including a new platform called Byte by Yum!. The idea is to make operations smoother and customer interactions more efficient. Digital sales were up about 15% this quarter and now make up over half of all sales, which shows how important this shift is for the company’s long-term game plan.

Meanwhile, Yum! raised its quarterly dividend by 6%, bringing it up to $0.71 per share. That kind of move usually signals confidence from the top—and it’s a nice plus for income-focused investors. The company also opened over 4,500 new stores in 2024, continuing its aggressive push into new markets.

All in all, the earnings report paints a picture of a company that’s still evolving, growing in the right places, and focused on delivering long-term value.

Chart Analysis

YUM has been steadily climbing since late January, and the one-year chart reflects a shift in momentum that’s hard to ignore. After a relatively quiet period through most of 2023, the stock broke out sharply in early February 2024, pushing past previous resistance levels and showing a sustained move higher.

Moving Averages

The 50-day moving average (red line) has crossed decisively above the 200-day moving average (blue line), a classic technical signal that typically points to a strong upward trend. That crossover occurred right around the time the stock price began its steep rally. Since then, the price has remained well above both moving averages, reinforcing the bullish trend. This kind of separation between price and long-term averages can often reflect growing investor confidence and buying pressure.

Volume Trends

Looking at volume, the most noticeable spikes occurred during the February breakout. That surge in participation usually validates a move like this, as it suggests broader market support behind the rally. Since then, volume has remained relatively stable with occasional peaks, but no major sell-off signals appear. The lack of panic selling is a healthy sign in any long-term trend.

RSI Behavior

The Relative Strength Index (RSI) dipped into overbought territory above 70 in February and March but has since cooled off. While it briefly pulled back toward neutral levels, it’s now edging higher again. This suggests some renewed buying interest without entering the danger zone of being severely overbought. The RSI’s ability to stay above 50 for extended periods also supports the overall strength of the uptrend.

General Price Action

From a broader perspective, YUM has shifted out of a prolonged sideways channel that lasted through much of mid-to-late 2023. That consolidation phase is now clearly behind, and the recent price action is showing conviction. Higher highs and higher lows have formed consistently since the beginning of the year. This pattern, along with rising averages and stable RSI, reflects a well-supported trend.

This setup signals a healthy market posture, especially for a stock that doesn’t rely on hype to gain traction. It’s not just a short-term bounce—it looks like a breakout that’s found solid footing.

Management Team

Yum! Brands is led by a deeply experienced leadership team that has played a major role in shaping the company’s strategy and long-term growth. David Gibbs has been the CEO since 2020, and he’s been part of the organization in various roles since the late ’80s. His leadership has centered on expanding Yum!’s global footprint and pushing forward its digital evolution, which has become a key part of the brand’s operations.

Earlier this year, Gibbs announced plans to retire in the first quarter of 2026. The board has already begun a search for his successor and is aiming for a smooth transition. Until then, he’ll continue to guide the company through this next phase of growth and execution. Supporting him is Tracy Skeans, the Chief Operating Officer and Chief People & Culture Officer. She’s known for reinforcing company-wide operational standards and maintaining a strong organizational culture across a wide range of markets. Chris Turner, who holds the role of Chief Financial & Franchise Officer, is focused on financial strategy and supporting Yum!’s franchise-driven model, which remains central to the company’s profitability.

This leadership team has helped build Yum! into a globally recognized name with a consistent focus on innovation and shareholder return.

Valuation and Stock Performance

Yum! Brands (YUM) is trading around $161 as of early April 2025. Its current price-to-earnings ratio is just over 30, which is on the higher end of the industry. That kind of valuation implies the market is pricing in steady earnings growth and continued operational execution. Compared to other big names in the quick-service space, Yum! trades at a premium, which reflects confidence in the brand portfolio and the consistency of its franchise model.

Looking at stock performance over the past 12 months, YUM has gained a little over 12%, outpacing the broader market. That’s been driven in part by its strong performance from Taco Bell, solid international expansion at KFC, and a growing digital footprint. Analyst price targets are somewhat divided. The average sits around $151.70, with a range that stretches from $135 up to $176. This spread shows a market trying to balance optimism about Yum!’s momentum with some caution around valuation and macro risks.

While the stock is near the higher end of that range, it’s not far off from its 52-week high, and the upward trend has been supported by rising volume and technical strength over the past few months.

Risks and Considerations

There are some meaningful risks to weigh when looking at Yum! from a long-term view. One of the most immediate is the upcoming change in leadership. While succession planning is underway and appears to be well-managed, transitions at the top can introduce shifts in execution style or strategic focus that ripple through the company.

Valuation is another factor. Yum!’s P/E ratio reflects a lot of investor confidence. If earnings growth slows or doesn’t match expectations, the stock could face pressure. That kind of compression can happen quickly in a high-multiple name, even when the business is otherwise performing well.

Then there’s the international exposure. Yum!’s strength is in its global scale, but that also means navigating a wide array of markets with different economic, political, and regulatory environments. Currency swings and geopolitical volatility are always on the table when a company operates across so many regions. Operational risk, particularly in emerging markets, is a factor worth monitoring.

Consumer behavior is another wildcard. The fast-food industry often feels insulated from economic downturns, but shifts in health trends, labor markets, or competitive pricing can impact customer loyalty and margin performance.

Final Thoughts

Yum! Brands continues to show what consistency looks like in a global business. The company’s ability to grow, reward shareholders, and adapt to shifting consumer habits is part of what’s helped it maintain relevance in a competitive field. It’s also one of the few names in the space that has built a truly international franchise model with strong brand equity.

The company’s long-term investments in technology and international markets are showing up in both sales and operating efficiencies. That, paired with its dividend growth and steady free cash flow, gives Yum! a financial profile that supports investor confidence.

Still, it’s important to keep an eye on execution. Leadership transitions, valuation levels, and global exposure are all factors that can shift sentiment quickly. But with the fundamentals still sound and the momentum leaning positive, Yum! continues to be a name that merits attention from those looking for a mix of stability and strategic growth.