Updated April 2025

Willis Towers Watson has built itself into a trusted name in the world of advisory and risk management. The company’s roots stretch back over a century, and since its merger in 2016, WTW has sharpened its focus, zeroing in on high-margin, repeatable business lines. These aren’t the kinds of services that make waves in the news cycle, but they’re the kind that make for dependable revenue—and for dividend investors, that’s music to the ears.

With its global reach and stable client base, WTW has carved out a niche that emphasizes predictability and professional relationships over flash. The company may not scream growth, but when you peel back the layers, you’ll find a well-run business with consistent performance and a shareholder-friendly capital allocation approach.

Recent Events

The past year has been quietly impressive for WTW. The stock’s climbed around 27% over the last twelve months, easily outpacing the broader market. That sort of move doesn’t happen by accident, and the numbers behind it show a business that’s working smarter.

Most recent quarterly revenue came in at just under $10 billion on a trailing twelve-month basis, marking a 4.2% year-over-year increase. The company’s operating margin of over 34% stands out in a sector not known for excess fat. Management has clearly been doing the work of tightening operations without cutting into productivity.

There was a net loss reported—around $98 million—but don’t let that number spook you. It’s largely the result of one-off accounting items that don’t truly reflect how the company is running on the ground. In fact, earnings growth was up over 100% year-over-year in the most recent quarter, a sign that the underlying operations are moving in the right direction.

Another point that may not jump out at first glance is WTW’s beta—sitting at just 0.69. That signals a lower level of volatility than the broader market, which is exactly the kind of thing dividend investors love to see. With $1.89 billion in cash and a current ratio of 1.2, the balance sheet looks solid even with a total debt load nearing $6 billion.

Key Dividend Metrics

📅 Ex-Dividend Date: March 31, 2025

💵 Forward Dividend Yield: 1.09%

📈 5-Year Average Dividend Yield: 1.33%

🔁 Payout Ratio: 33.14%

🚀 5-Year Dividend Growth Rate: Solid and consistent

🏦 Next Dividend Payable Date: April 15, 2025

📊 Trailing Dividend Rate: $3.56

📉 Price at Time of Writing: $336.94

Dividend Overview

At first glance, WTW’s 1.09% yield might not catch your eye. But a closer look reveals a consistent dividend story that’s often overlooked. The yield has dipped below the 5-year average of 1.33%, but that’s largely due to the stock’s recent rally. As the price climbs, yield naturally contracts—yet the actual dividend per share has steadily increased over time.

This isn’t a stock for income chasers looking for a 5% yield. This is for investors who appreciate a company that keeps raising its payout year after year, without overextending. The dividend may be modest, but it’s dependable, and that predictability can be more valuable in the long run than a shaky, oversized payout.

What stands out is how comfortably WTW manages its dividend. With a payout ratio sitting around 33%, there’s plenty of room to reinvest in the business, pay down debt, or continue bumping up the dividend without stretching the balance sheet. It’s a sign of strong financial discipline, and that matters when you’re relying on a company to deliver consistent income.

Dividend Growth and Safety

If you’re focused on dividend growth and stability, WTW checks a lot of the right boxes. The company’s been increasing its dividend regularly over the past few years, and while the bumps haven’t been huge, they’ve been dependable. That reliability reflects a company that isn’t trying to impress anyone—it’s just executing well and rewarding shareholders as a result.

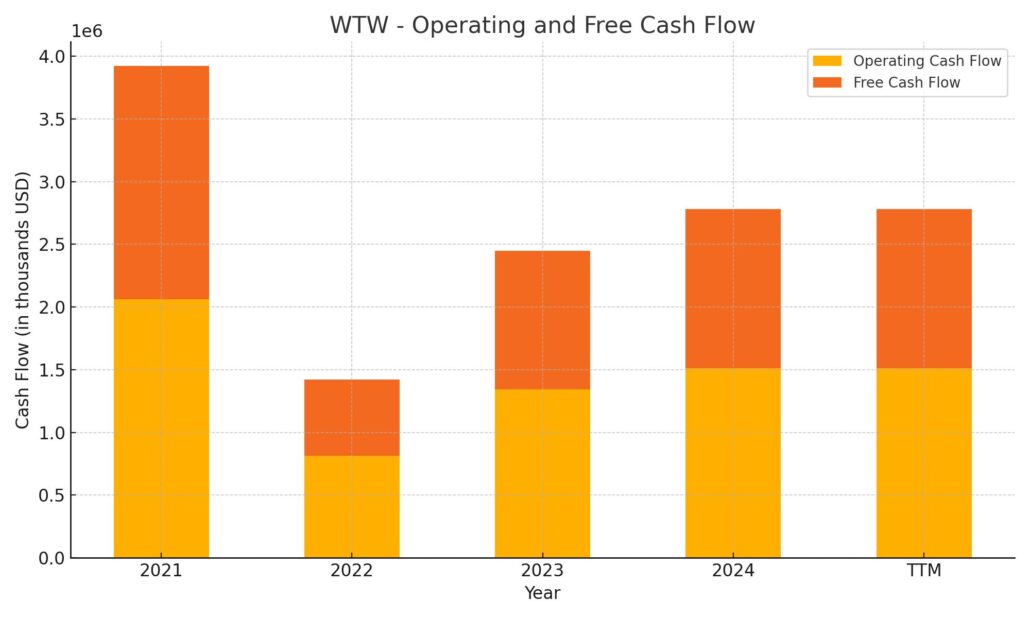

Behind the scenes, WTW’s cash flow picture is very reassuring. With $1.51 billion in operating cash flow and just under $1 billion in levered free cash flow over the past year, there’s a healthy cushion for dividend payments. These aren’t razor-thin margins—it’s clear the company has the breathing room to keep shareholders happy even in tougher environments.

Debt does exist, but it’s manageable. With a debt-to-equity ratio around 74%, WTW isn’t immune to interest rate pressure, but its business model isn’t capital intensive. That means it doesn’t need to spend heavily to keep growing, giving it more flexibility with how it handles that debt.

In short, the dividend here isn’t flashy, but it’s built on solid ground. For income investors looking for consistency, low volatility, and a management team that clearly understands capital discipline, WTW quietly delivers. The yield may not blow you away, but the dependability? That’s hard to beat.

Cash Flow Statement

Willis Towers Watson’s trailing twelve-month cash flow statement shows a company in control of its financial engine. Operating cash flow came in at $1.51 billion, up from $1.35 billion the year prior, indicating improved efficiency and earnings quality. Free cash flow followed suit, rising to $1.27 billion, giving WTW a strong buffer for dividends, buybacks, and debt service. These figures suggest a solid base of recurring revenue and good cost discipline, even in a year that included rising interest expenses and taxes.

On the investing side, the company flipped from heavy outflows in prior years to a $250 million inflow—likely from asset sales or reduced investment activity. Financing cash flow remained negative at -$459 million, reflecting debt repayment and share repurchases. WTW returned $901 million to shareholders via buybacks and paid down $655 million in debt, all while maintaining a growing end-of-period cash balance of $5 billion. Even with these outflows, the company has kept a healthy liquidity cushion, showing it can sustain capital returns without compromising its financial position.

Analyst Ratings

📈 Willis Towers Watson (WTW) recently picked up an upgrade from UBS, shifting its rating from Neutral to Buy. The firm also lifted its price target from $344 to $395. This move wasn’t just about sentiment—it was backed by expectations for stronger revenue growth. UBS sees WTW posting a 5.9% rise in 2025 revenue, topping the broader industry’s average estimate of 5.2%. That optimism appears to be rooted in operational efficiencies and a disciplined capital return strategy that has quietly impressed.

📉 Earlier in the year, Wells Fargo took a slightly more cautious stance. While maintaining an Overweight rating, they trimmed their price target from $380 to $345. The adjustment was less about any red flags and more about aligning expectations after a strong run-up in the stock. WTW’s fundamentals remain intact, but the firm seemed to be signaling a more measured pace ahead.

🚀 Keefe, Bruyette & Woods remained in the bullish camp, keeping their Outperform rating while nudging the price target up from $378 to $387. Their move reflects confidence in WTW’s continued execution, especially around cost controls and steady client retention across core business lines.

📊 The current analyst consensus sits at Moderate Buy. Out of 13 analysts, 10 rate it a Buy, 2 are holding steady, and just 1 leans bearish. The average price target across the board is $346.15, suggesting analysts still see room for upside, even after the stock’s recent gains.

Earnings Report Summary

Willis Towers Watson wrapped up 2024 on a strong note, showing some solid momentum as it heads into the new year. The fourth quarter brought in $3.04 billion in revenue, which was about a 4% increase from the same time last year. Most of that came from organic growth—roughly 5%—which means more clients, more business, and steady execution across the board.

What really caught attention was earnings per share. Reported diluted EPS came in at $12.25, more than double what it was in the previous year’s fourth quarter. On an adjusted basis, EPS was $8.13, a nice 9% bump year over year. That tells us the business isn’t just growing—it’s becoming more efficient and more profitable at the same time.

Margin Expansion

The company also tightened up its operations, which showed up clearly in its margins. Operating margin climbed to 29.7%, up 300 basis points from the year before. Adjusted operating margin hit 36.1%, which speaks to better cost control and smarter allocation of resources. It’s clear management is focused on delivering more with less.

Segment Performance

Looking at the different parts of the business, the Health, Wealth & Career segment brought in $1.85 billion, a 3% year-over-year increase. That growth came mainly from stronger project work and better performance in brokerage, especially in North America. The Risk & Broking unit also had a solid quarter, with revenue growing 6% to $1.14 billion, thanks to healthy new business wins and strong client retention.

Full-Year Highlights

For the full year, total revenue came in at $9.93 billion, up 5% compared to 2023. On paper, the company posted a net loss of $88 million, but that was largely tied to a big impairment charge from the TRANZACT divestiture. If you strip that out, the adjusted net income was $1.73 billion, up 13%—a more accurate reflection of how the core business is really doing.

Cash Flow and Capital Return

Cash generation stayed strong. Operating cash flow for the year was $1.5 billion, up 12%, and free cash flow was up too, hitting $1.4 billion. That kind of cash cushion gives WTW flexibility to invest in growth while still rewarding shareholders. In fact, the company returned $901 million to shareholders through stock buybacks in 2024, showing a steady hand when it comes to capital allocation.

Chart Analysis

Price Trend and Moving Averages

WTW has shown a strong and steady uptrend over the past year, moving from the mid-$240s to just under $340 by early April. What’s clear in the chart is how the price consistently stayed above the 200-day moving average, a sign of long-term strength. Even when the stock dipped or consolidated, it never broke below that long-term trendline in any meaningful way. The 50-day moving average has also been trending higher, providing short-term support and showing healthy momentum throughout the year.

There was a brief period in late spring when the price lagged below the 50-day line, but the recovery was swift. From June onward, the price stayed comfortably above both moving averages, creating a smooth, sustained climb. That type of action suggests continued institutional interest and buyers stepping in during pullbacks.

Volume and Price Confirmation

Volume remained relatively consistent, with a few spikes around price breakouts in July and again in December. These volume surges lined up with sharp price movements higher, reinforcing that those weren’t just random jumps—there was participation backing those gains. No signs of panic selling or unusual distribution patterns appeared along the way, which adds to the case for the stock being in strong hands.

RSI Momentum

The RSI stayed mostly in the middle-to-upper range, often hovering around 60–70. That’s a sweet spot indicating strength, but not a manic, overheated market. There were a couple of dips in late October and early January where RSI briefly approached the oversold zone, but the bounce back each time was quick and decisive. Most recently, the RSI moved closer to the 70 mark again, suggesting renewed buying pressure into the latest leg up.

Overall, the chart reflects a company with stable, upward momentum and no major technical red flags. Steady moving average trends, supported by moderate volume and consistent RSI behavior, suggest the trend is intact and healthy.

Management Team

At the helm of Willis Towers Watson (WTW) is Chief Executive Officer Carl Hess, who took over the role at the start of 2022. He’s been with the company for decades and has a deep understanding of the business, especially from his time leading WTW’s Investment, Risk, and Reinsurance segment. That kind of long-term experience gives him a strong sense of what makes the company tick and where the opportunities lie.

Andrew Krasner, the company’s Chief Financial Officer and Co-head of Corporate Development, has been key in shaping WTW’s financial strategy. His role goes beyond the numbers—he’s involved in identifying ways the company can expand and maintain a balanced capital structure. Then there’s Alexis Faber, the Chief Operating Officer, who focuses on making sure the global business runs efficiently. And leading the Risk & Broking segment is Lucy Clarke, bringing decades of experience to an area that remains a major revenue driver. The leadership team is a blend of operational know-how and strategic foresight.

Valuation and Stock Performance

WTW is currently trading around $336, which places its price-to-earnings ratio at about 26 times earnings. That’s above the industry average, which signals that investors are expecting higher growth and continued strength in the company’s earnings. But when you compare the price-to-sales ratio—sitting at 3.4 times revenue—it tells a more modest story, especially against peers trading closer to 6 times. That mix suggests the market sees potential, but WTW still looks reasonably priced for what it offers.

The stock has performed well over the past year, pushing to a 52-week high just above $344 in early March. That run-up has been steady, not speculative, supported by earnings growth, margin expansion, and strong operational execution. The company’s market cap now sits north of $32 billion, putting it firmly in large-cap territory with the kind of stability investors often look for in long-term holdings.

From a financial health standpoint, WTW shows good liquidity, even if its quick ratio is just under 0.5. Gross profit continues to trend up, growing just under 5 percent year over year, reinforcing the idea that its top-line momentum is matched with profitability.

Risks and Considerations

WTW operates globally, which exposes it to a range of geopolitical risks—from regional instability to regulatory changes in different jurisdictions. These issues can sometimes disrupt business or create headwinds in specific markets. The company has risk management in its DNA, but even that doesn’t make it immune to unexpected macroeconomic shifts.

Climate-related risks are another growing area. Clients increasingly expect forward-thinking guidance, and WTW needs to stay ahead of evolving insurance needs and new environmental exposures. These aren’t just moral or legal concerns—they’re business realities that affect underwriting assumptions and risk modeling.

Competition in the insurance and advisory space also can’t be ignored. It’s a highly fragmented market with new players and tech-driven disruptors always around the corner. WTW has the advantage of scale and established relationships, but it still needs to innovate to hold its ground.

Broader economic factors also play a role. Shifts in interest rates can impact client demand, while inflation and rising costs can pressure margins. In a slower economic environment, clients may also cut back on consulting and advisory services, which could impact revenue growth.

Final Thoughts

Willis Towers Watson isn’t flashy, but that’s part of its appeal. It’s run by a management team with deep institutional knowledge and a clear approach to capital allocation and operational discipline. The stock’s valuation reflects a business that has earned investor confidence without overextending, and its price movement over the past year has mirrored its steady progress.

There are risks, sure—but they’re not out of line with what you’d expect from a global operation in a complex industry. In fact, WTW’s entire business model is about helping others navigate risk, so it’s no surprise the company approaches its own strategy with that same measured mindset.

What you’re left with is a stock that quietly continues to execute, returning capital, expanding margins, and adapting as the world around it shifts. That’s not always the story that grabs headlines, but it’s often the one that lasts.