Updated April 2025

Westlake Corporation is built on fundamentals—manufacturing materials like polyethylene and PVC that serve as the backbone of construction and infrastructure. Whether it’s pipes for plumbing or materials for vinyl siding, Westlake is one of those companies working behind the scenes to keep the world running.

Its business is tied closely to housing and industrial cycles, which means it tends to move more with economic momentum than tech trends. And while the broader market might overlook that, dividend investors might want to take a closer look.

Recent Events

It’s been a rough stretch for Westlake’s stock price. Shares are down over 35% from their 52-week high, now trading just above $100. It’s not the prettiest chart, but a beaten-up price can open the door for patient investors, especially when the underlying financials still hold up.

Westlake’s latest financials were steady, if not exciting. The company pulled in $12.14 billion in revenue over the past year, with a profit margin of just under 5%. Operating margins are slimmer—only 2.6%—but that’s typical for a chemical company in a soft cycle. Even so, Westlake generated $1.31 billion in operating cash flow and is sitting on nearly $3 billion in cash. That’s not a company in distress—it’s one waiting for the cycle to turn.

What stands out most right now is the company’s discipline. No flashy spending, no chasing growth at the expense of stability. Instead, it’s maintaining liquidity, supporting its dividend, and letting time do its work. There’s a certain quiet confidence to that approach.

Key Dividend Metrics

💸 Forward Dividend Yield: 2.06%

🧾 Trailing 12-Month Dividend: $2.05 per share

📈 5-Year Average Dividend Yield: 1.36%

🛡 Payout Ratio: 44.18%

💼 Dividend Growth: Steady and active

📅 Most Recent Dividend Date: March 19, 2025

⚖️ Ex-Dividend Date: March 4, 2025

Dividend Overview

The 2.06% forward yield isn’t going to light up a dividend screener, but it’s meaningfully above Westlake’s five-year average of 1.36%. That bump alone makes the stock more attractive right now, especially if you’re focused on steady income and not chasing flashy returns.

Westlake isn’t paying out too much either. A payout ratio just over 44% leaves room for reinvestment and cushions the dividend even in leaner periods. It’s not an overly generous policy, but it’s disciplined—and that kind of approach tends to work over time.

There’s also the debt picture to consider. Total debt sits around $5.4 billion, but with $2.92 billion in cash and a current ratio of 2.8, the balance sheet is in solid shape. That’s important when looking at dividend safety. You want to know the company can handle downturns without having to touch the dividend—and Westlake passes that test.

Another point that doesn’t get enough attention: insider ownership is high. Over 74% of shares are held by insiders, which says a lot. The people running the company are clearly invested in its long-term success, and that includes keeping dividend payments reliable.

Dividend Growth and Safety

Dividend growth has been steady over the years. While it’s not setting records, the company continues to raise its payout consistently, even during times when the market gets choppy. That kind of quiet consistency is exactly what income-focused investors should look for.

Safety-wise, the numbers check out. The business throws off reliable free cash flow—around $379 million over the past year after capital expenditures. It’s enough to support the dividend with room to spare. And that’s after navigating a tougher macro environment with rising costs and soft construction activity.

Revenue has held up reasonably well, growing 0.6% year-over-year. Margins might be under pressure, but that’s common for a chemical company in the down part of the cycle. What matters more is how the company positions itself during these times, and Westlake has done a good job maintaining discipline without pulling back on shareholder returns.

Looking at valuation, the stock trades at a forward P/E of 16.08. That’s not screaming cheap, but it’s far from stretched either—especially for a company with this kind of cash flow generation and solid balance sheet. The EV/EBITDA multiple is just under 7x, which suggests the market isn’t pricing in much optimism right now.

That’s not necessarily a bad thing. For dividend investors, what you often want is a business that’s reliable, not riding waves of hype. Westlake fits that bill. It’s not flashy, but it’s durable—and that counts for a lot if you’re in it for the long haul.

Cash Flow Statement

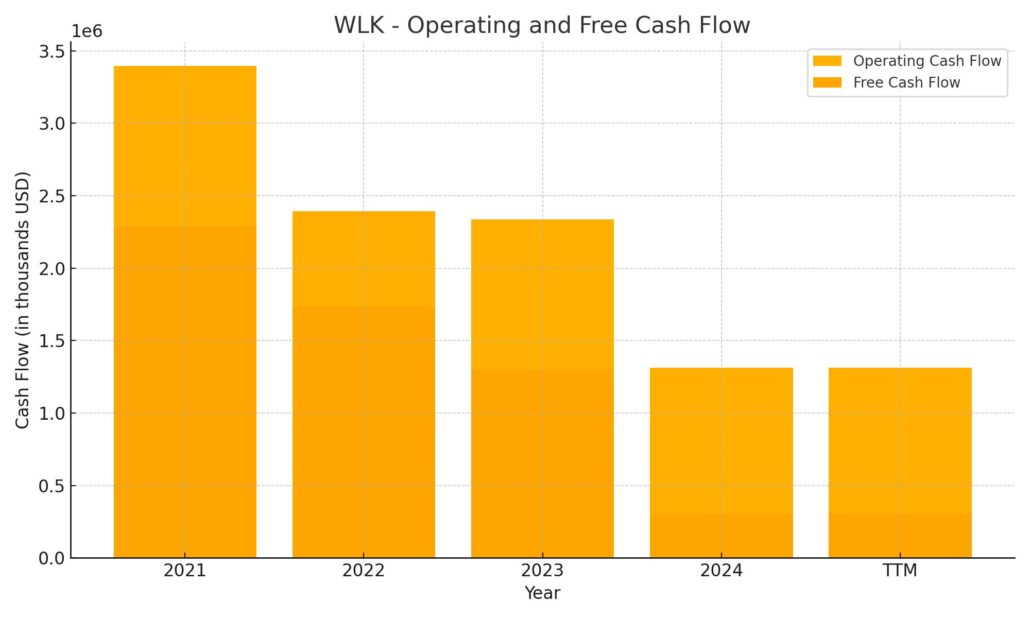

Westlake Corporation’s trailing twelve-month cash flow tells a story of operational strength paired with disciplined capital management. The company generated $1.31 billion in operating cash flow, which, while lower than the $2.34 billion posted in 2023 and well off the $3.39 billion peak in 2021, still reflects solid cash generation during a softer market phase. Capital expenditures remained steady at just over $1 billion, resulting in free cash flow of $306 million—enough to support dividends and maintain financial flexibility, though a notable decline from prior years.

On the investing side, outflows totaled $1.00 billion, nearly matching capital expenditures, indicating limited M&A or expansionary moves. Financing activities drew another $650 million out of the business, driven by debt repayment and modest share repurchases. Despite the reduced free cash flow, the company ended the period with $2.94 billion in cash—near its highest cash balance in years. This strong liquidity position gives Westlake breathing room to weather cyclical slowdowns, sustain its dividend, and fund future capital needs without leaning heavily on external financing.

Analyst Ratings

📉 Westlake Corporation (WLK) has recently seen a mix of analyst rating changes reflecting shifts in the company’s earnings outlook and market sentiment. As of April 3, 2025, shares are trading at $102.01.

🔽 On March 26, 2025, Piper Sandler downgraded Westlake from “Overweight” to “Neutral” and adjusted the price target from $135 to $120. The downgrade was driven by a recalibration of the company’s midcycle earnings potential, which analysts now view as more limited than previously assumed. A softening in new home construction played a major role in this shift, adding pressure to margins and dampening forward guidance.

🔼 On the other hand, JPMorgan Chase & Co. moved Westlake up from “Underweight” to “Neutral” on February 27, 2025. While they lowered the price target slightly from $135 to $110, the upgrade suggests that the firm now sees the stock more fairly valued compared to peers. The revised outlook reflects a more balanced view of Westlake’s risk and reward profile, especially as the market digests weaker volume trends and compressed margins in the chemicals space.

📊 Among 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” The average price target is $138.21, implying a potential upside of about 35.56% from the current level. Price estimates range from $110 on the low end to $174 at the high, revealing a broad spectrum of expectations depending on macro trends and housing demand recovery.

Earnings Report Summary

Westlake Corporation wrapped up 2024 with results that were steady, even if not particularly exciting. Revenue for the fourth quarter came in at $2.8 billion, nudging up slightly compared to the same time last year. Net income landed at just $7 million, or $0.06 per share. That number took a hit from a one-time non-cash tax expense of about $45 million, so it’s not quite as low as it might first appear.

Stronger Operations, Softer Margins

EBITDA came in at $416 million for the quarter, a 7% improvement year over year. This bump was mostly thanks to stronger sales volumes across several product lines, even as pricing power remained a little muted. While earnings weren’t spectacular, they were solid—especially considering the mixed backdrop in the construction and chemicals markets.

Westlake’s Housing and Infrastructure Products segment had a strong showing. It posted a record $807 million in annual operating income and EBITDA of $1.1 billion. Sales volumes in this segment grew 7%, which makes sense given the persistent demand in residential construction. That part of the business continues to be a bright spot.

Materials Segment Faces Pricing Pressure

The Performance and Essential Materials segment wasn’t quite as upbeat. Sales dipped slightly, mostly due to lower prices for products like chlorine, PVC resin, and polyethylene. Volume actually ticked up a bit, but it wasn’t enough to fully offset the pricing weakness. The impact was manageable, though, and management seems focused on riding out the cycle without overreacting.

Full-Year Perspective

Looking at the full year, Westlake brought in $12.1 billion in net sales and $677 million in net income. They’ve now had five straight quarters of year-over-year volume growth, which says something about their ability to keep moving product even when prices are under pressure.

On the cash flow side, Westlake continues to run a tight ship. They generated $434 million in operating cash in the fourth quarter, adding up to $1.3 billion for the year. Capital spending totaled $1.0 billion, showing the company is still investing in growth while keeping things financially sound.

By year-end, Westlake was holding $2.9 billion in cash, with total debt at $4.6 billion. That leaves the company in a pretty stable position heading into the new year—enough flexibility to handle whatever comes next without sacrificing its long-term plans.

Chart Analysis

Price Trend and Moving Averages

Looking at the one-year stock chart for WLK, it’s clear the overall price action has been in a consistent downtrend. The 50-day moving average has been falling sharply since September, and it’s now significantly below the 200-day moving average. This kind of technical setup often reflects sustained weakness. The 200-day moving average also started to roll over in the last few months, suggesting that pressure isn’t just short term—momentum has shifted for a while now.

What stands out is how frequently the price tried to challenge the 50-day moving average but failed to push through it. That kind of behavior tells you sellers are still in control, with rallies losing steam quickly. Most of the recent trading has stayed well below both moving averages, which confirms that bearish sentiment has been lingering.

Volume Patterns

Trading volume has picked up slightly in recent months, especially on down days. That’s not the kind of participation you want to see if you’re looking for a turnaround. There were a few green volume bars suggesting some buying interest, but it hasn’t been consistent or strong enough to shift the trend. Until the volume starts aligning with up moves, it’s hard to argue that a base is forming yet.

RSI and Momentum

The Relative Strength Index (RSI) has spent a lot of time under the midpoint of 50, with several dips into the oversold territory below 30. That weakness in momentum supports what the chart is already showing—buyers just aren’t stepping up in a meaningful way. There was a small bounce in RSI during February, but it didn’t break into overbought levels and quickly pulled back again.

The most recent RSI reading shows a bit of life, hovering just under 50. That may hint at a potential shift in tone, but it’s too early to read much into it. For now, the stock seems to be trying to find some footing after a long slide, but the technicals still lean cautious.

Overall Structure

This chart shows a breakdown that hasn’t yet stabilized. Lower highs, lower lows, and a declining slope on both key moving averages paint a picture of a name still under pressure. Any meaningful reversal will likely need confirmation from volume, a sustained move above the 50-day moving average, and a shift in momentum that pushes RSI back into more constructive territory. Until then, the stock remains in a watch-and-wait phase.

Management Team

Westlake Corporation’s leadership saw a meaningful shift in 2024, with Jean-Marc Gilson stepping into the role of President and Chief Executive Officer. He brings decades of experience in the global chemicals space, and his leadership style leans heavily into operational efficiency and strategic expansion. With Gilson at the helm, the company appears poised to navigate both industry shifts and internal evolution with a fresh lens.

Albert Y. Chao, who previously served as CEO, has moved into the Executive Chairman role, and his brother, James Y. Chao, continues as Senior Chairman. This transition keeps the Chao family’s long-term vision involved in day-to-day guidance, while making room for Gilson to bring in new energy and direction. Supporting this leadership structure is a solid executive team, including M. Steven Bender as CFO and L. Benjamin Ederington, who wears several hats including EVP of the Performance and Essential Materials segment, General Counsel, and Chief Administrative Officer. It’s a seasoned bench that seems to understand the business from the inside out.

Valuation and Stock Performance

As of early April 2025, shares of Westlake Corporation are trading at around $102.01, giving the company a market cap of approximately $13.1 billion. That price reflects a sharp decline from its 52-week high, showing a drop of roughly 35% over the past year. By comparison, broader indices have moved higher during that time, which has left WLK lagging behind its peers and the market overall.

The current trailing price-to-earnings ratio sits at just under 22, which is elevated compared to historical levels for the stock but understandable given the downturn in earnings. On a forward basis, the P/E compresses to about 16, suggesting the market expects earnings to rebound in the coming year. The EV/EBITDA ratio of just under 7 adds another layer of valuation context—Westlake is not priced for aggressive growth, but neither is it trading at a distressed level.

Despite the downward trend, the stock continues to offer steady dividends and carries a modest yield that may appeal to investors looking beyond short-term volatility. Volume trends and technical indicators, as discussed earlier, show that the stock is still searching for a base after months of weakness. For now, price action remains cautious, and sentiment is clearly waiting for a fundamental catalyst.

Risks and Considerations

Westlake operates in a cyclical industry, and the current backdrop reflects many of the common challenges associated with the chemicals sector. Overcapacity in core product lines like polyethylene and PVC has weighed on pricing, and demand from key end markets, particularly housing and infrastructure, has been soft. That pressure on volumes and margins can make it difficult for even well-managed firms to post growth.

There’s also the issue of environmental compliance. Chemical manufacturers like Westlake must meet increasingly complex regulations, both in the U.S. and globally. These aren’t just checkbox requirements—they often require significant capital to upgrade facilities, refine processes, and meet sustainability targets. That kind of investment can stretch free cash flow in the short term, even if it benefits operations long term.

Beyond industry-specific headwinds, macroeconomic factors add another layer of uncertainty. Higher interest rates, persistent inflation in input costs, and currency volatility all feed into the equation. Westlake has a solid balance sheet and ample cash on hand, but the next year or two may test how resilient the business model really is if broader conditions remain tight.

Final Thoughts

Westlake Corporation continues to show signs of careful stewardship, even as it moves through a challenging phase. The leadership handoff to Jean-Marc Gilson has been well-planned, and the executive team is structured to maintain consistency while adapting to new market demands. The Chao family’s continued involvement also reinforces the long-term vision that has helped Westlake grow from a regional operator into a global materials player.

From a valuation standpoint, the stock is not screamingly cheap, but it also doesn’t reflect any aggressive optimism. It sits in a zone where expectations are tempered—possibly even too low if market conditions begin to turn in its favor. And while the recent performance has been lackluster, especially against the broader market’s gains, it hasn’t erased the core value of the business or its ability to generate consistent cash flow.

There are certainly risks ahead, especially with commodity pricing and regulatory demands continuing to evolve. But Westlake has a track record of weathering cycles, and the company has the liquidity and leadership to stay positioned for the long game. It’s a name that may not be grabbing headlines, but it’s continuing to do the quiet, consistent work behind the scenes—just as it always has.