Updated April 2025

Based in Phoenix, this bank has carved out a strong presence across the Western and Southwestern U.S., focusing on relationship-based commercial lending. Its strategy leans into serving mid-sized businesses, real estate developers, and entrepreneurs—clients who value a personalized banking touch. Over the past year, WAL has had its fair share of ups and downs. Like many regional banks, it faced some heat during last year’s banking shake-ups. But unlike some peers, it didn’t just survive—it’s now back on its feet and showing real signs of strength. That rebound has income investors looking closely, especially at what WAL offers from a dividend perspective.

Let’s take a deeper look at recent developments and break down what makes this bank tick for dividend-focused portfolios.

Recent Events

Western Alliance closed at $77.64 on April 2, up over 2.5% for the day. Yet just hours before, pre-market trading had it dipping more than 7% to $72. Volatility like that is often enough to spook casual observers, but beneath the surface, there’s a lot more to the story.

The bank just wrapped up a strong year. Full-year earnings growth came in at a hefty 46.7%, and revenue grew nearly 16% year over year. That kind of momentum is hard to ignore. Profit margins are healthy at 26%, and the bank’s return on equity sits above 12%—a strong sign WAL is turning shareholder capital into real results.

They’re also sitting on over $4.3 billion in cash. That’s a comfortable cushion. On the flip side, negative operating cash flow of $2.74 billion is a number that needs watching. It’s a reminder that while profits look strong, there’s still some balance sheet pressure. But taken in context with their capital position and steady earnings, it doesn’t look like something that’s threatening their ability to pay shareholders anytime soon.

Key Dividend Metrics

For dividend-focused investors, here are the key numbers to know right now:

📈 Dividend Yield: 1.96% (Forward)

💸 Annual Dividend Rate: $1.52

🔁 5-Year Average Yield: 2.08%

🔒 Payout Ratio: 21.02%

📅 Next Dividend Payment: February 28, 2025 (Ex-Date: February 14)

These stats tell a pretty clear story: this isn’t a stock for high-yield chasers, but it is one that prioritizes sustainability. The sub-25% payout ratio is a solid signal that management isn’t overextending, which matters a lot when banking gets bumpy.

Dividend Overview

WAL doesn’t wave a big dividend flag, but that’s exactly why it deserves a closer look. Its 1.96% forward yield isn’t going to lead any rankings, but it reflects a strategy grounded in long-term thinking. The company pays out a modest portion of its earnings and keeps the rest working inside the business. That’s a smart formula when you’re navigating tighter credit conditions and still trying to grow.

This isn’t a company that’s been tossing around big dividend hikes. But importantly, they haven’t had to pull back either—not even during last year’s turmoil in regional banking. That kind of steady hand tells you a lot about how the leadership team views their obligations to shareholders.

There’s something to be said for a dividend you can count on. And WAL has quietly built that reputation. If you’re looking for income that won’t give you whiplash, this kind of disciplined, under-the-radar payout can be just what the doctor ordered.

Dividend Growth and Safety

Here’s where things get really interesting. WAL is about as safe as it gets on the dividend front. The 21% payout ratio leaves plenty of buffer if earnings take a temporary dip. They’re not stretching to meet dividend obligations—and that’s exactly what conservative income investors like to see.

As for growth? It’s been slow. They haven’t aggressively hiked the dividend, but that’s more a reflection of strategic capital allocation than weakness. Management has clearly made the decision to reinvest more heavily in the bank’s operations, especially in growth markets across the West and Southwest.

At a forward P/E of 8.72 and a price-to-book ratio of 1.34, the stock is reasonably valued. It’s not trading in distress territory, but it’s not priced for perfection either. That gives it room to run without relying on aggressive earnings assumptions.

Return on equity at 12.3% shows that internal profitability is still quite strong. That gives the bank the breathing room to self-fund both its operations and its dividend, a luxury not all financials can boast.

Debt sits at $6.66 billion, but with a cash reserve north of $4.3 billion, they’re in a good position. Add to that over 90% institutional ownership, and you’ve got a shareholder base that clearly believes in the long-term story here.

Western Alliance might not be in the headlines every day, but for dividend investors looking for steady income from a bank that knows how to manage risk, this one is worth keeping on the radar.

Cash Flow Statement

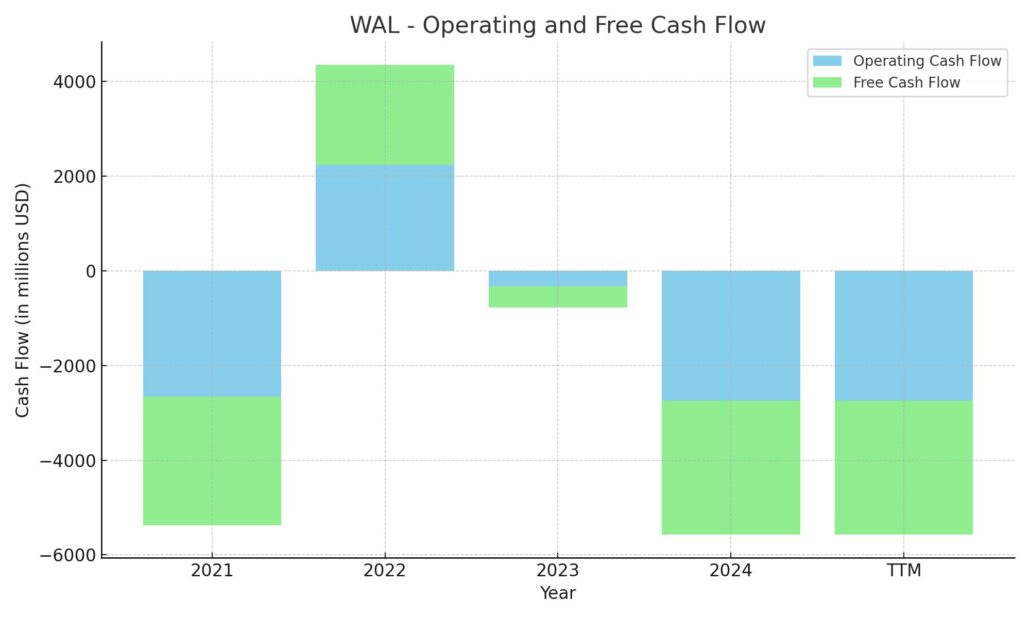

Western Alliance Bancorporation’s cash flow statement for the trailing twelve months shows a notable shift in internal liquidity trends. Operating cash flow came in deeply negative at -$2.74 billion, a stark reversal from the $2.2 billion positive figure in 2021. This drop, continuing from a slight dip in 2023, indicates significant outflows tied to day-to-day business activities, likely driven by changing lending patterns and deposit volatility common in the regional banking space.

On the investing side, the bank continues to be capital-intensive, posting -$5.97 billion in outflows. This suggests heavy allocation toward securities or loan portfolio growth, consistent with a strategy to position for long-term earnings. Meanwhile, financing cash flow surged to $11.2 billion, funded heavily through debt issuance, helping them nearly quadruple their end cash position to over $4 billion. Free cash flow, however, remained negative at -$2.83 billion, further underlining that internal operations aren’t currently self-funding. For now, WAL appears to be leaning on capital markets to maintain liquidity while navigating a high-interest-rate environment.

Analyst Ratings

📈 Western Alliance Bancorporation (WAL) has been drawing positive attention from Wall Street analysts lately, with sentiment leaning solidly in its favor. 🏦 Out of 15 analysts covering the stock, 14 currently rate it a buy, while just one suggests holding. That puts the consensus rating at a clear “Moderate Buy.” The average 12-month price target sits at $98.07, implying a healthy upside of roughly 26% from where the stock currently trades.

🧭 Some notable revisions have come through in recent months. RBC Capital Markets, for example, bumped its price target to $105 from $109 while keeping its outperform rating. UBS went a step further, raising its target to $115 from $98, maintaining a buy rating as well. These updates reflect growing confidence in WAL’s earnings consistency and its strategic direction, especially as the bank continues to stabilize post-2023 market turbulence.

💡 Analysts seem encouraged by the company’s strong return on equity and solid capital positioning, along with its ability to navigate a high-interest rate environment more deftly than some peers. The upgrades suggest a belief that WAL is not just recovering—it’s positioning itself for renewed growth.

Earning Report Summary

Western Alliance wrapped up the fourth quarter of 2024 on a strong note, continuing to rebuild confidence after a volatile stretch for regional banks. The numbers tell a clear story—WAL is finding its rhythm again, and investors paying attention to fundamentals likely walked away from the report with a sense of optimism.

Solid Finish to the Year

Net income came in at $216.9 million for the quarter, which was a noticeable step up from $199.8 million in Q3. Earnings per share hit $1.95, a steady climb from $1.80. Total revenue for the quarter edged up to $838.4 million, thanks to solid loan growth and healthy fee income, even though the net interest margin ticked down a bit to 3.48%. That’s slightly lower than the prior quarter’s 3.61%, but still respectable given the shifting rate environment.

Year-Long Performance

Looking at the full year, WAL delivered $787.7 million in net income, with EPS reaching $7.09. That’s an 8.4% gain over the previous year, which reflects disciplined execution in a tough environment. Revenue for the year reached $3.2 billion—up over 20% from 2023. Pre-provision net revenue also improved, climbing to $1.1 billion, a healthy 14% increase.

Loan and Deposit Growth

Loan balances showed solid momentum, growing 6.7% to hit $53.7 billion. On the deposit side, there was an even stronger jump—up nearly 20% year over year to $66.3 billion. That’s a strong signal that clients are sticking with the bank, or even shifting more funds its way, which speaks volumes in today’s market.

The bank also got a little more efficient. Its adjusted efficiency ratio dropped to 51.1% in the fourth quarter from 52.7% previously. That’s exactly the kind of slow, steady progress you want to see in a regional bank that’s tightening up its operations.

Fee Income and Credit Quality

One of the more encouraging developments came from non-interest income, which nearly doubled to $171.9 million. That was driven by better performance in loan sales and servicing. On the credit front, things stayed under control. Net charge-offs were low at 0.18%, and non-performing assets remained manageable at 0.65% of total assets.

The bank ended the year with a tangible book value of $52.27 per share, almost 12% higher than a year ago. All in all, it was a confident close to the year and one that sets a solid foundation heading into 2025.

Chart Analysis

Western Alliance Bancorporation (WAL) has had a dynamic year, and the one-year stock chart helps shed some light on the overall trend and investor sentiment. From a broader perspective, the stock has experienced a strong upward movement through the middle part of the year, followed by a more volatile consolidation period. Let’s break down what’s been happening technically.

Price and Moving Averages

The blue-shaded area representing the price shows a clear uptrend that began in early summer, with the stock moving from the high $50s to a peak near $95 before pulling back. The 50-day moving average (red line) rose steadily until February, then started to slope downward. This recent dip in the short-term trend suggests the rally has cooled and momentum is currently pausing or turning. Meanwhile, the 200-day moving average (dark blue line) continues to climb, showing longer-term strength remains intact despite the short-term weakness.

At the moment, the stock is trading very close to its 200-day average, which historically has acted as a support level. If this level holds, it may mark a pivot point for renewed upside, but if it breaks meaningfully below, it could open the door for deeper pullbacks.

Volume Behavior

Volume spikes were scattered, but notable surges occurred in late summer and again in early autumn—possibly reflecting institutional activity or reaction to earnings and macro developments. Since then, volume has remained relatively steady with no extreme selling pressure, which supports the idea that the recent weakness may be more of a breather than a panic-driven reversal.

RSI Momentum

The relative strength index (RSI) at the bottom of the chart paints a clearer picture of sentiment. Throughout the year, the RSI frequently approached or surpassed the 70 mark, indicating short-term overbought conditions during periods of strong gains. Recently, the RSI bounced from the oversold territory near 30 and is now trending upward again, currently hovering close to the 70 zone. This shift could suggest that buyers are stepping in again, although it also hints at a potential short-term overextension.

All things considered, the chart tells the story of a stock that has already gone through its major recovery phase and is now seeking direction. How it behaves around these key moving averages in the coming weeks will be worth watching closely.

Management Team

At the helm of Western Alliance Bancorporation (WAL) is Kenneth Vecchione, who has served as President and CEO since 2018. With a long track record in the financial services industry, including leadership roles at MBNA and Apollo Global Management, he’s been instrumental in shaping WAL’s growth-focused strategy. His leadership style balances calculated expansion with careful risk oversight, a combination that’s helped the bank maintain credibility through challenging periods.

Supporting him is Dale Gibbons, Vice Chairman and Chief Financial Officer, whose financial stewardship has been a steadying force over the years. Gibbons has earned a strong reputation for his discipline in managing capital and navigating interest rate cycles. Together, Vecchione and Gibbons have guided the company through a shifting economic landscape, keeping their focus on core fundamentals and long-term shareholder value.

Other key members of the team include Lynne Herndon as Chief Credit Officer, Jessica Jarvi as Chief Legal Officer, and Emily Nachlas, who oversees enterprise risk. The broader management bench brings deep expertise across commercial banking, compliance, credit, and technology, which has helped the company remain nimble as the banking sector continues to evolve. It’s a leadership group that’s not just experienced, but well-aligned in its strategic vision.

Valuation and Stock Performance

WAL is currently trading around $77.64, recovering from a dip earlier in the year and showing a year-over-year gain of nearly 29 percent. The stock has been volatile at times, especially amid concerns last year over the stability of regional banks, but has since regained momentum. That rebound reflects growing investor confidence, bolstered by strong earnings and consistent execution.

Looking at valuation, the stock trades at a trailing P/E of 10.95 and a forward P/E closer to 8.7. Those figures suggest WAL is still reasonably priced, especially when viewed against the earnings growth it’s been delivering. The price-to-book ratio sits around 1.34, a level that indicates investors are willing to pay a slight premium for its book value, but not so much that expectations are overly stretched.

The company’s dividend yield of just under 2 percent doesn’t make it a high-yield play, but combined with earnings growth and a low payout ratio, it offers a balanced return profile. Long-term holders have seen both capital appreciation and income potential, and the recent performance suggests that trend could continue if fundamentals hold up.

Risks and Considerations

While WAL’s recent results and stock performance have been encouraging, it’s important to keep risks in view. The regional banking sector remains sensitive to macroeconomic forces—interest rate policy, credit conditions, and liquidity pressures can shift quickly. For a lender with a large commercial book, even a modest uptick in defaults or funding stress can tighten margins and dent profitability.

Another key risk is competition. Larger national banks continue to invest heavily in technology and scale, which can make it harder for regional players to keep up, especially when it comes to digital services. WAL has made strides in expanding its tech and service offerings, but staying ahead in a fast-moving environment will require ongoing investment and adaptation.

There’s also the regulatory backdrop to consider. Capital rules and reserve requirements have been evolving, and while WAL has navigated them well so far, future adjustments could add operational complexity. Lastly, the volatility in WAL’s stock over the past year underscores the importance of watching both technical and fundamental indicators, especially for investors looking to manage drawdowns or time entries more precisely.

Final Thoughts

Western Alliance Bancorporation has shown that it can perform under pressure. Its leadership team brings a steady hand, its earnings growth has been real and measurable, and it’s maintained a disciplined approach to dividends without overextending itself. The stock’s recovery in the past year highlights how much market sentiment can shift when execution lines up with expectations.

Though the company faces challenges common to all regional banks, including interest rate exposure and competition from bigger players, it’s also positioned with solid fundamentals and a clear strategy. The balance sheet is strong, the management team has been consistent, and the valuation remains reasonable in today’s market.

For investors looking to stay grounded in companies with a track record of resilience and a focus on long-term value, WAL presents a compelling story worth following closely.