Updated April 2025

Waste Connections sticks to what it knows—handling waste and recycling across North America—and it does that job with a quiet confidence that dividend investors can appreciate. The company has built a smart strategy around serving secondary and exclusive markets. These are the kinds of regions where pricing is steadier, competition isn’t as cutthroat, and contracts tend to be long term. That leads to something investors love to see: stable, recurring cash flow. And while waste management might not be flashy, it’s one of those essential services that rarely sees demand fall off a cliff.

Waste Connections has also proven itself as a disciplined operator. By focusing on operational efficiency and thoughtful expansion, the company has become a consistent performer in a sector that rewards dependability. It may not be exciting, but for those who care about dividends, that’s a big part of the appeal.

Recent Events

Over the past year, Waste Connections has been on a solid upward trajectory. The stock has gained nearly 18% over the last 52 weeks—beating the broader market by a good margin. That kind of performance isn’t fueled by hype, but rather by strong fundamentals and a healthy top line. Revenue climbed 11% year over year, a nice surprise for a business built on predictable municipal and commercial contracts.

The latest earnings report continued that trend. Waste Connections delivered stable EBITDA—around $2.39 billion over the trailing twelve months—and kept free cash flow healthy. Operating cash flow hit $2.23 billion, more than enough to cover capital needs and still leave room for shareholder returns.

The balance sheet, while carrying some weight with $8.41 billion in debt, remains manageable. With a payout ratio under 50%, the company has a comfortable buffer for maintaining and growing its dividend without having to stretch financially.

🧮 Key Dividend Metrics

📈 Forward Yield: 0.64%

💸 Annual Dividend: $1.26 per share

🧷 Payout Ratio: 48.95%

📆 Ex-Dividend Date: February 27, 2025

📊 5-Year Average Yield: 0.69%

📈 Dividend Growth: Around 10% annual average over the past five years

🔐 Dividend Safety: Solid, thanks to reliable cash flow and a conservative payout structure

📆 Last Dividend Paid: March 13, 2025

Dividend Overview

If you’re looking for high yield, Waste Connections probably isn’t your top pick. The current yield sits at 0.64%, and it’s hovered in that ballpark for some time. But here’s the thing—it’s not about the headline number. It’s about what’s underneath.

This is a company that treats its dividend like a long-term commitment. It doesn’t chase yield with risky behavior or overextended balance sheets. Instead, it builds from a base of solid operations and strong cash flow. With a payout ratio just under 49%, there’s still plenty of earnings left over after the dividend is paid. That leaves room for reinvestment, debt paydown, and—critically—future dividend increases.

The consistency here is key. Waste Connections hasn’t missed a beat when it comes to paying dividends, and its track record of annual increases makes it a reliable source of growing income. Even if the yield doesn’t jump off the page, the quality of the payout is hard to ignore.

Dividend Growth and Safety

What really stands out is the steady dividend growth over time. Waste Connections isn’t flashy with its increases, but it’s consistent. Over the last five years, the company has raised its dividend at a pace of roughly 10% annually. That kind of growth, layered on top of a low-volatility stock, creates a compelling long-term income story.

There’s real strength behind the safety of this dividend, too. Free cash flow is strong—$853 million over the last twelve months after capital expenditures. That’s more than enough to cover dividend payments with room to spare.

It’s also worth noting the business itself is built for resilience. Waste management isn’t something people or businesses stop needing, even during tough economic times. That reliability in the core business gives the dividend a strong foundation. Plus, with a beta of just 0.67, WCN tends to move less than the market, adding a layer of stability for income-focused investors.

Debt levels are on the higher side, with debt-to-equity over 100%, but that’s not unusual for a capital-intensive business like this. Importantly, the company hasn’t shown any signs of struggling to meet its obligations. Operating income, while modest in margin terms, is steady, and cash generation has been more than adequate to support both the dividend and the balance sheet.

So while the yield may not be eye-popping, the dependability and upward trend of Waste Connections’ dividend make it a worthwhile name for investors who value consistency, predictability, and quiet growth.

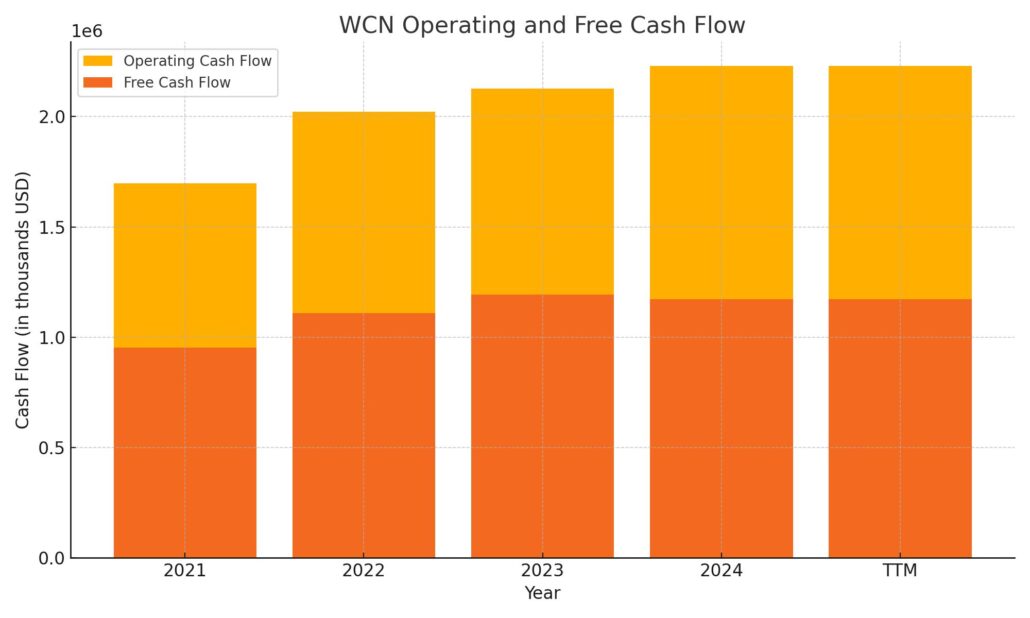

Cash Flow Statement

Waste Connections continues to show strong performance on the cash flow front, with trailing twelve-month (TTM) operating cash flow coming in at $2.23 billion. That’s a slight uptick from the previous year and a clear sign of the company’s consistency in converting its top-line growth into real cash. The company’s free cash flow for the same period was $1.17 billion, which is solid and provides a strong foundation for covering dividends, interest obligations, and reinvestment in the business.

On the investing side, the company posted a cash outflow of $3.16 billion, reflecting its continued capital expenditures and likely some acquisition activity, which is typical for a waste management company with a growth-through-consolidation strategy. Financing cash flow turned positive at $944 million after significant new debt issuance totaling over $4.5 billion, offset by $3.2 billion in repayments. Despite all this movement, the company’s end-of-period cash position remained stable at $198 million, nearly unchanged from the prior year, suggesting careful capital allocation and liquidity management.

Analyst Ratings

📊 Waste Connections (WCN) has recently seen mixed sentiment from the analyst community. About a year ago, the stock was downgraded by a major firm from “Buy” to “Neutral,” with valuation being the key concern. The reasoning was straightforward—the stock had appreciated enough that the upside seemed limited in the near term. While the fundamentals remained solid, analysts at the time felt the price had gotten ahead of itself.

🔍 Despite that downgrade, the broader picture remains positive. WCN currently holds a consensus rating of “Moderate Buy” across the board. Out of 15 analysts covering the stock, 12 have rated it a “Buy” and the remaining 3 have it at “Hold.” No one is calling it a “Sell,” which speaks volumes about the confidence in the company’s long-term positioning and financial health.

💰 The average price target among analysts is $204. That suggests a modest upside from where the stock is currently trading, indicating that most analysts expect continued steady performance. The expected growth is largely tied to Waste Connections’ consistent earnings, stable free cash flow, and its strategy of targeting exclusive and secondary markets that provide pricing power and operational stability.

Earning Report Summary

Strong Finish to the Year

Waste Connections wrapped up its fourth quarter of 2024 with a solid performance, showing once again why it’s earned a reputation for reliability in a not-so-glamorous industry. Revenue came in at $2.26 billion for the quarter, up 11% from the same period last year. That kind of growth doesn’t happen by accident—it’s the result of a steady hand at the wheel, smart acquisitions, and organic expansion in the markets they know best.

What stands out is that this wasn’t just a fluke quarter. The company has consistently delivered, and even with some added costs from integrating new operations, they kept margins in a healthy spot.

Profitability Holding Up

Adjusted net income hit $300.6 million, or about $1.16 per diluted share. That’s just a little under what they posted the year before, and most of that slip came from one-time costs and the usual growing pains that come with acquisitions. Nothing that signals a red flag. In fact, it’s a pretty good sign they’re managing the growth well without letting costs get out of hand.

Even more encouraging was the EBITDA figure—$732 million for the quarter. That tells you the company is still generating a lot of cash, and that gives it plenty of flexibility going forward. Whether it’s reinvesting into operations, picking up new assets, or returning value to shareholders, there’s no shortage of options.

Looking Ahead

Management’s tone heading into the next year is optimistic, and for good reason. They expect the growth to continue, both from the businesses they’ve recently brought in and from their existing operations. There’s confidence in the pipeline, and that usually means they see more opportunities ahead than risks.

Waste Connections isn’t chasing growth for growth’s sake. They’re sticking to a disciplined approach—buying smart, operating efficiently, and making sure the numbers back up their moves. For a company in the business of hauling trash, they’ve got a pretty clean playbook when it comes to running a tight financial ship.

Chart Analysis

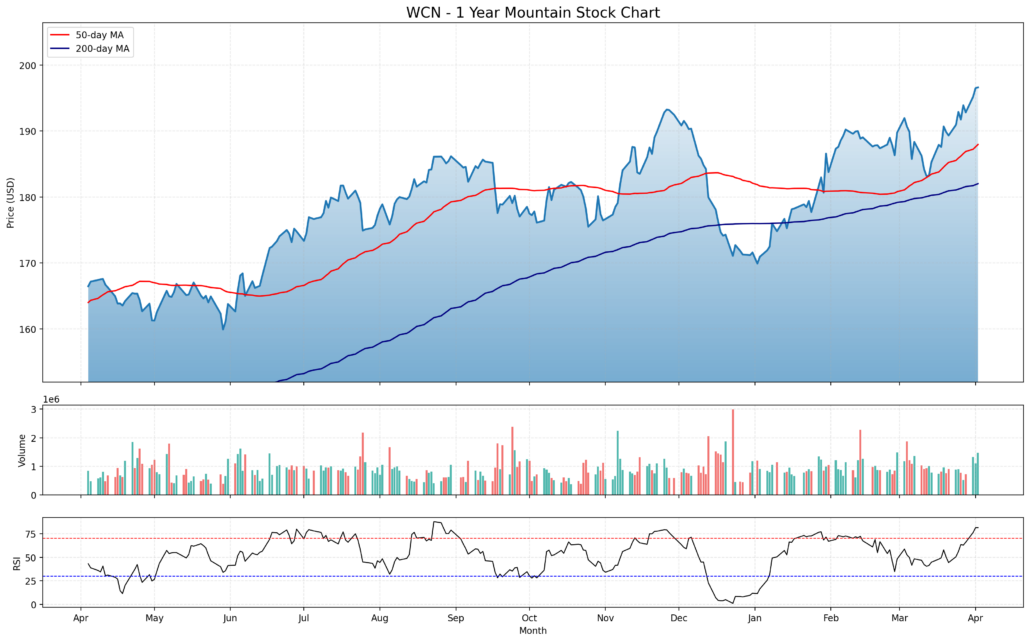

Steady Climb with Technical Support

WCN has shown a consistent upward trend over the past year, marked by a series of higher highs and higher lows. The stock moved smoothly from the $160 range up toward the $195–$197 zone, reflecting strong price momentum. The 50-day moving average (red line) has mostly stayed above the 200-day moving average (blue line) since early summer, which is typically a healthy technical signal. When that crossover first occurred, it lined up with a sustained price rally. Any time the stock pulled back toward the 200-day line, buyers appeared to step in, keeping the longer-term trend intact.

What’s interesting is that the dips, particularly in January, were fairly short-lived. The recovery after those drawdowns was quick, and the recent move in March shows a break above prior resistance levels. That sort of price action suggests that confidence in the name has remained intact even during broader market volatility.

Volume and Relative Strength Insight

Volume has stayed relatively steady with occasional spikes, especially during the larger price moves. These bursts don’t appear overly speculative—there’s no panic-selling or runaway buying. Instead, it looks like institutional interest has likely remained strong. The consistency in volume also suggests conviction in the trend.

The Relative Strength Index (RSI) at the bottom of the chart is now approaching overbought territory, hovering just under 70. That doesn’t mean a drop is guaranteed, but it does suggest the stock may need a short breather before making its next push. Earlier instances of elevated RSI levels were followed by brief consolidation periods rather than any severe reversals, which lines up with how this stock tends to trade—gradual, measured, and stable.

Overall, this chart reflects a name that’s well-supported, trending steadily, and showing signs of strength without excessive volatility. The trend, the technicals, and the volume all point toward a stock with strong underlying participation and a steady hand on the wheel.

Management Team

📌 At the helm of Waste Connections is President and CEO Ronald J. Mittelstaedt, a seasoned leader with over three decades of experience in the waste services industry. Mittelstaedt helped launch the company back in 1997, and after briefly stepping back, he returned as CEO in 2023. His vision and long-term thinking have been central to the company’s evolution from a regional player to a dominant force across North America.

📌 Supporting him is Darrell Chambliss, Executive Vice President and Chief Operating Officer, who has also been with the company since its early days. Chambliss brings operational consistency and deep institutional knowledge, playing a key role in integrating acquisitions and optimizing service delivery.

📌 The financial engine of the business is managed by Mary Anne Whitney, EVP and CFO. Her careful oversight of capital allocation, cost structure, and cash flow planning has kept Waste Connections on solid financial footing. Rounding out the leadership team are key executives covering legal, engineering, environmental compliance, and strategic development—ensuring every corner of the business is led by experienced professionals with a strong track record.

Valuation and Stock Performance

📈 Waste Connections’ stock has moved steadily upward over the last twelve months, gaining roughly 14% over that span. That kind of climb reflects investor confidence in the company’s stable business model and continued ability to deliver both revenue and earnings growth. It’s not a name that swings wildly with the market, and that relative calm has been a draw.

📈 The company is trading at a forward price-to-earnings ratio near 26x, which is on the high end for the waste services sector. That premium likely reflects the consistency in results and the reliability of cash flows. Investors appear willing to pay up for the stability and long-term growth that comes with Waste Connections’ operating model. The stock’s performance relative to its moving averages and overall market strength also contributes to its current valuation stance.

📈 Analyst sentiment has remained positive, with the average 12-month price target sitting around $204. That suggests modest upside from current levels. With earnings growth, a defensive business model, and steady capital returns, it’s easy to see why the stock commands a strong multiple.

Risks and Considerations

⚠️ No company is risk-free, and Waste Connections is no exception. Environmental regulation is one area that requires constant attention. Compliance isn’t optional in this business—it’s essential—and any missteps could result in costly operational setbacks or legal challenges. Issues like landfill odor complaints, permitting delays, or compliance with new emissions standards can hit both reputation and results.

⚠️ The company also leans on acquisitions for growth, which means execution risk is always on the table. Buying another business is one thing—integrating it and maintaining service quality is another. While management has a strong track record in this area, it still requires careful oversight.

⚠️ On the economic front, a broader downturn could reduce commercial waste volumes, particularly from construction, retail, and hospitality clients. Although residential services are more stable, a slowdown in industrial activity can put pressure on revenue growth. And with the stock trading at a premium valuation, any earnings miss or shift in market sentiment could weigh on the price more than it would for lower-multiple peers.

Final Thoughts

🧭 Waste Connections isn’t a flashy name, but it continues to execute at a high level. With a strong leadership team, steady financials, and a strategic focus on stable markets, the company has carved out a reliable space in a traditionally cyclical industry. It’s this blend of operational discipline and long-term thinking that has kept the business growing even in challenging environments.

🧭 While risks do exist—ranging from regulatory to macroeconomic—the company’s diversified revenue streams, disciplined acquisition strategy, and strong free cash flow give it the flexibility to manage through different cycles. As it continues to scale and refine operations, Waste Connections remains positioned as a durable name for those who value consistency and quality execution.