Updated April 2025

Unitil Corporation isn’t the kind of stock that gets a lot of attention, and that’s exactly what makes it appealing to long-term dividend investors. Headquartered in New Hampshire, this small-cap utility provides electric and natural gas service to customers across parts of New England. It’s a classic example of a business that just quietly does its job—keeping homes warm, lights on, and income flowing steadily to shareholders.

The nature of the utility industry means Unitil operates in a tightly regulated space, which limits explosive growth but provides stability. That reliability makes it a strong fit for investors looking to build a stream of consistent, predictable income over time.

Let’s take a closer look at what’s been happening with the company recently, and how the dividend stack up for income-minded portfolios.

Recent Events

Unitil wrapped up its 2024 fiscal year with $494.8 million in revenue and net income of $47.1 million. The top line dipped slightly by about 1.6%, but earnings edged higher, which shows the company kept expenses in check. For a utility, that’s the kind of operational efficiency investors like to see—quiet, methodical, and grounded in the essentials.

The stock’s been riding a pretty smooth wave. It traded between $47.40 and $63.52 over the past year, and its beta is just 0.59. That low-volatility profile makes it a comfortable place to park capital for those not looking to stomach sharp market swings. Interestingly, Unitil posted a 14.66% gain over the past year—handily outpacing the broader market. It didn’t do this with any major announcements or hype, but by staying the course while others were trying to figure out which way the wind was blowing.

As interest rates climbed and put pressure on rate-sensitive sectors, utilities as a whole faced headwinds. Yet Unitil held its ground, showing that its model can work even when the broader environment gets tricky.

Key Dividend Metrics

📈 Dividend Yield: 3.07% (Forward)

💰 Annual Dividend: $1.80 per share

🧮 Payout Ratio: 58.14%

🔁 5-Year Average Dividend Yield: 3.16%

📅 Most Recent Dividend Date: February 28, 2025

📆 Ex-Dividend Date: February 13, 2025

Dividend Overview

Right now, Unitil is offering a 3.07% forward yield. That’s just a bit under its five-year average of 3.16%, suggesting the stock isn’t priced at a premium or a discount relative to its typical dividend range. The latest annual dividend was bumped to $1.80 per share, up from $1.70, signaling that management continues to prioritize returning capital to shareholders.

This isn’t the kind of yield that will blow your socks off—but it’s consistent, and that’s exactly what dividend-focused investors tend to value. The payout comes with relatively low drama, and that’s especially important when looking for income that won’t disappear the moment a quarter disappoints.

With a payout ratio around 58%, Unitil is striking a good balance. It’s rewarding shareholders while still retaining enough earnings to keep operations running smoothly and fund future projects.

Dividend Growth and Safety

The safety profile here is pretty typical for a utility—some debt, yes, but strong recurring cash flow. Unitil carries $756.3 million in total debt, and the debt-to-equity ratio is high at 147.57%. For many companies, that would be a cause for concern, but this is par for the course in utilities, where large capital investments are part of the business model.

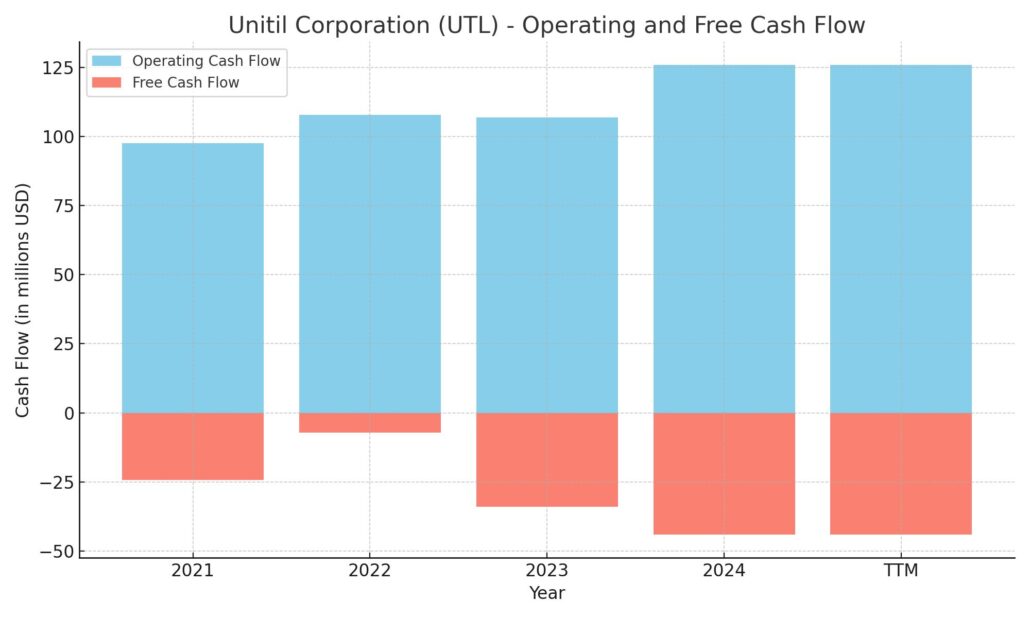

Cash flow paints a clearer picture. Operating cash flow came in at $125.9 million, giving the company ample coverage for its dividend, even though free cash flow was in the red due to infrastructure spending. Utilities often deal with negative free cash flow in the short term when they’re upgrading or expanding systems. As long as operating cash flow stays strong—and it is—the dividend remains safe.

Unitil’s record on dividend growth has been quiet but steady. Over the years, increases have been modest, but they’ve come regularly. That’s the kind of slow burn that can really benefit investors reinvesting dividends, especially in tax-advantaged accounts.

Ownership is another small vote of confidence. With over 80% of shares held by institutions, there’s a solid base of long-term investors who clearly trust the management team. That level of commitment from professional investors doesn’t guarantee anything, but it does show confidence in the company’s ability to keep delivering value over time.

For anyone looking to lock in income without needing to constantly watch the headlines, Unitil offers something increasingly rare—dependability. And in today’s market, that counts for a lot.

Cash Flow Statement

Unitil’s trailing twelve-month (TTM) cash flow shows a utility in full investment mode. Operating cash flow reached $125.9 million, marking a steady climb from prior years and showing strong core operations. However, capital expenditures nearly matched that inflow dollar for dollar, hitting $169.9 million. This aggressive reinvestment resulted in a negative free cash flow of $44 million, consistent with a long-term infrastructure buildout strategy that’s not unusual for utilities.

On the financing side, Unitil raised $135 million in new debt and $1.1 million through equity issuance to help support those capital needs. Even after debt repayments of nearly $5 million, it exited the period with $6.3 million in cash—slightly down from recent years, but not alarming given the capital-heavy nature of the business. Interest expenses rose slightly to $31.2 million, suggesting a modest increase in debt servicing costs. Overall, the cash flow pattern reflects a company maintaining strong operations while heavily investing in its future grid and service infrastructure.

Analyst Ratings

📊 Unitil Corporation (UTL) has seen modest adjustments in analyst ratings over the past couple of years. On February 12, 2025, Guggenheim reiterated a “Hold” rating with a price target of $55. This stance was based on the firm’s view that the utilities sector was oversold and undervalued, with potential to outperform through the remainder of 2025.

📉 Previously, on September 6, 2023, RBC Capital also maintained its “Hold” rating but adjusted the price target downward from $56 to $51. That move reflected valuation concerns, as the stock had climbed ahead of fundamentals in the view of some analysts.

🔎 As of now, the general consensus from analysts is leaning toward an “Overweight” rating for Unitil, with an average price target of $59. That represents a modest upside from current levels, suggesting expectations for continued stable performance, especially if interest rate pressures ease and utilities regain favor in more defensive portfolio strategies.

Earnings Report Summary

Solid Performance to Close Out the Year

Unitil wrapped up 2024 on a strong note, with net income landing at $47.1 million, or about $2.93 per share. That’s a noticeable improvement from the year before. Stripping out the costs tied to the Bangor acquisition, adjusted earnings ticked up to $47.8 million, or $2.97 per share. Either way you slice it, the company moved in the right direction.

The biggest lift came from the gas side of the business. Gross margin there jumped by $6 million, driven by new rate structures and a steady increase in customer count. The electric business held steady—no fireworks, but no disappointments either. Increases in depreciation costs were absorbed through improved rates and more customers coming online.

Keeping Up With Infrastructure

Spending was up, as expected. Depreciation and amortization rose $8.7 million, which tracks with all the infrastructure projects Unitil’s been putting in place. They’re clearly leaning into long-term reliability and network strength. Operating and maintenance costs also nudged higher, mainly from higher wages and more hands-on work in the field.

On the dividend front, Unitil’s board gave the green light to a quarterly payout of $0.45 per share. That pushes the annual dividend to $1.80, reinforcing the company’s ongoing commitment to rewarding shareholders. It’s a quiet signal that leadership feels confident about cash flow and future stability.

Expansion Through Acquisition

The biggest headline from a strategic standpoint was the completion of the Bangor Natural Gas acquisition in early 2025. That deal brought in a new customer base and opened the door for Unitil to scale further in Maine. It’s a meaningful move that fits well with the company’s measured approach to growth.

Looking Ahead

With $176 million earmarked for capital projects in 2025, Unitil isn’t slowing down. The focus remains on strengthening infrastructure and integrating new customers efficiently. It’s all part of a broader strategy to stay ahead of energy demand while continuing to provide consistent service. So far, it looks like they’re on the right track.

Chart Analysis

Price Trend and Moving Averages

The price action over the past year shows a fairly steady climb from the low $47 range in early spring, topping out above $60 during the summer. After that peak, the stock gave back some of those gains but managed to stabilize around the $55–$58 zone through the winter months. More recently, the price has started moving upward again, closing in on previous highs.

The 50-day moving average (red line) had been trending above the 200-day moving average (blue line) for most of the year, confirming the upward momentum. But there was a bearish crossover earlier this year when the 50-day dipped below the 200-day. Interestingly, that crossover didn’t trigger a significant breakdown. Instead, the stock quickly recovered and is now pushing higher again, with the 50-day flattening and starting to curl upward. That’s a healthy technical sign and suggests the pullback may have run its course.

Volume Behavior

Volume has remained relatively light and stable, with only a few notable spikes. These spikes tend to coincide with sharp price moves or reversals, likely tied to earnings reports or corporate news. Overall, there’s no indication of panic selling or excessive buying, which adds to the sense of stability.

RSI Momentum

Looking at the RSI (relative strength index) in the bottom panel, the stock has moved from an oversold position below 30 late last year to pushing near the overbought threshold of 70 as of now. That climb in RSI without dipping back toward mid-range levels shows a strong recent trend. While it’s nearing overbought territory, it’s not extreme, and strong names can stay elevated for extended periods without a pullback.

The combination of recent price strength, recovering moving averages, and a rising RSI points to growing momentum. It doesn’t appear to be a speculative run-up, but rather a continuation of a measured uptrend. The chart leans more toward stability than volatility, which matches what’s typically expected from this kind of stock.

Management Team

Unitil Corporation’s leadership team brings a wealth of experience and a steady hand to the company’s operations. At the helm is Thomas P. Meissner, Jr., who has been with Unitil since 1994. He stepped into the role of Chairman and Chief Executive Officer in 2018, after serving as Senior Vice President and Chief Operating Officer. His long tenure gives him deep insight into the business and its evolving role in the energy space.

In May 2023, Robert B. Hevert took on the role of President and Chief Administrative Officer, having previously served as CFO and Treasurer since joining the company in 2020. His experience in utility finance and rate regulation adds a steady perspective to Unitil’s executive team.

Financial operations are now led by Daniel J. Hurstak, who became CFO in 2023. Before that, he was Unitil’s Chief Accounting Officer and Controller. With a background in public accounting and nearly two decades of experience, Hurstak brings strong financial discipline to the company.

Overseeing external affairs and customer strategy is Katherine Bourque, who’s been with Unitil since 2019. She has served in various public policy and regulatory roles and now plays a key role in shaping customer engagement and government affairs.

On the operations side, Kevin Sprague and Christopher LeBlanc are responsible for electric and gas operations, respectively. Both are long-time Unitil veterans with decades of experience managing the day-to-day reliability and performance of their respective divisions.

Together, this management team blends long-term internal experience with targeted external expertise, helping Unitil remain steady while preparing for future challenges in the utility space.

Valuation and Stock Performance

Over the past year, Unitil’s stock has shown a pattern of steady resilience. It’s moved within a range of $47.40 to $63.52 and currently trades at $58.23. With a market cap around $937 million, it’s a relatively small player in the utility world, but its consistent track record speaks volumes.

The current price-to-earnings ratio sits just above 20, which suggests the stock is fairly valued for its sector. It’s not screamingly cheap, but that’s typical for a company with stable earnings and a solid dividend. The forward yield is 3.07 percent, offering investors a regular income stream, which is attractive in a time when volatility elsewhere makes that harder to find.

With a beta of just 0.55, Unitil tends to move less than the overall market. That lower volatility makes it appealing for portfolios looking for consistency. Overall, the performance has reflected cautious optimism, with analysts keeping their targets around the $59 range.

Risks and Considerations

Like any utility, Unitil operates in a highly regulated space. That can be a blessing or a limitation, depending on how policy shifts. Regulatory changes—whether at the state or federal level—can directly influence what Unitil can charge and how it can grow. The rules are unlikely to change overnight, but when they do, they can affect the bottom line quickly.

There’s also the weather factor. While not always top of mind, severe storms or temperature swings can impact operations and maintenance costs. The company has shown that it can handle disruptions, but no utility is immune from these risks.

As the energy landscape shifts toward renewables, traditional utilities face both challenges and opportunities. Unitil is investing in infrastructure, but those upgrades take time and capital. The cost of transitioning systems or adding capacity may weigh on cash flow in the short term.

Economic factors play a role too. A slowdown in industrial or commercial energy use could drag on revenue. While residential demand tends to be more stable, a broader downturn could still have ripple effects.

Lastly, the pace of innovation in the energy space can’t be ignored. From solar panels to battery storage, alternatives are becoming more accessible, and customers have more options than ever. Utilities that don’t keep pace could lose relevance over time, but Unitil seems aware of that and is positioning itself accordingly.

Final Thoughts

Unitil continues to offer what many investors look for in this space: steady financials, consistent leadership, and a reliable dividend. It’s not flashy, and that’s the point. The company has been methodical in how it manages growth, handles expenses, and returns capital to shareholders.

The leadership team blends long-time insiders with newer voices, providing continuity while bringing in fresh thinking. Operationally, the company has weathered recent challenges well and is investing in its future infrastructure with an eye on reliability and scale.

It’s not without its risks, particularly around regulation and the ongoing energy transition. But Unitil appears to be approaching these hurdles with a measured hand, making it a name to continue watching in the utility sector.

For those interested in steady performance and predictable income, it offers a clear, dependable narrative in a sector where that still matters.