Updated April 2025

United Bankshares, Inc. (UBSI) has been around the block a few times. With a history stretching back to 1839, it’s one of those financial institutions that have grown not by chasing headlines but by building relationships and sticking to what works. Today, the bank operates more than 200 branches across the Mid-Atlantic and Southeastern U.S., quietly becoming a regional player with a strong dividend backbone.

You’re not going to see UBSI trending on social media or making splashy tech announcements. That’s not its game. What it does offer, though, is something that dividend investors appreciate deeply: stability, predictability, and a long history of rewarding shareholders with consistent cash returns.

So let’s walk through what’s been happening lately and take a close look at the dividend side of the story.

Recent Events

UBSI’s most recent earnings release showed the kind of results that fly under the radar—but in a good way. Net income for the trailing twelve months came in at $372 million, showing a nearly 19% jump from the year before. Revenue did dip slightly by 0.5% year-over-year, but that’s been a theme across the banking sector, thanks to mixed signals from the interest rate environment and slower lending activity.

But UBSI has something not every bank can boast about—strong margins. Operating margin for the period clocked in at nearly 49%, and return on assets held steady at 1.24%. These aren’t jaw-dropping numbers, but they reflect a business that knows how to manage its expenses and extract value from its operations.

Another thing to note: the bank’s liquidity and balance sheet. UBSI is sitting on $2.29 billion in cash, which breaks down to about $16 per share. That’s a sizable cushion, especially considering the current stock price. Meanwhile, total debt sits under the $1 billion mark, which keeps the bank in a low-leverage position—something that matters a lot when you’re trying to maintain a dependable dividend.

UBSI also stuck to its dividend tradition with a recent payout of $0.37 per share, declared for the April 1, 2025, payment date. Quietly consistent, as usual.

Key Dividend Metrics

🟢 Forward Dividend Yield: 4.30%

💵 Annual Dividend: $1.48

📈 5-Year Average Yield: 4.20%

🔁 Dividend Growth Streak: 50 years

📊 Payout Ratio: 53.82%

📆 Next Ex-Dividend Date: March 14, 2025

📅 Last Dividend Paid: April 1, 2025

📉 Stock Price: $34.71 (as of market close)

Dividend Overview

There’s something refreshing about a company that doesn’t try to overcomplicate things. UBSI isn’t throwing around buzzwords or pushing into risky new verticals. It’s running a tight, well-managed banking business and sharing the rewards with shareholders. That’s been the story for decades.

With a current dividend yield of 4.30%, the stock offers an above-average income stream—especially in this environment, where dependable yield is tough to come by. And this yield isn’t the result of a sharp drop in stock price; it’s been relatively stable. Over the past five years, UBSI’s average yield has hovered around 4.20%, which tells you this isn’t a fluke—it’s part of the bank’s DNA.

The real gem here is the longevity. UBSI has raised its dividend for 50 straight years. That’s not a typo. It’s among the small group of companies that have managed to maintain and grow their payouts across multiple economic cycles, crises, and regulatory changes.

If you’re looking for flashy dividend growth or double-digit hikes, UBSI might feel a bit slow. But if what you want is a steady flow of cash backed by a bank that knows how to navigate both good and bad times, this is the kind of stock worth keeping an eye on.

Dividend Growth and Safety

Now let’s talk safety—because a dividend isn’t worth much if it’s not sustainable. UBSI’s payout ratio sits just below 54%, which is comfortably within a conservative range. It leaves room for earnings to fluctuate without putting the dividend at risk. That’s key, especially in a sector like banking where interest rates and loan demand can shift quickly.

Earnings per share currently sit at $2.75, compared to an annual dividend of $1.48. That’s a decent coverage ratio, and it shows that the bank isn’t stretching to make payments. Instead, it’s paying what it can comfortably afford and keeping a healthy chunk of profits for future growth or balance sheet strength.

Speaking of the balance sheet, it’s in good shape. UBSI’s book value per share is $36.98, almost exactly where the stock is trading right now. That tells you the market isn’t pricing in any dramatic risks or concerns. With more than $2 billion in cash and low debt, the company isn’t relying on external funding to meet its dividend obligations.

As for growth, dividend increases over the past decade have typically landed in the 2–3% range annually. Modest? Sure. But again, it’s not about the size of the raise—it’s about the consistency and the signal that management prioritizes returning capital to shareholders.

In short, this isn’t a high-octane dividend stock. It’s not going to deliver surprise 10% bumps or headline-grabbing announcements. But if you want something that just quietly delivers, quarter after quarter, year after year—UBSI fits that mold almost perfectly.

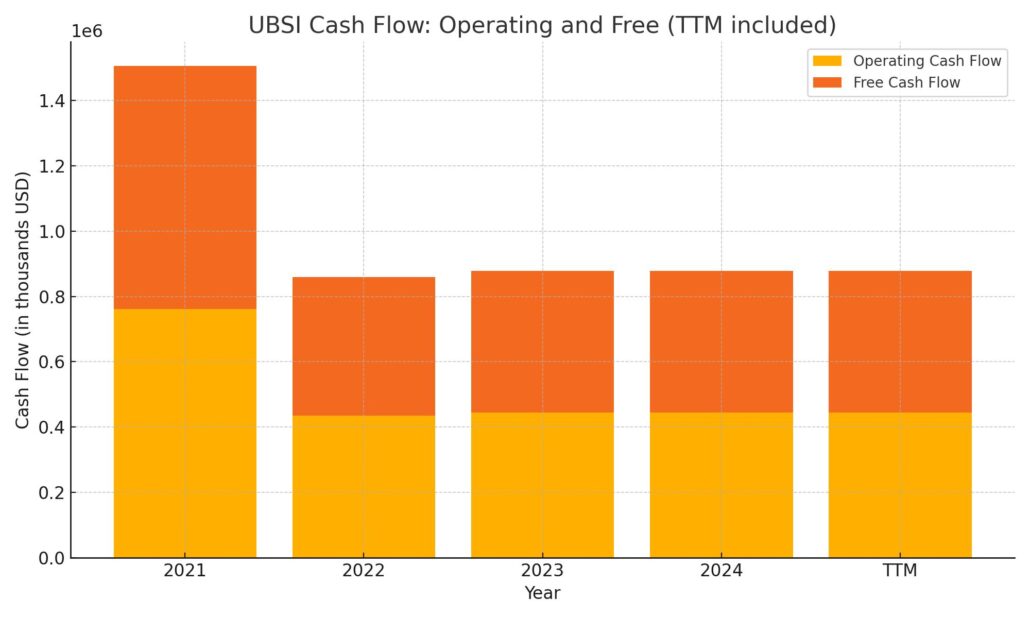

Cash Flow Statement

United Bankshares, Inc. generated $445 million in operating cash flow over the trailing twelve months, slightly above the previous year’s $435 million. This consistency shows that the bank continues to bring in a healthy amount of cash from its core business despite a shifting rate environment and modest earnings growth. Free cash flow also improved marginally to $433 million, indicating tight control over capital expenditures and a stable cash-generating foundation.

On the investing side, UBSI reported a notable inflow of $571 million, a dramatic shift from past years where activity leaned more heavily on outflows—particularly the steep -$3.4 billion seen in 2021, likely tied to acquisitions or large security purchases. Financing activities told a more conservative story, with $324 million in outflows due to significant debt repayments totaling $1.5 billion. That repayment was only partially offset by $250 million in new debt issuance, reflecting a strategy of deleveraging. The end cash position grew to $2.29 billion, marking a significant gain from the prior year and reinforcing UBSI’s strong liquidity position going into 2025.

Analyst Ratings

📉 United Bankshares, Inc. (UBSI) has recently seen a shift in sentiment from analysts, with a general tilt toward caution as macroeconomic pressures linger. The overall analyst consensus currently sits at a “Hold,” which reflects a neutral view on the stock’s immediate direction.

🎯 The average price target among analysts comes in around $41.75, implying some upside from the latest share price levels. Forecasts vary, with targets ranging from a conservative $38.50 to a more optimistic $45.00. This spread shows that while expectations are modest, there’s still belief in the bank’s underlying fundamentals.

🔄 Keefe, Bruyette & Woods recently trimmed their price target slightly, moving from $46 to $45, but maintained their Hold rating. The adjustment seemed to stem from expectations of slower net interest income growth and the overall industry pressure from elevated funding costs. Meanwhile, Stephens & Co. echoed the same Hold stance with a $43 price target, signaling that while the bank remains fundamentally sound, there isn’t a clear catalyst to drive aggressive upside in the near term.

🧭 For dividend-focused investors, these ratings are less a red flag and more a signal to stay patient. The bank is steady, but in the eyes of the analyst community, it’s not in a breakout phase—yet.

Earning Report Summary

United Bankshares, Inc. (UBSI) closed out 2024 on a solid note, posting earnings that reflected both stability and careful execution in a tough banking environment. The fourth quarter brought in net income of $94.4 million, or $0.69 per share. For the full year, UBSI earned $373 million, translating to $2.75 per share. Those numbers don’t scream growth, but they do reflect a business that knows how to hold its ground.

Net Interest Income and Margin

Net interest income for the quarter came in at $232.6 million, nudging up slightly from the previous quarter. That bump was helped by a drop in deposit costs and an increase in average earning assets, which came from stronger deposit growth. On the flip side, loan yields dipped a bit, which put slight pressure on the margin. All said, the net interest margin landed at 3.49%, just a touch lower than the 3.52% seen in Q3.

Noninterest Income and Expenses

On the noninterest income side, UBSI reported $29.3 million—down about 8% from the quarter before. Mortgage-related revenue took a bit of a hit, both in servicing and banking activity, though the impact was softened by fewer investment losses. Noninterest expenses held fairly steady at $134.2 million. There were some minor shifts across categories, but nothing dramatic. One thing that did stand out was an uptick in merger-related expenses, which climbed to $1.3 million due to the closing of the Piedmont Bancorp deal in early January.

Acquisition Impact

That Piedmont acquisition brought in about $2.4 billion in assets and $2.1 billion in loans—definitely a meaningful addition to the balance sheet. It’s a move that signals UBSI isn’t just sitting back and coasting; they’re growing, just in a methodical way.

Credit Quality and Taxes

Credit conditions remained stable with a $6.7 million provision for credit losses, right in line with the previous quarter. Meanwhile, taxes ticked higher, with a $26.7 million bill due to a higher effective tax rate of 22%.

UBSI didn’t deliver fireworks, but it didn’t need to. The latest results show a bank staying the course, growing in measured steps, and delivering consistent performance—exactly what long-term income investors tend to value most.

Management Team

United Bankshares, Inc. (UBSI) is led by a leadership team with a strong foundation in traditional banking and regional expansion. At the top is Richard M. Adams, now serving as Executive Chairman of the Board. He’s been part of the bank’s story for decades, having previously served as CEO and playing a major role in its long-term growth and acquisition strategy.

James J. Consagra, Jr., the company’s President, oversees the bank’s major business lines, from lending to retail and wealth management. His background includes significant experience in managing multi-state operations and driving efficiency across business segments.

W. Mark Tatterson is the bank’s Chief Financial Officer, and he’s been with UBSI for over 25 years. His role covers financial planning, reporting, and treasury management. He’s known for a detail-oriented approach that’s helped the bank maintain its solid financial footing through various economic cycles.

Ross M. Draber, Chief Operating Officer, has helped guide the integration of acquired banks over the years and manages the day-to-day operations. Alongside him, Douglas B. Ernest serves as Chief Credit Officer, managing underwriting standards and loan portfolio quality.

Together, this team blends institutional memory with a steady hand, a big reason why UBSI has remained stable through challenging market periods.

Valuation and Stock Performance

UBSI’s stock is currently trading around $34.71, with a 52-week range between $30.68 and $44.43. That price movement reflects some of the uncertainty that’s hung over the regional banking space recently, but UBSI has managed to stay relatively resilient compared to some of its peers.

Its current market capitalization is just under $5 billion, and it’s priced at about 12.5 times earnings. That puts it in line with other banks of similar size, suggesting the market is pricing it fairly, without any extreme expectations baked in. What stands out more, though, is the price-to-book ratio sitting just below 1. That implies the stock is trading at a slight discount to the underlying value of its assets.

For income investors, the 4.3 percent dividend yield is especially appealing. It’s higher than the bank’s five-year average yield, and with the company having raised dividends for 50 straight years, that payout has the weight of a long-standing commitment behind it. Analysts have a consensus target price of around $41.75, which gives the stock some modest room to climb if sentiment improves.

Risks and Considerations

As with any bank, UBSI carries exposure to interest rate movements. If rates remain elevated or climb further, the cost of funding could weigh on margins, especially if loan demand slows at the same time. The bank has managed that risk well so far, but it’s always a moving target in the banking business.

Credit risk is another area to watch. UBSI’s portfolio has held up well, but if economic conditions soften, especially in key lending regions, that could mean higher loan loss provisions in future quarters. While current levels are manageable, shifts in asset quality can change quickly in a downcycle.

There’s also the competitive landscape to consider. Regional banks face pressure not only from larger national institutions but increasingly from fintechs and digital-first platforms. While UBSI has leaned into its community roots, it’ll need to keep modernizing to stay relevant, particularly with younger customers.

And of course, regulatory oversight remains an ongoing variable. Changes in capital requirements or consumer protection rules can impact costs and limit operational flexibility.

Final Thoughts

United Bankshares, Inc. continues to hold its ground as a dependable name in the regional banking space. It’s not a fast grower or a market disruptor—but it doesn’t try to be. The bank focuses on consistency, measured growth, and steady returns, especially for shareholders who value income.

That makes it a compelling option for dividend-focused investors. The leadership team has experience on its side, and the company’s long history of rising payouts gives it a certain comfort factor that many income stocks lack.

Still, like any investment, it’s not without its risks. The interest rate environment, economic shifts, and evolving competition all have the potential to reshape the outlook. But for those seeking a dividend that has weathered decades of economic change, UBSI stands out as one of the few financial institutions that has consistently delivered.