Updated April 2025

UMB Financial Corporation, traded under the ticker UMBF, is one of those names in the banking space that has built a legacy without the need for constant spotlight. With roots that trace back over a century, this Kansas City-based bank holding company has quietly grown into a multi-state institution offering everything from commercial banking to wealth management.

For dividend investors, UMBF isn’t just another financial stock. It’s a steady name that’s carved out a space based on disciplined growth, conservative management, and a real focus on long-term shareholder value.

Recent Events

UMB has had a busy start to the year. The most notable move was its completed acquisition of Heartland Financial. This deal pushed UMB’s total assets near the $70 billion mark and extended its reach from eight to thirteen states. That kind of growth doesn’t just widen the client base—it deepens the bank’s earnings potential and adds heft to its wealth management segment, where assets under management and administration rose over 30%.

The scale and synergy of this acquisition could strengthen UMB’s operating margins over time and provide a broader foundation from which dividends can grow. For investors who lean on yield and consistency, scale backed by careful execution is a welcome signal.

Key Dividend Metrics

Dividend Yield: 1.57%

Annual Dividend: $1.60 per share

Payout Ratio: 16.72%

Dividend Growth: 16 consecutive years of increases

Recent Dividend: $0.40 per share (Q1 2025)

Dividend Overview

UMB’s dividend strategy isn’t flashy, but it’s dependable. The company currently pays a quarterly dividend of $0.40 per share, translating to $1.60 annually. Based on its recent share price, that gives UMBF a dividend yield of around 1.57%.

While that yield isn’t high by traditional income standards, it’s underpinned by strong fundamentals. The payout ratio sits at just under 17%, suggesting the dividend is well-covered by earnings. In plain terms, UMBF isn’t stretching to pay shareholders—it’s doing so comfortably.

This approach leaves ample room for both reinvestment in growth and protection during economic downturns. For long-term income investors, that kind of flexibility is exactly what keeps dividend checks arriving without interruption.

Dividend Growth and Safety

UMB Financial has built a quiet track record of dividend growth, year in and year out. Over the past decade, it’s raised its annual dividend from under a dollar to over $1.50. That pace isn’t explosive, but it is consistent—and that consistency carries weight, especially in a sector where payout cuts can hit with little warning.

What makes UMB’s dividend profile particularly appealing is how safe it looks on paper—and even more so in practice. A payout ratio below 20% is a green flag for sustainability, signaling that the company is reserving a majority of its earnings for other uses. It’s a sign of strength, not stinginess.

The recent acquisition, while still early in integration, could further bolster the dividend story. More assets, broader revenue streams, and increased scale usually translate into improved cash flow. If UMB stays the course, it’s reasonable to think dividend growth could keep tracking upward without putting pressure on the balance sheet.

That said, UMB’s yield won’t turn heads at first glance. It’s not built to. What the company offers is something a little more old-fashioned: consistency, prudence, and measured growth. For investors who value reliability over rapid yield-chasing, this kind of profile is exactly the kind that earns its place in a long-term income portfolio.

There’s a lot to like about a dividend that’s not only been paid but raised for sixteen straight years. And with strong earnings coverage, disciplined leadership, and the tailwinds of a recent expansion, UMBF looks like it intends to keep that streak alive.

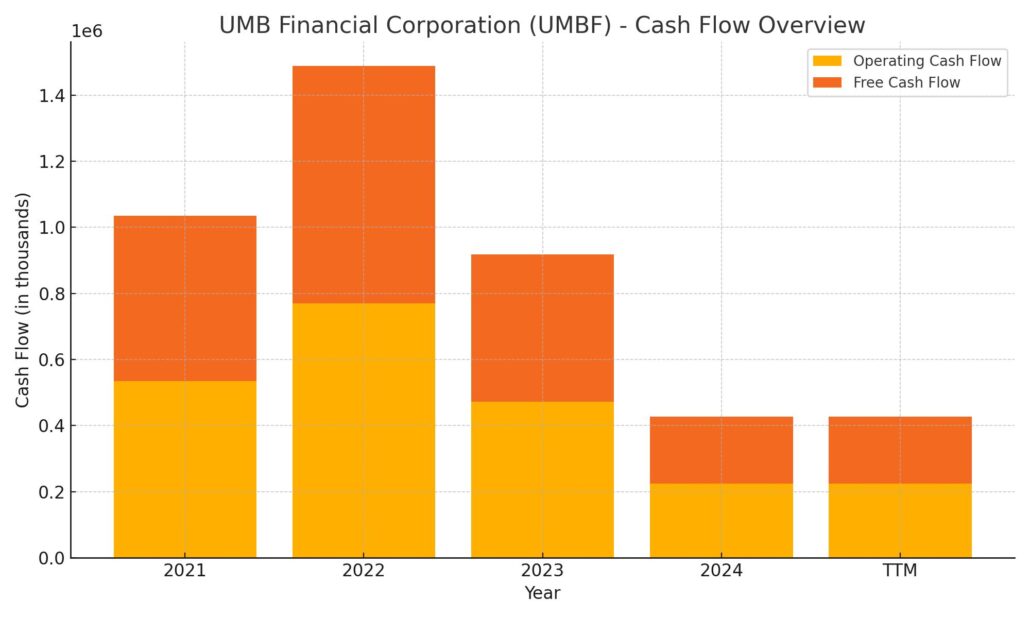

Cash Flow Statement

UMB Financial’s cash flow statement over the trailing twelve months reflects a significant shift in capital strategy, particularly tied to its acquisition activity. Operating cash flow for the TTM sits at $225 million, a notable drop from prior years, signaling higher expenditures or reduced core earnings efficiency during the integration of newly acquired assets. Free cash flow followed the same pattern, down to $201 million from $445 million the year prior, though still firmly positive, indicating UMB is generating more cash than it spends even after capital expenditures.

On the investing side, cash outflows expanded sharply to over $3.2 billion, a jump tied primarily to acquisition-related activity, far exceeding past levels. Meanwhile, financing cash flow saw a massive influx at nearly $6 billion, compared to $4.7 billion in 2023. That reversal from negative financing in 2021 suggests heavy debt issuance and capital raising efforts to fund expansion. End cash position rose substantially to $8.4 billion, reflecting strong liquidity despite higher interest costs and a complex operating environment.

Analyst Ratings

UMB Financial Corporation (UMBF) has recently seen a shift in analyst sentiment, with one of the notable changes coming from a reduction in price target. One firm lowered its target from $156 to $146, while still maintaining an overweight rating. The reason? While revenue growth has been solid, there’s some hesitation around how efficiently those top-line gains are translating into bottom-line performance. There’s a sense that operating costs or integration challenges from recent acquisitions may be putting a temporary damper on earnings growth.

Even so, the broader analyst community remains fairly constructive. Out of seven analysts covering the stock, the consensus rating sits at a moderate buy. The average price target comes in at $128.71, which implies a potential upside of about 28% from where shares are trading now. While not a unanimous endorsement, it reflects a generally optimistic view that UMBF has the fundamentals and strategy in place to navigate short-term headwinds and continue creating shareholder value. For investors who like steady, dividend-paying financial names with upside, this kind of analyst sentiment often adds another layer of confidence.

Earning Report Summary

UMB Financial closed out 2024 on a strong note, with the fourth quarter showing a solid uptick in both earnings and momentum. Net income came in at $120 million, or $2.44 per diluted share. After adjusting for a few one-time items, operating income landed at $122.6 million, or $2.49 per share. That’s a noticeable step up from the $109.6 million the company reported in the previous quarter—and a strong improvement over where things stood a year ago.

Net Interest Income Rises with Margin Expansion

One of the big positives this quarter was net interest income, which climbed to $269 million. That was an 8.7% jump over the previous quarter, largely thanks to a higher net interest margin that ticked up to 2.57%. This improvement suggests the bank’s doing a good job managing its lending and funding mix even with rate pressures in the background.

Fee-Based Business Adds Balance

On the non-interest income side, UMB pulled in $165.2 million, up just over 4% from Q3. What stood out here was the balanced growth across different lines—fund services, corporate trust, private wealth, and even card services contributed. The story here is diversification. It’s clear the bank isn’t leaning too heavily on any single revenue stream.

Lending Sees Strong Growth

Loan growth was another highlight. Average loan balances increased at nearly a 15% annualized pace, hitting $25.3 billion. A big chunk of that came from new loan production, which hit a record $1.6 billion for the quarter. The bank is seeing activity across commercial, real estate, and consumer segments, which shows there’s demand—and trust—for its lending services.

Deposit Base Expands, Costs Kept in Check

Deposits also moved higher, jumping by more than $2.7 billion from the previous quarter. That’s a 30% annualized increase. Non-interest-bearing deposits made up 27% of the mix, which is helpful in keeping funding costs low. It’s a positive signal that clients are still parking their cash with UMB despite a competitive deposit environment.

Credit Quality Holding Steady

Charge-offs stayed minimal, at just 0.10% of average loans for the year. That’s a testament to the bank’s conservative credit standards and stable underwriting. With economic uncertainty still out there, this kind of consistency in credit quality is a real strength.

Overall, UMB Financial ended the year with growing momentum, strong loan and deposit activity, and a solid handle on risk—all of which put it in a good spot heading into the new year.

Chart Analysis

Price Movement and Trend Behavior

The stock spent the first half of the year trading in a relatively narrow range before making a strong breakout in early summer. From there, it steadily climbed, topping out just above the $130 mark in late fall. Since then, the momentum has cooled, with the price gradually pulling back and now sitting in the low $100s. The 50-day moving average rolled over a few months back and is now trending below recent prices, while the 200-day moving average is still climbing, though at a gentler slope.

This type of behavior—where the short-term moving average curls downward while the longer-term trend is still intact—often suggests the stock is pausing after a run, rather than reversing outright. The recent bounce off the 200-day average adds to that idea. It’s holding ground near a key support level, which could act as a base for a new leg higher if strength returns.

Volume and Relative Strength

Volume spiked a few times during the mid-year rally and again during some of the more recent declines, but overall, trading activity has settled down. That points to a market that’s digesting the earlier gains rather than one being driven by panic or euphoria. Lighter, more balanced volume near the current level often reflects consolidation, not capitulation.

Looking at the Relative Strength Index (RSI) at the bottom, it dipped close to oversold territory around early March but has since climbed steadily and is now approaching the higher end of the range. While not quite in overbought territory, it’s getting there, which could signal some short-term caution. Still, the upward slope of the RSI mirrors the modest recovery in price, suggesting improving momentum from a technical standpoint.

Big Picture Takeaway

The chart shows a stock that had a strong run-up, pulled back in an orderly fashion, and now appears to be stabilizing. It’s showing respect for long-term support levels and rebuilding momentum gradually, without excessive volatility. That kind of pattern reflects underlying confidence in the name, even if near-term upside may not come in a straight line. It’s behaving like a stock that’s resetting after a solid year, rather than one that’s breaking down.

Management Team

At the helm of UMB Financial Corporation is Mariner Kemper, who serves as Chairman and Chief Executive Officer. With nearly three decades at UMB, Kemper has held a variety of roles across the organization, including time as President of UMB Bank Colorado. His long tenure gives him a deep familiarity with the company’s operations and an ability to lead with both vision and continuity.

Supporting him is Ram Shankar, the company’s Chief Financial Officer and Executive Vice President. He oversees financial strategy, treasury, investor relations, and planning. Shankar has been instrumental in ensuring UMB maintains a strong capital position, especially during periods of market uncertainty and interest rate volatility.

Jim Rine serves as President of UMB Financial Corporation and also leads UMB Bank as its President and CEO. He’s responsible for a broad portfolio that includes commercial banking, personal banking, wealth management, and credit administration. His operational oversight gives him a frontline view into the company’s performance and client relationships.

Together, this team brings a mix of experience and hands-on leadership that has helped shape UMB’s disciplined, conservative approach—one that’s been effective across different market environments.

Valuation and Stock Performance

As of early April 2025, shares of UMBF are trading just under $102. The stock has climbed significantly over the past year, recovering from a low in the mid-$70s to a high of nearly $130. That range illustrates the volatility financials have faced, but also UMB’s ability to push through and regain momentum.

Looking at valuation, UMBF’s price-to-earnings ratio is around 11, suggesting the market sees steady earnings but isn’t pricing in much aggressive growth. That could present a more favorable entry point for those looking for dependable, cash-generating companies. Its price-to-book ratio is just over 1.3, which signals that the stock trades only slightly above its tangible value—often a sign of a well-regarded but reasonably priced financial institution.

The stock’s strong performance in 2024 was supported by a combination of healthy loan growth, disciplined credit management, and the anticipated benefits from its acquisition of Heartland Financial. These drivers have helped rebuild investor confidence and contribute to a relatively stable forward outlook.

Risks and Considerations

Like any financial stock, UMB isn’t immune to broader macroeconomic shifts. Rising or falling interest rates can impact net interest margins, and economic slowdowns tend to weigh on lending activity and credit quality. While UMB has shown solid performance in these areas, the external environment still matters.

Acquisition risk is another factor. UMB’s deal with Heartland Financial is a big one, and successful integration will be key to delivering on the strategic upside. Cultural alignment, technology integration, and regulatory approval all take time—and can create some bumps along the way.

There’s also the growing challenge of cybersecurity and fraud, which isn’t unique to UMB but is a constant concern in banking. UMB has made visible efforts to manage these risks with enhanced digital security tools and transaction oversight, though the threat landscape remains dynamic.

Lastly, regulatory scrutiny in the financial sector can shift rapidly depending on changes in legislation or policy direction. Even well-run institutions like UMB can be impacted by shifting compliance burdens or new capital requirements.

Final Thoughts

UMB Financial Corporation continues to demonstrate resilience and focus. With a leadership team rooted in long-term thinking, disciplined growth strategies, and a consistent approach to capital allocation, the company has managed to stand out in a sector that can be difficult to navigate.

Its valuation appears reasonable in the current landscape, offering the potential for continued upside if it executes well on its integration plans and market positioning. While risks are always present, particularly in the banking sector, UMB’s measured style and steady fundamentals give it a strong foundation for the future.