Updated April 2025

UFP Industries might not be the first name that jumps out in the industrial space, but it’s one of those companies that quietly does its job—and does it well. Based out of Grand Rapids, Michigan, UFPI has steadily evolved from a lumber distributor into a global player in wood and alternative building materials. With its hands in retail, industrial, and construction markets, it has created a solid revenue base that can ride out cycles without losing its footing. And while the business isn’t flashy, its commitment to consistent dividends is what makes it stand out for long-term income-focused investors.

Recent Events

Over the past year, UFPI has seen a bit of a reset. Total revenue over the trailing twelve months came in at $6.65 billion, down about 4% from the previous year. That’s not nothing, but in the context of falling lumber prices and a slower construction backdrop, it’s manageable. The more eye-catching stat was the 34% year-over-year drop in earnings. But when you zoom out, it’s clear the business is still sound.

What’s telling is how the company handled this environment. Despite the hit to earnings, UFPI maintained a rock-solid balance sheet. It closed the most recent quarter with $1.2 billion in cash and only about $357 million in debt. That’s a debt-to-equity ratio of just under 11%, which gives the business plenty of breathing room. The current ratio is sitting close to 5, showing just how comfortably the company can cover its short-term obligations.

While the operating environment may be a bit softer, UFPI’s fundamentals haven’t lost their footing. And for dividend investors, that means there’s a dependable cushion underneath those payouts—even in slower times.

Key Dividend Metrics

💰 Forward Dividend Yield: 1.31%

📈 5-Year Average Yield: 1.00%

📅 Next Dividend Date: March 17, 2025

⚖️ Payout Ratio: 19.50%

📊 Dividend Growth: Upward trend over past 5 years

📉 Trailing Annual Dividend Rate: $1.32

💸 Free Cash Flow: $286.87 million

🏦 Cash on Hand: $1.2 billion

Dividend Overview

Looking at the yield alone, UFPI may not catch every dividend hunter’s eye at 1.31%. But when you look under the hood, the quality and sustainability of that dividend tell a different story. The payout ratio sits comfortably under 20%, which shows a clear commitment to keeping the dividend manageable, even when business conditions shift.

That kind of discipline is key. The company is not stretching to impress income-focused shareholders, but it’s delivering where it counts. There’s plenty of room for the dividend to grow without putting pressure on operations. And with a cash position over $1 billion and solid free cash flow, the ability to maintain—and increase—dividends feels secure.

The most recent dividend was paid out on March 17, with the ex-dividend date falling on March 3. Looking at the pattern, there’s no reason to expect any surprises. UFPI has found its rhythm, and shareholders are benefiting from that steady cadence.

Dividend Growth and Safety

Over the last five years, UFPI has built a reputation for quietly growing its dividend without taking on unnecessary risk. The increases aren’t explosive, but they’re reliable, and that’s what gives them weight. The consistency reflects a thoughtful strategy rather than reactionary changes.

What’s more important is how safe that dividend is. The company isn’t just paying out earnings—it’s doing so with a massive financial buffer. With just 11% debt-to-equity and over a billion in the bank, UFPI can weather a lot more turbulence than most. Even with earnings down more than 30% year-over-year, the dividend stayed intact. That says something.

There’s also a notable lack of financial engineering here. UFPI doesn’t lean on buybacks to mask performance. Instead, they focus on the core business and allocate capital with long-term strength in mind. The free cash flow position—nearly $287 million over the last twelve months—is more than enough to support dividend payments, reinvestment, and still have room to breathe.

All signs point to a management team that takes capital allocation seriously. For long-term investors focused on growing income streams, that kind of foundation matters more than a flashy payout.

UFPI may not be the loudest voice in the market, but its dividend story is built on something solid. In a market where flash often overshadows fundamentals, it’s nice to see a company quietly doing right by its shareholders.

Cash Flow Statement

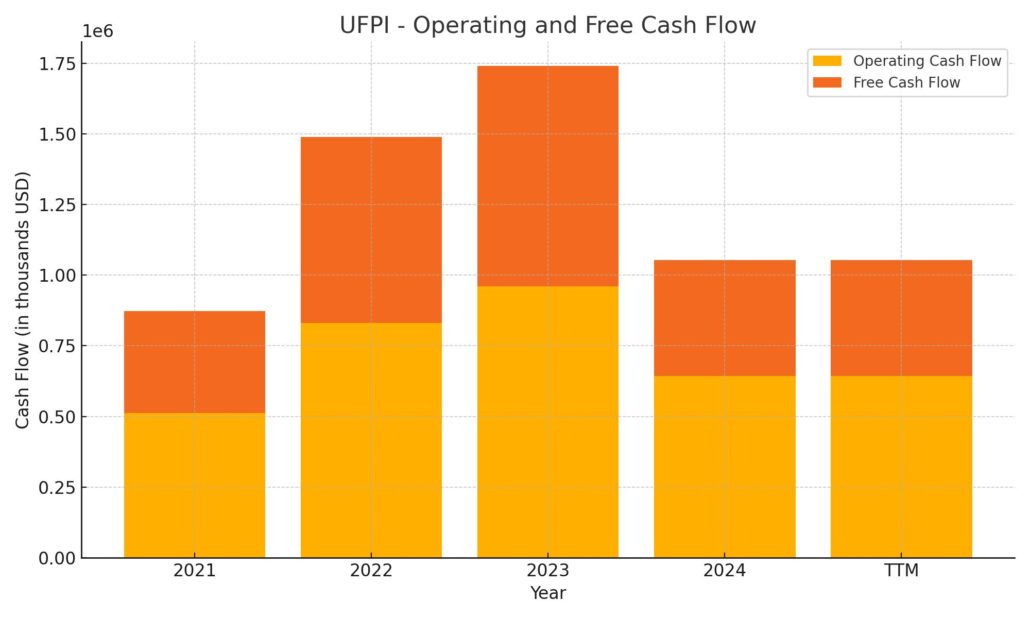

UFP Industries ended the trailing twelve months with $642.6 million in operating cash flow, showing a decline from the previous year’s $959.9 million. While this drop reflects broader earnings pressure, especially from lower lumber pricing and softer demand, the company remains solidly cash generative. Free cash flow came in at $410.3 million—down from a high of $779.5 million in 2023, but still strong relative to historical levels. This cash strength provides flexibility to support dividends, fund operations, and reinvest in the business without overextending.

On the investment side, UFPI spent $270.8 million, primarily aimed at maintaining and expanding operations. Financing cash flow was negative $307.1 million, with a notable $141.1 million allocated toward share repurchases. The company also kept debt issuance modest at just under $30 million, signaling a preference for internally funded growth. Despite reduced cash from operations, UFPI’s end-of-period cash position rose slightly to $1.18 billion—underscoring just how conservatively this business is run.

Analyst Ratings

📈 UFP Industries (UFPI) has recently seen a few shifts in analyst sentiment and expectations. As of April 2, 2025, the stock is trading around $109.10, and analysts continue to revisit their outlook as market conditions evolve.

💼 Back in February 2025, Benchmark reaffirmed its confidence in UFPI by maintaining a “Buy” rating while holding steady with a price target of $135. That implies a potential upside of about 24% from current levels. Analysts pointed to the company’s resilient balance sheet, reliable cash generation, and strategic position in industrial and construction markets as reasons to stay optimistic despite broader economic headwinds.

🔼 In a notable shift from late 2024, Wedbush upgraded the stock from “Neutral” to “Outperform,” bumping their target from $120 to $155. The rationale? A combination of improving lumber pricing trends, a lean cost structure, and expectations for a pickup in industrial demand. The move showed increasing confidence in UFPI’s ability to maintain earnings quality even in a mixed macro landscape.

🎯 The current consensus among analysts sits at a “Moderate Buy,” with an average price target around $143. It reflects a balanced view—cautious optimism grounded in solid fundamentals and ongoing faith in the management team’s capital discipline.

Chart Analysis

Price Trend and Moving Averages

The chart shows a clear shift in momentum over the past 12 months. From spring through late fall, UFPI steadily climbed, even breaking above the $130 mark in the late summer and early fall. During this time, the 50-day moving average stayed above the 200-day, confirming the strength of the uptrend.

But that picture started to change in December. Price slipped below both moving averages, and the 50-day line crossed under the 200-day in early January. That crossover was a key signal of shifting momentum. Since then, the stock has struggled to reclaim higher ground, holding mostly below both moving averages, which have now flattened or started to slope down.

This kind of technical setup doesn’t necessarily mean the long-term story is broken, but it does suggest the stock has lost its short-term leadership and may take time to rebuild its base.

Volume Behavior

Volume has remained relatively steady, with a few noticeable spikes. Most of the large volume days occurred during sharp downswings, which often signals distribution—larger players moving out of positions. More recently, volume has been lighter, and there hasn’t been a convincing surge on up days. That tells us conviction on the buy side remains low, even as the price attempts to rebound off recent lows.

RSI Momentum

Looking at RSI, the stock has been climbing back from oversold territory hit in early January. It has recently approached the upper end of the neutral zone, suggesting improving momentum. It hasn’t quite hit overbought levels yet, but the strength of the rebound is notable.

Still, RSI hasn’t stayed consistently above 50 for a prolonged stretch since the downtrend began, which reflects the broader softness in price action. Until that changes, upside movement may continue to be capped in the short to medium term.

Overall Outlook

This chart paints a picture of a stock that had a strong run through much of last year but ran into trouble as market conditions shifted. It’s trying to stabilize now, but hasn’t yet re-established its upward trend. The recent bounce shows some signs of life, but without volume confirmation or a break above key moving averages, it’s still early. Patience and a focus on the fundamentals remain important here.

Earning Report Summary

Slower Quarter, Still Solid

UFP Industries closed out 2024 with a fourth-quarter that showed a bit of a slowdown, but nothing too alarming. Sales landed at $1.46 billion, which was down about 4% from the same quarter the year before. The slip mostly came from lower selling prices, while unit volume stayed pretty consistent. It’s a clear sign that while demand might be softening, the company is still moving product.

What stood out, though, was how steady the balance sheet remains. UFP ended the year with nearly $1.2 billion in cash and access to more if needed. That kind of liquidity gives them a good cushion—not just for weathering economic bumps, but also for staying aggressive when the right opportunity comes up.

New Products and Efficiency Moves

Innovation is becoming a bigger part of the story here. New product sales hit $505 million in 2024, making up nearly 8% of total revenue. Management has its eye on pushing that to 10% in the future. It’s a good sign they’re not standing still and are working to diversify beyond traditional lumber offerings.

On the cost side, they’ve identified about $60 million in savings to be unlocked over the next couple of years. Some of that’s coming from trimming expenses and consolidating certain operations. It’s the kind of behind-the-scenes work that doesn’t make headlines but does improve margins over time.

Investments and Outlook

Looking ahead, UFP plans to invest around $350 million in capital projects this year. That’s part of a broader plan to pump a billion dollars into the business by 2028. The focus is on automation, technology upgrades, and boosting capacity—moves that should help them stay competitive and scale where needed.

They’re also growing strategically. The recent acquisition of C&L Wood Products gives them a stronger footprint in the packaging space. And on the shareholder side, they bumped the dividend by 6%, bringing it to $0.35 per share. That kind of consistency keeps income-focused investors in the fold.

As for the near-term outlook, management is realistic. They’re expecting softer demand and tighter pricing through the first half of 2025. But with their financial strength and clear investment strategy, they seem ready to play both defense and offense, depending on how the year unfolds.

Management Team

UFP Industries recently made some key leadership changes that signal a thoughtful transition into its next phase. As of December 29, 2024, Matthew J. Missad stepped down from his role as CEO and moved into the position of Executive Chairman. His time as CEO saw strong strategic growth and consistent profitability, and his continued presence on the board should provide steady guidance.

William “Will” Schwartz, formerly President of UFP Retail Solutions, has stepped into the CEO role. Schwartz brings deep experience from within the company and has a strong grasp of both its culture and operations. His promotion suggests a seamless shift and continuity in UFP’s long-term vision.

Adding to that, Michael R. Cole, the company’s CFO, has taken on the expanded role of President of Corporate Services. His financial leadership and broad understanding of the business are expected to be instrumental as UFP looks to build on its current momentum.

Altogether, the team is a blend of seasoned leadership and homegrown talent, aiming to keep the company grounded in its core strengths while looking for new opportunities to evolve.

Valuation and Stock Performance

UFP Industries shares are trading around $109.10 as of early April 2025. Over the past year, the stock has seen its ups and downs, with a high of $141.33 and a low of $102.35. That range reflects a business feeling the effects of broader economic swings, particularly in the housing and construction markets, which are closely tied to its revenue streams.

Looking at valuation, UFPI is trading at a price-to-earnings ratio just over 16, which is fairly reasonable given the company’s track record. Its price-to-sales ratio is around 1.05, suggesting the market isn’t overpaying for revenue, and there’s some room for upside if demand rebounds.

The average analyst price target is hovering near $133, which points to some cautious optimism in the investment community. Analysts seem to appreciate the company’s balance sheet strength and disciplined capital strategy, even as they factor in short-term pressures.

Overall, while the stock has pulled back from its highs, the long-term setup still looks grounded. UFPI’s ability to maintain strong financial footing in a more volatile environment has kept investor confidence intact.

Risks and Considerations

There are a few key risks worth considering. The first is the cyclical nature of UFP’s core markets. Any slowdown in residential or commercial construction can directly impact sales. We’ve already seen a bit of that pressure in recent quarters as demand and pricing have cooled off.

Then there’s the issue of raw material volatility. Lumber prices, in particular, can swing sharply from one quarter to the next, and even with some hedging and pricing power, it’s not always easy to maintain steady margins. This type of cost variability can affect earnings even when sales volumes are solid.

Leadership transitions also add a layer of unpredictability. While the company promoted from within and seems to be taking a well-planned approach, any change at the top naturally brings questions about strategy and execution in the near term.

Competition is another factor. UFP doesn’t operate in a vacuum, and the building materials space has plenty of well-capitalized players. Staying competitive requires innovation, efficient production, and strong relationships with customers. The company’s ongoing investments in automation and product development are aimed at staying ahead, but execution will be key.

Final Thoughts

UFP Industries has built a business that has proven resilient across cycles. With a refreshed leadership team, a strong balance sheet, and a clear strategy to invest in its future, the company appears to be preparing for the next wave of growth while navigating near-term headwinds.

Its current stock price may not reflect its full long-term potential, especially if housing and construction activity stabilize later in the year. Management’s steady hand, paired with a disciplined approach to capital allocation, helps maintain confidence during uncertain periods.

Of course, risks remain—from market cyclicality to input costs and competition. But the company has weathered similar periods before and seems positioned to do so again. Those following the name will want to stay dialed in to economic trends and company updates, particularly around volumes, pricing, and how new leadership shapes the next leg of the journey.

With patience and a long view, UFP Industries continues to look like a company that’s building for more than just the next quarter.