Updated April 2025

TXNM Energy, Inc. might not generate buzz on financial news tickers every morning, but for dividend-focused investors, this stock tells a story worth hearing. The company sits in the energy infrastructure space, handling the logistics, storage, and distribution that keep the broader energy sector humming. Over the years, TXNM has evolved into a steady, well-managed operator with a keen focus on shareholder returns.

The beauty of TXNM is in the consistency. While the stock price doesn’t swing wildly and the company isn’t chasing high-risk, high-reward bets, it has something that many investors crave: reliability. Institutional interest is strong, with over 108% of shares held by institutions, and the company has rewarded patient holders with a nearly 44% return over the past 12 months. Add a dividend yield over 3%, and you start to see why income investors keep a close eye on this one.

🧮 Key Dividend Metrics

📈 Forward Dividend Yield: 3.05%

💵 Forward Annual Dividend Rate: $1.63 per share

📊 Payout Ratio: 58.05%

🕒 5-Year Average Dividend Yield: 3.06

📆 Next Ex-Dividend Date: April 25, 2025

💸 Dividend Date: May 16, 2025

🔁 Last Stock Split: 3-for-2 on June 14, 2004

Recent Events

TXNM wrapped up its most recent quarter with momentum. Year-over-year revenue jumped nearly 16%, signaling healthy operational execution in what can be a choppy industry. Earnings per share for the trailing twelve months reached $2.67, backed by net income of just over $242 million.

That kind of growth isn’t an accident. It reflects a company quietly expanding its market value, now near $5 billion after steadily rising from just over $3 billion a few quarters ago. Margins are solid, with profit margins sitting at 12.3% and operating margins comfortably over 16%. TXNM is showing it can run a tight ship even as it grows.

Now, one area worth watching is the company’s debt. With $5.83 billion in total debt and a debt-to-equity ratio above 224%, it’s a serious figure. That said, TXNM brings in solid operating cash flow—over $500 million—which helps to manage that burden. EBITDA for the trailing twelve months sits at $878 million, giving the company breathing room to maintain operations and meet obligations without putting shareholder returns at risk.

Even after a slight dip in after-hours trading, there’s nothing in the recent numbers to suggest a shift in direction. The fundamentals are intact, and the stock’s low beta of 0.33 underscores its defensive appeal.

Dividend Overview

TXNM’s dividend track record isn’t flashy, but it’s dependable—and that’s what matters. The current forward yield of 3.05% lands right in line with the company’s five-year average, which tells us the dividend isn’t being stretched or overengineered to chase attention. It’s sustainable, steady, and backed by earnings.

Management recently bumped the dividend up to $1.63 per share on an annual basis. It’s not a massive increase, but it’s meaningful. What it really shows is confidence—confidence that cash flows are stable enough to continue growing the payout without overextending the balance sheet.

The payout ratio sits just over 58%, which is a bit on the higher side, but still well within reason for a company of this size and maturity. It signals a willingness to share profits with investors while keeping enough capital in-house for future growth and debt servicing.

Timing-wise, everything’s on track. The next ex-dividend date is April 25, with checks hitting investor accounts in mid-May. For income-focused portfolios, that kind of predictability is golden.

Dividend Growth and Safety

TXNM may not be a headline-grabbing dividend growth machine, but there’s a quiet rhythm to how it handles shareholder payouts. Over the years, the dividend has grown right alongside earnings. No flashy double-digit hikes, but consistent, manageable increases that reflect actual financial performance.

This approach speaks volumes about management’s priorities. The focus isn’t on making waves—it’s on building a sustainable income stream. That makes TXNM a more attractive holding for long-term investors who value stability over excitement.

The payout ratio, again, deserves mention. At 58%, it’s balanced. High enough to be generous, but low enough to remain flexible. Importantly, the dividend isn’t being funded with debt—always a red flag in this space. Instead, TXNM relies on genuine cash flow from its operations, which speaks to the strength of its underlying business.

There’s also a behavioral side to dividend safety, and TXNM checks those boxes. The company has never shown signs of reckless distribution increases. It doesn’t overpromise. It moves in step with what its operations can realistically support. That’s a mark of discipline.

With a low beta, strong institutional backing, and a cash flow engine that still turns even in uncertain energy markets, TXNM offers dividend investors a compelling mix of reliability and steady returns. It’s not about chasing big moves—this is a stock that delivers in the long run by doing the fundamentals right.

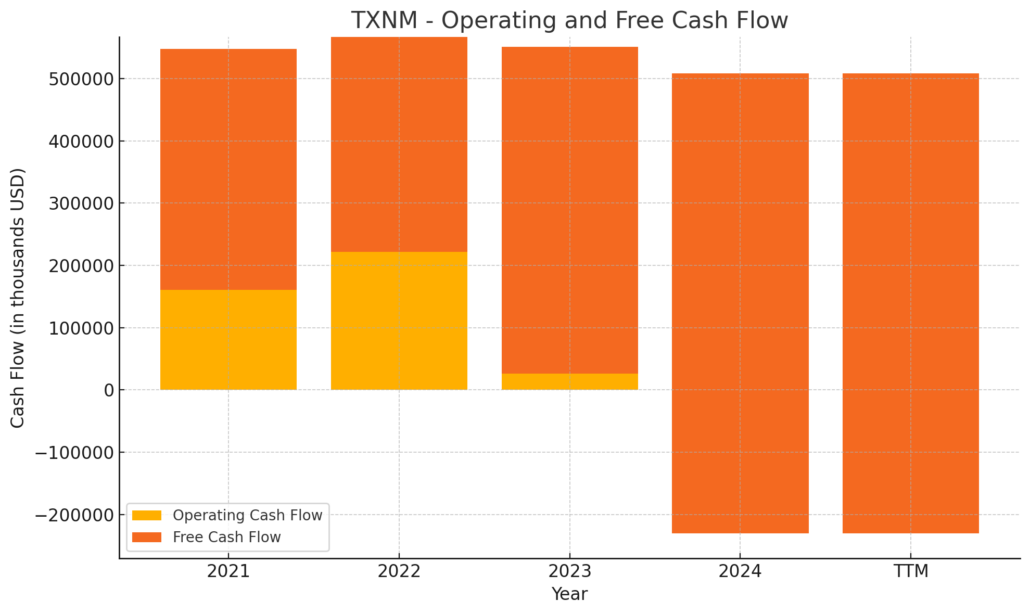

Cash Flow Statement

TXNM Energy’s cash flow statement over the trailing twelve months reflects a business under heavy capital deployment but still generating solid operating cash. The company brought in $508 million in operating cash flow, a dip from the previous two years but still a healthy figure considering the broader capital strategy at play. Interest expenses also increased, hitting nearly $208 million, which tracks with the rise in issued debt. This is a business clearly leaning into growth or asset expansion, rather than retrenching.

Investing activities continue to weigh heavily on free cash flow, with outflows reaching over $1.17 billion—larger than any of the past three years. That aggressive investment pace drove free cash flow to a negative $739 million, raising the stakes on those capital commitments. On the financing side, TXNM raised $4.13 billion in new debt while returning only modest amounts to shareholders through buybacks, suggesting a capital structure that prioritizes debt-driven expansion. Despite the cash burn, the company’s end cash position has improved substantially to $22 million, a big jump from under $4 million last year. All in all, the company is clearly choosing growth, even if it means burning cash in the short term.

Analyst Ratings

📈 In recent months, TXNM Energy has seen a wave of analyst upgrades and upward revisions to its price targets. Mizuho shifted its stance from “Neutral” to “Outperform” in early March, setting a price target of $53.00. This move was largely driven by expectations for growth in TXNM’s rate base and earnings, as well as its strong positioning within the electric utilities sector. The firm emphasized improving fundamentals and steady operational performance as key reasons for the upgrade.

💹 Barclays followed suit a week later, lifting its price target from $56.00 to $57.00 while maintaining an “Overweight” rating. Analysts there pointed to TXNM’s strategic execution and clarity around its capital investment plans, especially in grid modernization and energy distribution infrastructure, as reasons for the positive outlook.

🔄 Citigroup had also made adjustments earlier, raising its target from $45.00 to $53.00 and assigning a “Neutral” rating. Meanwhile, Evercore ISI bumped TXNM from “In-Line” to “Outperform” in February, increasing its target from $51.00 to $54.00. Around the same time, Scotiabank raised its outlook from $52.00 to $55.00 with a “Sector Perform” call.

🧮 Across the board, the stock now holds a consensus “Moderate Buy” rating. The average price target from analysts currently sits at $53.57. These outlooks reflect confidence in TXNM’s solid balance sheet, its role in regional energy expansion, and the long-term potential in both renewable and traditional transmission projects across Texas and New Mexico.

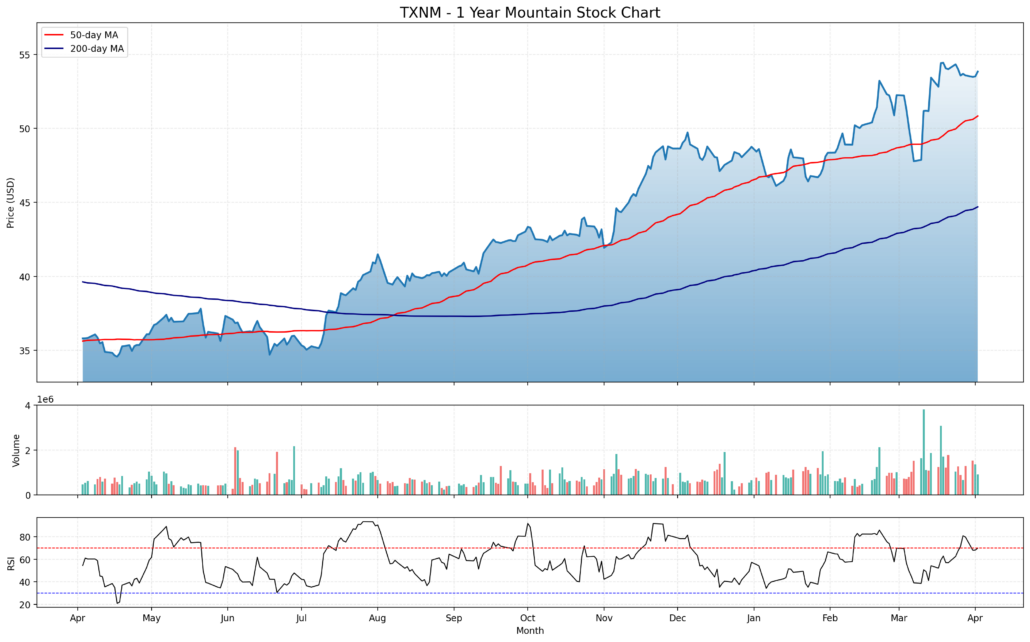

Chart Analysis

Price Trend and Moving Averages

The past year has painted a steady and convincing uptrend in the price action. Starting in the mid-$30s, the stock moved gradually higher, establishing a clear pattern of higher highs and higher lows. Around mid-July, the price began breaking above previous consolidation zones with strength, riding the support of the 50-day moving average (red line). The 50-day crossed above the 200-day moving average (blue line) shortly after, confirming a classic golden cross pattern—an indicator of sustained upward momentum. Since then, the 50-day has provided consistent support, even during pullbacks, and the stock remains comfortably above both averages heading into April.

Volume and Participation

Volume picked up notably in the second half of the chart, particularly from late February onward. This uptick in trading activity aligns with multiple surges in price, suggesting strong institutional involvement during those legs higher. The green volume bars on up days are prominent, showing commitment behind the buying. While there are red volume days, none signal distribution or sharp unwinding. The market seems to be absorbing selling pressure without any sign of panic or reversal.

RSI and Momentum

The RSI at the bottom of the chart has been mostly healthy throughout the year. It oscillated between 40 and 70 for the majority of the period, only briefly poking into overbought territory around August and again more recently in March. Importantly, during the recent push to new highs, the RSI has stayed elevated but hasn’t blown out—this often signals sustainable momentum rather than excessive froth. Periodic dips toward the 50 line have acted as resets rather than breakdowns, allowing the price to catch its breath before resuming higher.

Overall Structure

The overall price action reflects a well-supported uptrend with few signs of exhaustion. Pullbacks have been shallow, and support levels are respected. The upward slope of both moving averages and persistent momentum in the RSI suggest this move has been orderly, not speculative. Volume confirms that interest remains solid without becoming overheated. This kind of technical setup points to a market participant base that is committed, measured, and still looking for value in the current price range.

Earning Report Summary

Strong Finish to the Year

TXNM Energy closed out 2024 with numbers that showed both resilience and a clear direction. Reported earnings came in at $2.67 per diluted share, a noticeable jump compared to the prior year’s results. On an ongoing basis, the company landed at $2.74 per share—right in line with what they had projected earlier. That level of consistency tends to build trust with investors, especially in an environment where energy markets can be anything but predictable.

Revenue for the year reached $1.97 billion, and margins looked healthy, with EBITDA sitting at a solid 44.2 percent. That suggests management is keeping a tight grip on costs while still executing on their operational goals. The balance sheet remains stable, too. Long-term debt stands at $4.57 billion against equity of $2.55 billion, giving the company enough flexibility to continue investing without overextending.

Segment Highlights and Challenges

On the operational side, their New Mexico utility, PNM, saw some upside from increased customer usage—even though the summer weather was milder than usual. Meanwhile, the Texas arm, TNMP, benefitted from stronger rate recovery mechanisms. That said, both segments had to deal with higher expenses tied to capital projects. It’s the kind of trade-off that often comes with long-term investments in infrastructure, where the benefits show up gradually over time.

Looking Ahead

What really stands out is how TXNM is setting itself up for the future. They’ve laid out earnings guidance for 2025 in the range of $2.74 to $2.84 per share, keeping expectations grounded but optimistic. More notably, the company raised its five-year capital plan to $7.8 billion—a 26 percent increase over the last version. That bump is mainly geared toward expanding transmission capabilities in Texas and continuing to modernize the grid.

That level of planned investment points to a company that’s not sitting still. They’re aiming for a 12 percent increase in their regulated rate base over the next five years, with the goal of pushing long-term earnings growth into the 7 to 9 percent range. It’s an approach that blends caution with ambition, which feels about right in today’s utility landscape.

Management Team

TXNM Energy’s leadership is anchored by a team with deep roots in the utility sector, guiding the company with a steady hand through growth and transformation.

Patricia K. Collawn leads as Chairman and Chief Executive Officer. With more than 30 years in the industry, she’s held senior roles including CEO of Public Service Company of Colorado. She also brings board-level experience from across the energy and tech sectors. Her background includes an MBA from Harvard and a degree from Drake University, combining executive presence with a sharp financial mind.

Don Tarry, the company’s President and Chief Operating Officer, has over 25 years of utility experience. His career within TXNM has seen him rise through finance and operations, previously serving as CFO. He’s a Certified Public Accountant and brings a practical, numbers-driven approach to managing day-to-day operations.

Lisa Eden serves as Senior Vice President and CFO. Her career with the company spans investor relations, technology, and human resources—giving her a broad view of internal operations. She holds both bachelor’s and master’s degrees in business and is also a Chartered Financial Analyst.

Brian Iverson, who joined in 2024 as General Counsel and SVP of Regulatory and Public Policy, adds a strong legal and policy edge. He spent two decades at Black Hills Corporation, where he honed his skills in utility law and regulatory affairs.

Robert Bischoff, the company’s Controller, has been with TXNM since 2005 and oversees accounting operations. Prior to that, he worked with KPMG. He’s a CPA with a degree from the University of New Mexico.

Sabrina Greinel, Vice President and Treasurer, manages financing and risk. Her steady leadership in treasury operations has been part of the company’s DNA since 2007.

Together, this management team combines technical know-how, regulatory expertise, and a strong financial foundation—all critical for navigating a shifting energy landscape.

Valuation and Stock Performance

TXNM has seen a meaningful run in the market over the last year. The stock now trades around $53.84, climbing nearly 39 percent over the past 12 months. That kind of appreciation doesn’t happen in a vacuum—it reflects rising earnings, growing investor confidence, and the broader momentum behind infrastructure-focused utility plays.

Earnings per share jumped by 67 percent in the most recent report, while revenue saw a solid 16 percent gain. Those numbers back up the upward move in the stock price and show that fundamentals are pulling their weight. The company’s price-to-earnings ratio sits at 19.86, placing it right in the middle of the pack for utility peers. Not cheap, not overly stretched either.

Analysts currently peg the consensus 12-month price target at $53.57, and most rate the stock as a moderate buy. That suggests expectations are balanced—there’s optimism about future growth, but it’s grounded in earnings visibility and capital investment plans that are already in motion.

TXNM’s capital spending is also catching attention. Management has upped its five-year infrastructure plan to $7.8 billion. That level of investment, especially in grid upgrades and transmission lines, tends to support rate base growth and long-term earnings expansion.

Risks and Considerations

Every company carries risks, and TXNM is no exception. The most immediate factor is the regulatory environment. As a utility provider, the company is tightly regulated. Any shifts in state or federal policy—especially around pricing, emissions, or grid modernization—can influence the bottom line.

There’s also the market side of the equation. Even in regulated environments, energy demand can fluctuate. Economic slowdowns, shifts to alternative energy providers, or new entrants into the space could impact customer growth or revenue.

Another thing to watch is the company’s debt and capital spend. While TXNM’s plan to invest heavily in infrastructure is a positive for long-term growth, it does come with the challenge of balancing cash flow and financing. If energy prices dip or costs overrun, those investments could stretch liquidity.

Then there’s the transition to renewables. TXNM is moving forward on this front, but it’s a delicate balance. Too much investment in green tech without matching revenue could strain returns, while moving too slowly risks regulatory or competitive pressure.

Investors looking at the stock should weigh these risks against the company’s track record, transparency, and capital discipline.

Final Thoughts

TXNM Energy has carved out a space for itself with a blend of solid financials, experienced leadership, and a long-term strategy that looks well thought out. The stock has performed well, and analysts are generally on board with where the company is heading. It’s not without its challenges—few businesses are—but the balance of risks and rewards seems to favor continued progress.

With a large capital plan in motion, stable earnings, and a management team that knows how to execute, the path forward looks steady. The company’s ability to adapt to regulatory change and lead its infrastructure investments will be key in determining whether it can keep up this momentum. For now, the pieces are in place.