Updated April 2025

Turning Point Brands (TPB) may not be on the radar for every dividend investor, but this small-cap player has been quietly building something solid in the background. The company focuses on branded consumer products, including legacy tobacco alternatives, smoking accessories, and a growing presence in the cannabinoid and hemp markets. Known names like Zig-Zag and Stoker’s form the backbone of its offerings. While TPB has evolved to stay current, its core value still lies in consistent cash flow and a measured approach to rewarding shareholders.

Recent Events

Over the last year, TPB has experienced a resurgence. After trading sideways for a while, the stock has come alive, rising more than 111% over the past 12 months. That’s a striking move, especially compared to broader market returns during the same period. It reflects growing investor appreciation for smaller, cash-generating names that aren’t as sensitive to economic noise.

Even though quarterly revenue dipped by 3.6% year over year, the company is holding onto its margins with a firm grip. Operating margin sits at a healthy 24%, and net profit margin at 11% shows TPB isn’t letting top-line softness hurt the bottom line too much. While earnings growth for the most recent quarter saw a sharp drop, it looks more like a short-term dip than a deeper issue.

From a financial strength perspective, TPB is in a solid position. It’s sitting on $46 million in cash and has a current ratio of 4.42, which means it has ample liquidity to handle short-term obligations. Total debt stands at $261 million, which might seem hefty, but consistent free cash flow—almost $58 million annually—keeps that in check. The forward P/E ratio is sitting at 19, reflecting investor confidence without pricing in unrealistic growth expectations.

Key Dividend Metrics

💰 Forward Yield: 0.50%

📈 5-Year Avg. Yield: 0.75%

🔁 Dividend Growth: Gradually increasing

🛡️ Payout Ratio: 11.07%

📅 Next Dividend Date: April 11, 2025

🗓️ Ex-Dividend Date: March 21, 2025

Dividend Overview

Let’s be honest—TPB’s dividend isn’t going to knock anyone’s socks off. At a 0.5% yield, it’s not competing with high-income names, but that’s not really the point here. What stands out isn’t how much they’re paying, but how carefully they’re paying it.

The payout ratio is barely over 11%, which is exceptionally low. That gives the company a wide margin of safety to continue paying its dividend through all kinds of cycles. There’s no sense here that TPB is stretching to reward shareholders—it’s simply using a small slice of profits to return value without compromising other priorities.

The dividend itself has been steady. While not aggressive in its growth, the board has shown a commitment to maintaining regular payouts. The most recent quarterly dividend of $0.075 keeps the yield modest but consistent. For investors looking to layer in smaller, sustainable dividend contributors to a broader strategy, this kind of profile can add quiet strength.

Dividend Growth and Safety

This is where TPB quietly impresses. The low payout ratio is the headline, but it’s the consistency of cash flow and a strong operating margin that really drive confidence in the dividend’s sustainability.

Over the past few years, TPB has made small increases to its dividend, prioritizing predictability over big leaps. That approach fits the business model well. These aren’t high-growth, speculative operations—they’re stable, niche consumer brands that throw off dependable cash year after year. It’s exactly the kind of foundation you want when you’re evaluating dividend safety.

Even with a total debt load that’s a bit on the higher side, the company has managed it responsibly. Interest coverage remains strong, and the debt-to-equity ratio—while elevated—hasn’t raised red flags due to the strength of the underlying cash generation.

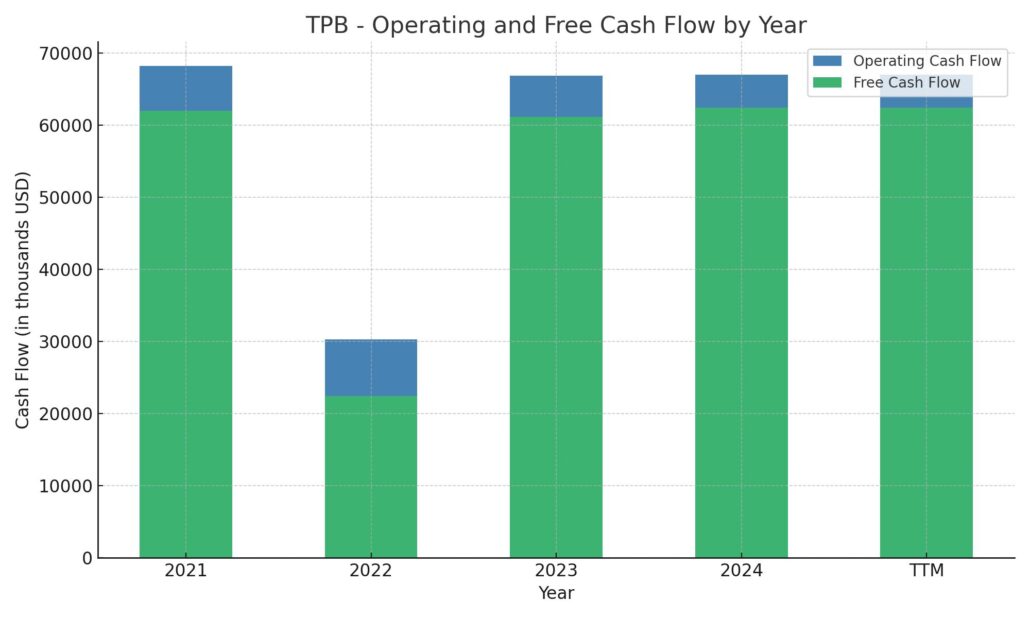

Free cash flow is comfortably outpacing the dividend. With nearly $58 million in levered free cash flow annually and a dividend commitment of just a fraction of that, TPB has plenty of room to grow its payout, should management choose to go that route.

What also adds a layer of security is the company’s relatively low beta of 0.75. That means it tends to move less than the overall market, giving it a more defensive tilt. For dividend investors looking to reduce volatility while still earning modest income, that’s a plus.

Institutional ownership is another subtle but meaningful signal. With nearly 84% of shares held by institutions, this isn’t a stock floating around in retail speculation territory. It’s supported by long-term capital that values stability and earnings consistency.

TPB may not offer the eye-popping yields that income chasers crave, but what it does offer is a reliable, well-managed dividend supported by strong fundamentals. In a market where plenty of companies overpromise and underdeliver, TPB keeps things refreshingly simple.

Cash Flow Statement

Turning Point Brands has generated steady operating cash flow over the trailing twelve months (TTM), coming in at $67 million. This marks a consistent trend when compared to the previous year’s $66.9 million and reflects strong underlying business fundamentals. The company has been able to convert earnings into real cash efficiently, with free cash flow sitting at $62.4 million—nearly identical to its operating cash flow, signaling minimal capital expenditure needs.

On the financing side, TPB returned a significant amount to shareholders and reduced debt, with cash outflows totaling $128 million. This includes $6.3 million in share repurchases. There were no new debt issuances in the period, indicating a focus on deleveraging and balance sheet strength. Investing cash flow saw a small outflow of $10.5 million, much lower than in past years, suggesting a more measured approach to capital spending. Despite the high outflows, the company maintains a cash position of just over $50 million at year-end, demonstrating sound liquidity while still prioritizing shareholder returns.

Analyst Ratings

📈 Turning Point Brands (TPB) has recently drawn renewed interest from analysts, leading to some shifts in ratings and target prices. Currently, the consensus among six analysts sits at a “Buy” rating, with an average price target of $73.33. That implies a potential upside of roughly 21.65% from the stock’s recent price around $60.

🔽 In March 2025, TPB received a downgrade from one firm, which moved its rating from “Buy” to “Hold.” This move seemed to reflect a more measured stance, possibly tied to broader market volatility or a wait-and-see approach as TPB navigates near-term industry headwinds.

🔼 On the flip side, optimism remains strong elsewhere. Alliance Global Partners started coverage on TPB with a bullish “Buy” and slapped on an $80 price target, reflecting confidence in TPB’s brand strength and category leadership. Roth MKM reiterated their Buy rating too, aiming for $70, while Craig-Hallum took their target up from $60 to $75, also keeping a “Buy” view intact.

🎯 The range in analyst targets and the overall sentiment shows that TPB is positioned favorably in the eyes of many, even if some are becoming slightly more cautious. The upgrades largely point to stable cash flow, category durability, and a shareholder-friendly capital strategy as key reasons behind the positive sentiment.

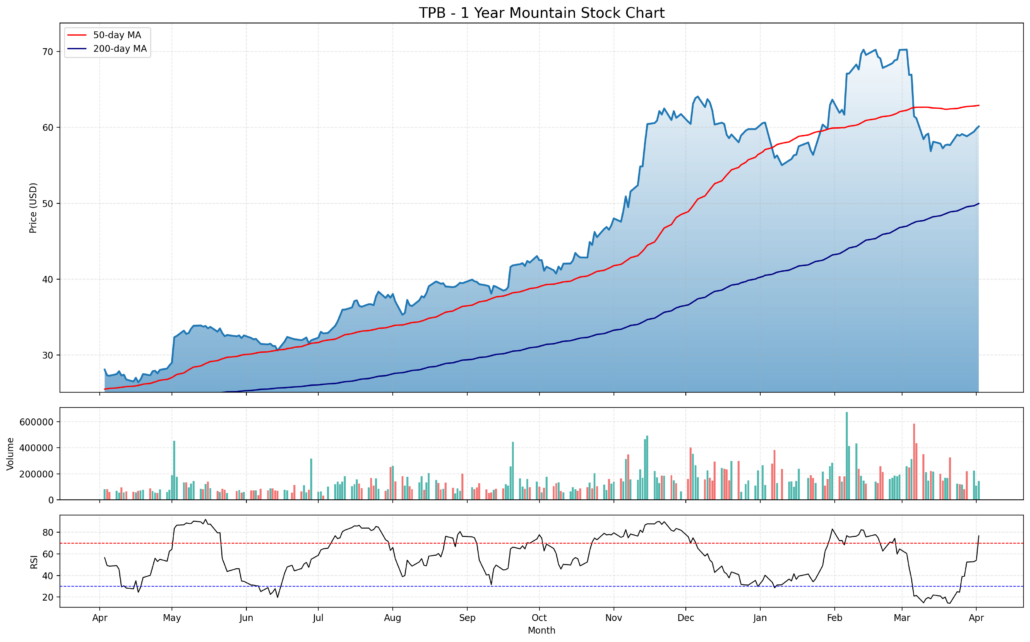

Chart Analysis

Price Trend and Moving Averages

The stock has shown a strong and steady climb over the past year, moving from the $25–30 range up to recent highs above $70 before pulling back into the low 60s. This kind of price appreciation over a 12-month period indicates growing investor confidence and a fundamental tailwind supporting the stock.

Both the 50-day and 200-day moving averages are sloping upward, a positive technical sign. The 50-day average recently started to flatten a bit after a long period of upward momentum, reflecting the recent consolidation after the sharp run-up in late Q4 and early Q1. The price still sits comfortably above the 200-day moving average, keeping the longer-term uptrend intact for now.

Volume Patterns

Volume has remained relatively stable throughout the year with periodic spikes, especially during the sharp rallies. These volume surges tend to line up with bullish price action, suggesting buyers are stepping in at key breakout points. Recent volume, however, has been more muted, which can happen when a stock is digesting gains. No clear signs of distribution or panic selling are present in this chart.

RSI and Momentum

The Relative Strength Index (RSI) dipped near oversold territory in March, briefly falling below 30 before reversing upward. That move coincided with the price bouncing off a recent low, suggesting buyers are still defending key levels. Currently, the RSI is pushing back toward the middle of its range, showing signs of recovering momentum without being overbought. Throughout the year, there were several occasions where the RSI flirted with the 70 level, confirming strong bullish sentiment during those stretches.

Overall Read

This chart tells a story of sustained growth followed by a healthy pullback. The structure remains supportive, with long-term moving averages trending higher and momentum indicators stabilizing. Volume activity doesn’t suggest any major breakdowns, and the RSI recovery shows renewed interest after a recent dip. From a technical perspective, the setup still leans constructive with no clear signs of long-term trend reversal.

Earning Report Summary

Solid Sales Momentum

Turning Point Brands wrapped up 2024 with some encouraging results, especially on the revenue side. In the fourth quarter alone, sales climbed 12.8% to $93.7 million. That kind of top-line growth was mostly fueled by strong demand in their Stoker’s line, which posted a big jump of nearly 26%, coming in at $47.8 million. Zig-Zag products also chipped in with steady performance, up just under 2% at $45.9 million. It’s clear both segments are holding their own, with one showing some real acceleration.

Looking at the full year, total net sales reached $360.7 million, a healthy 11% increase. Stoker’s continues to be a major growth engine for them, pulling in $168.3 million for the year—up 16.4%. Zig-Zag wasn’t far behind, growing by 6.6% to finish just over $192 million. Adjusted EBITDA came in at $104.5 million, which marked a 12% improvement compared to the year before. Those are the kind of numbers that show they’re running a lean and efficient operation.

A Mixed Bottom Line

Now, it wasn’t all sunshine and smooth sailing. Net income for the fourth quarter took a noticeable hit, dropping 76% to $2.4 million. But before that sends up too many red flags, it’s worth pointing out that the drop came from a one-time loss tied to discontinued operations. On an adjusted basis—which strips out the noise—net income actually climbed 12.7% to $18 million. That paints a much clearer picture of how the core business is performing.

For the full year, net income edged up 3.5% to hit $39.8 million. Adjusted net income was more impressive, rising 15.5% to $65.9 million. So while the headline number looks soft at first glance, the underlying trend shows improved profitability.

Leadership and Outlook

Management seems upbeat about where things are headed. The CEO called out strong momentum in Zig-Zag and continued market share gains for Stoker’s moist snuff products. They also sounded pretty excited about their modern oral nicotine line, with the FRE brand quadrupling its sales from the year before. The newer ALP brand is off to a good start as well.

Looking into 2025, the company expects adjusted EBITDA to land somewhere between $108 million and $113 million. They’re also projecting $60 million to $80 million in sales from the modern oral category. That’s a sign they’re confident this growth story still has room to run.

Management Team

Turning Point Brands (TPB) is guided by a seasoned leadership team with deep expertise in the consumer products space. Leading the charge is Graham A. Purdy, who stepped into the CEO role in 2022. Purdy has been with the company since 2004, holding a number of leadership positions over the years. His background spans everything from sales to operations, and during his time as COO, he played a big role in expanding key product lines like Zig-Zag and Stoker’s.

Backing him up on the financial side is Andrew Flynn, who became CFO in early 2024. While relatively new to the position, Flynn brings a strong financial toolkit to the table and is expected to help TPB maintain its disciplined capital approach as it continues expanding into new product categories.

On the board, David Glazek serves as Executive Chairman. He’s been involved with TPB in various capacities for over a decade, bringing a mix of investment experience and a strategic mindset that helps steer long-term planning. Together, the leadership team blends deep operational knowledge with a disciplined financial outlook—exactly what you want when navigating the complex consumer goods market.

Valuation and Stock Performance

Over the past year, TPB’s stock has shown serious strength. Shares have more than doubled over the last 12 months, moving from under $30 to trading in the $60 range, and briefly touching highs above $70. This kind of move speaks to a shift in sentiment as investors recognize the company’s ability to generate consistent cash flow and grow in challenging market conditions.

As of early April 2025, TPB trades around $59.66. Its trailing price-to-earnings ratio sits at 18.27, which suggests the market is valuing it at a reasonable premium given its earnings consistency and growth trajectory. Price-to-sales is around 2.68, and price-to-book is 5.26—both signals that the stock isn’t necessarily cheap, but it’s also not in bubble territory, especially when you factor in the stable earnings profile.

Dividends are modest but reliable, with a forward yield of about 0.5%. This isn’t a stock for high-income seekers, but the low payout ratio shows there’s room for future growth if the board decides to boost shareholder returns over time.

Risks and Considerations

Despite the strong financial performance and promising outlook, TPB does operate in a tightly regulated space. The company’s legacy in tobacco-related products means it’s exposed to ongoing regulatory risk. New rules or restrictions could affect certain product lines, and navigating the shifting landscape requires agility and foresight.

Consumer preferences are also evolving. While brands like Zig-Zag and Stoker’s have loyal followings, there’s always the risk that younger demographics will shift away from traditional products. TPB’s investment in modern oral nicotine products like FRE and ALP is a smart hedge, but scaling newer segments will take time and continued execution.

Financially, the company maintains healthy cash flow, but its debt load is something to monitor. The $300 million in new secured notes adds leverage, which can limit flexibility if market conditions tighten or borrowing costs rise. That said, the company’s proactive refinancing suggests they’re thinking ahead and managing risk rather than reacting to it.

Macro conditions are another wildcard. Inflation, shifting consumer spending habits, or broader market corrections could all influence TPB’s performance. While the company has shown resilience, these factors are largely out of its control.

Final Thoughts

Turning Point Brands is quietly building a name for itself as a focused, disciplined operator in a niche corner of the consumer goods world. Its legacy brands continue to perform, and new product categories are showing promising signs of life. The leadership team knows the business inside and out, and they’ve proven capable of adapting to change without losing sight of long-term goals.

The stock has already had a strong run, but with consistent free cash flow, a solid balance sheet, and a clear growth roadmap, there’s reason to believe the company is still moving in the right direction. There are always risks in this space, but the way TPB is positioning itself suggests it’s well aware of the road ahead—and it’s not just standing still.