Updated April 2025

Truxton Corporation doesn’t chase the spotlight, and frankly, it doesn’t need to. Based in Nashville, Truxton operates as a boutique private banking and trust management firm that caters to high-net-worth individuals and institutions. It’s small, focused, and quietly profitable—just the way many long-term investors like it.

With a market cap just over $214 million, TRUX flies under most radars. But when you dig into the numbers, you’ll find a company that’s quietly doing all the right things. It pulls in just under $50 million in revenue, sports a return on equity near 20%, and posts a profit margin above 38%. These are the kinds of metrics you usually see in larger, more visible institutions, not a lean operation with under 3 million shares outstanding.

And yet, it all works. Truxton is the kind of company that doesn’t make noise—but steadily delivers. Here’s what’s been happening lately, especially from the lens of a dividend-focused investor.

📌 Recent Events

Despite a choppy environment for regional banks and small-cap financials, Truxton’s performance has been smooth and steady. Revenue climbed over 17% year-over-year, and earnings rose by a similar 18%. That’s not flashy growth, but it’s clean, efficient, and sustainable.

They’re not overextending either. With $34 million in cash on hand and only $22.7 million in debt, the balance sheet is in great shape. That net cash position isn’t just a line item—it’s what allows them to keep paying and raising their dividend without blinking.

One thing that stands out is the low trading volume. This is a tightly held name, with almost no institutional ownership and minimal float. It’s not a liquid stock, but for long-term holders, that doesn’t matter much. It also comes with a low beta of 0.68, suggesting the stock is less likely to be tossed around by macro headlines. It moves on its own rhythm—and that’s appealing for those who care more about income than excitement.

📊 Key Dividend Metrics

💰 Forward Dividend Yield: 2.70%

🔄 Trailing Dividend Yield: 2.33%

📅 Ex-Dividend Date: March 11, 2025

💸 Payout Ratio: 23.65%

📈 5-Year Average Yield: 2.20%

💵 Dividend per Share (Forward): $2.00

🧾 Dividend Growth: Yes

📊 EPS (Trailing Twelve Months): $5.75

💵 Dividend Overview

For income investors, Truxton is a solid candidate. The current forward dividend yield sits at 2.70%, a touch higher than its five-year average. That’s a good sign, especially when paired with a recent dividend increase that brought the payout to $2.00 per share.

Last year’s dividend was $1.72, so this latest move represents a noticeable step up. That tells us management is confident about the business’s performance and cash flow. The trailing yield of 2.33% underscores the growth, and the bump in yield hasn’t come from price weakness—the stock has held its ground.

With a payout ratio just below 24%, there’s plenty of room for future increases. Truxton isn’t overextending itself to reward shareholders. Instead, it’s returning a healthy portion of earnings while keeping the rest to strengthen the balance sheet and grow the business.

And while the dividend is paid annually—something not every investor prefers—it’s consistent. The next ex-dividend date is already set for March of next year, so investors know what to expect and when.

📈 Dividend Growth and Safety

Here’s where Truxton really starts to shine. It’s not just paying a dividend—it’s building a track record of raising it. That latest jump from $1.72 to $2.00 per share is a 16% increase. For a company of this size, that’s significant.

More importantly, the fundamentals behind the payout are rock solid. Earnings of $5.75 per share cover the dividend more than twice over. Profit margins are comfortably high, and return on equity is strong. All of that suggests Truxton isn’t just throwing off cash—it’s doing so efficiently.

The balance sheet backs it all up. Holding more cash than debt gives the company room to maneuver. It doesn’t need to rely on borrowing or market conditions to fund dividends. That’s critical, especially for conservative investors looking to minimize risk.

And then there’s the volatility—or rather, the lack of it. With a beta well below 1.0, Truxton tends to move less than the broader market. For income investors who care about capital preservation, that lower volatility can be a big plus.

When you step back and look at the full picture, you’ve got a company with rising profits, a clean balance sheet, a growing dividend, and a management team that’s proven itself careful and consistent. It might not make a splash, but it does what it’s supposed to do: return value to shareholders, year in and year out.

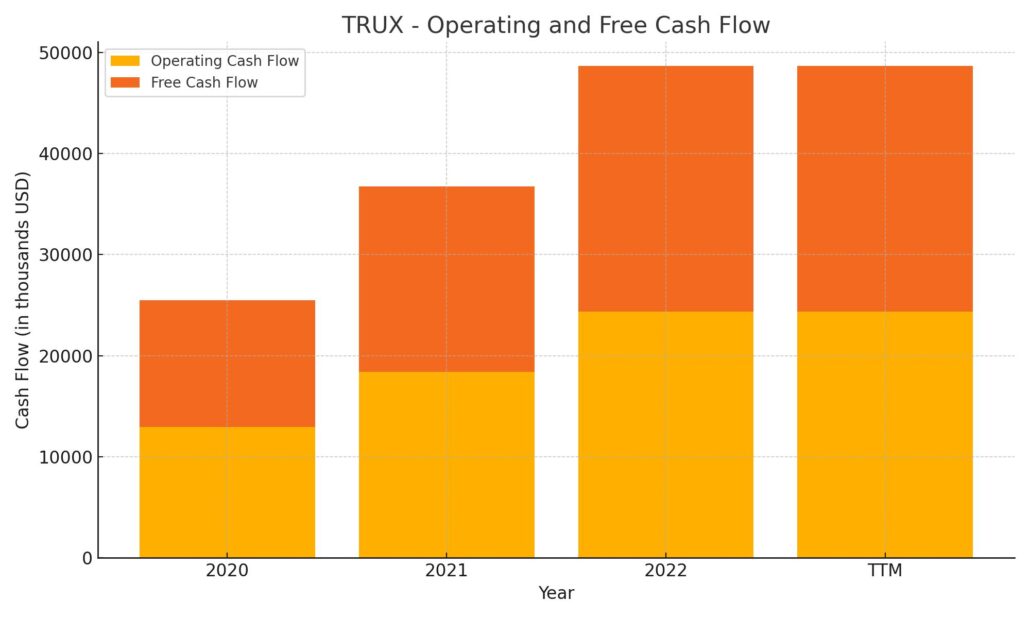

Cash Flow Statement

Truxton Corporation’s cash flow profile over the trailing twelve months shows strong operational performance with $24.4 million in operating cash flow, a meaningful increase from $18.4 million in 2022. The growth in free cash flow, now at $24.3 million, reflects the company’s ability to convert earnings into real cash, which supports both its dividend payments and internal growth initiatives without needing to stretch the balance sheet.

However, the cash flow statement also shows substantial investment activity, with $113.6 million flowing out under investing cash flow. This figure has been consistently high in previous years, pointing to ongoing reinvestment, likely in the bank’s loan portfolio or securities book, which is typical for financial institutions. On the financing side, there’s a mild net outflow of $3.7 million, which includes a $2.2 million repurchase of shares and $61.9 million in new debt issuance. Despite these moves, the ending cash position fell to $6.5 million, down sharply from prior years—likely the result of timing between investment and financing activity, rather than any stress on liquidity.

Analyst Ratings

📉 Truxton Corporation ( ) hasn’t seen any recent analyst upgrades or downgrades. This isn’t unusual for a company of its size, especially with a market cap just over $214 million and relatively low trading volume. With minimal institutional ownership and limited public-facing activity, Truxton operates more like a private firm that happens to be publicly listed.

) hasn’t seen any recent analyst upgrades or downgrades. This isn’t unusual for a company of its size, especially with a market cap just over $214 million and relatively low trading volume. With minimal institutional ownership and limited public-facing activity, Truxton operates more like a private firm that happens to be publicly listed.

🔍 Currently, there is no official consensus price target available from analysts. That’s partly because the company flies under the radar—no splashy headlines, no big sell-side coverage. But the fundamentals speak volumes. Consistent revenue growth, strong return on equity, and a well-covered dividend have caught the eye of some independent analysts and retail investors, even if major firms haven’t issued formal ratings.

📊 For now, Truxton is the kind of stock that invites close reading of financial statements rather than waiting for Wall Street opinions. While a lack of ratings may limit price momentum in the short term, it also means fewer eyes and less noise—something many long-term investors appreciate.

Chart Analysis

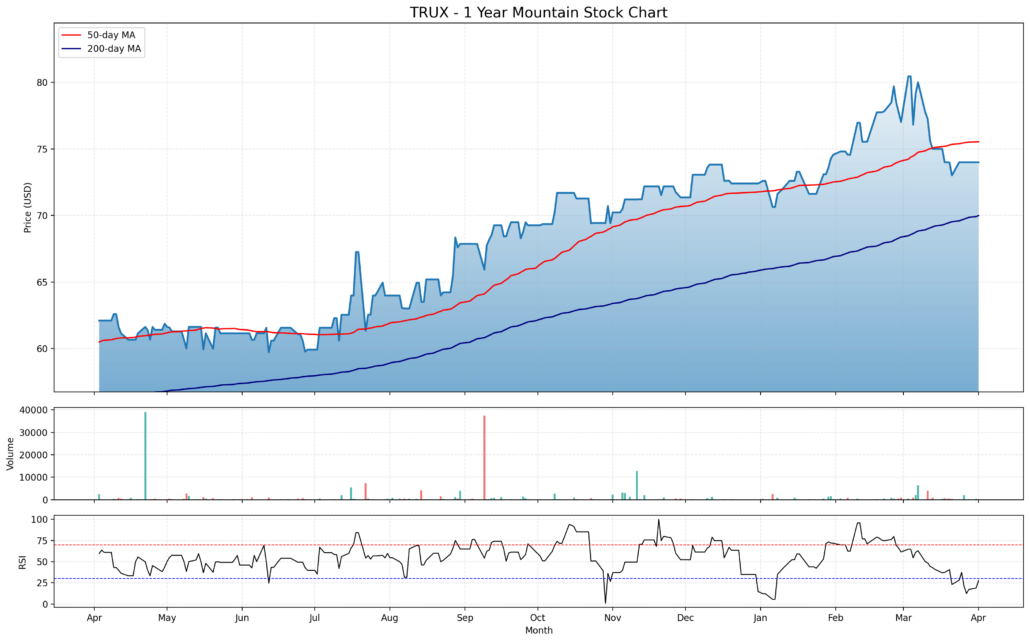

Price Trend and Moving Averages

The chart shows a clear upward trajectory for most of the past year, with a notable acceleration in the second half of the period. Price steadily climbed from the low $60s to a peak near $82 before pulling back slightly to its current level around $74. The 50-day moving average (red line) tracked closely with the price throughout the uptrend but has now started to flatten. This suggests a potential pause or short-term consolidation after a strong run. Meanwhile, the 200-day moving average (blue line) continues to rise smoothly, indicating that the broader long-term trend remains positive.

The recent decline below the 50-day moving average isn’t yet a warning sign, but it does hint that the stock could move sideways or drift slightly lower in the near term while digesting gains. However, the fact that price is still well above the 200-day line shows that the long-term structure hasn’t broken.

Volume Behavior

Volume remains thin overall, which is typical for a smaller stock like this. There were a few isolated spikes—most notably in early May and late September—but otherwise, trading remains quiet. Low volume often reflects strong hands holding the stock rather than speculative activity. No signs of distribution are evident in the volume pattern, which suggests that recent price weakness hasn’t been accompanied by heavy selling.

Relative Strength Index (RSI)

The RSI has mostly hovered in a healthy middle range between 40 and 70, with a few brief dips and overbought stretches. Notably, the RSI peaked just above 70 during the February highs and has since cooled off to the low 40s. This shows that recent selling was more about profit-taking than panic. The current RSI level is nearing the lower bound of its usual range, indicating the stock is not overbought and may be close to finding support.

In all, the chart presents a picture of a well-behaved, steadily appreciating stock that’s undergoing a natural breather. There’s no dramatic reversal here—just a pause within a longer-term uptrend.

Earning Report Summary

Truxton Corporation wrapped up 2024 on a strong note, showing steady progress across the board. The fourth quarter delivered $4.99 million in net income, or $1.74 per diluted share, which is a nice bump from $4.23 million, or $1.46 per share, during the same time last year. For the full year, earnings came in at $18.4 million, up about 5% from 2023, with earnings per share rising to $6.34.

Growth in Core Business

One of the key stories from the year was the continued growth in Truxton’s core operations. Net interest income grew 7% year-over-year, a solid improvement that speaks to how well the bank is managing its balance sheet. What really stood out, though, was the performance on the wealth management side. Revenue from that segment climbed 17%, a reflection of both client growth and deeper relationships.

Loan growth was fairly modest at 2%, with the total loan book reaching $670 million, but deposits told a different story. Deposits grew a healthy 11% year-over-year, ending the year at $866 million. That kind of deposit growth gives the bank more room to maneuver and signals customer trust in the brand.

Healthy Margins and Clean Balance Sheet

Truxton’s net interest margin ticked up to 2.79% in the fourth quarter. It’s not eye-popping, but it’s consistent and shows the bank is navigating the rate environment without pressure on spreads. Asset quality remains excellent—non-performing assets were nearly nonexistent at just $11,000, which says a lot about how carefully the bank is underwriting.

On the shareholder side, Truxton was active. They paid out $2.72 per share in dividends last year, which included a $1.00 special dividend. That kind of payout signals confidence in both the company’s earnings and its capital position. On top of that, Truxton bought back over 62,000 shares at an average price just under $67, putting around $4.2 million into those repurchases.

All in all, Truxton’s 2024 numbers tell a story of a company that isn’t chasing headlines but is steadily building value. They’ve grown earnings, rewarded shareholders, and kept the balance sheet squeaky clean—an approach that continues to work well for them.

Management Team

Truxton Corporation is led by a tightly knit leadership group with deep experience in banking, finance, and wealth management. At the top is Tom Stumb, Chairman and CEO, who has been with the company since its early days. His approach is marked by steady stewardship and a clear focus on long-term relationships with clients. Derrick Jones, who serves as President and also sits on the board, brings a legal and trust administration background, adding depth to the firm’s high-touch wealth management services.

Vice Chairman Andrew May adds strategic oversight, particularly around governance and risk, while Austin Branstetter, as CFO, keeps a close eye on the company’s financial discipline and reporting. J. Overton Colton, the Chief Administrative and Risk Officer, manages the behind-the-scenes work that keeps Truxton running smoothly, especially in the areas of compliance and internal controls. Treasury operations fall under Julie Marr, whose work ensures liquidity is managed conservatively and efficiently. Together, this team has created a structure that favors controlled growth, capital discipline, and a consistent client-first philosophy.

Valuation and Stock Performance

Truxton’s stock has followed a fairly measured path, without the kind of wide swings often seen in the financial sector. Shares currently trade at $74, up from lows in the $60 range and just shy of the 52-week high at $82. The pace of appreciation has been gradual, matching the company’s conservative approach to business.

The P/E ratio sits just over 11, which is fairly modest given the company’s consistent earnings growth and strong return on equity. The stock’s price-to-book ratio is around 2.9, which reflects investor confidence in the quality of its assets and its consistent profitability. Despite its small-cap status, Truxton has outperformed many of its larger peers on operational efficiency.

What stands out is the lack of volatility. Trading volume is low, often just a few hundred shares a day, but the stock tends to hold its value well. It doesn’t respond dramatically to short-term news or broader market shifts, which may appeal to investors looking for a smoother ride anchored in fundamentals rather than hype.

Risks and Considerations

There are a few realities to keep in mind. Truxton is concentrated geographically in the Nashville market. That focus brings expertise and customer loyalty, but it also means that any downturn in the local economy—whether driven by real estate, employment trends, or business activity—can have an outsized impact.

Another point is liquidity. With such light daily trading volume, it can be harder to get in or out of a position quickly without affecting the price. That may not matter to long-term holders, but it’s something to be aware of. Smaller-cap financials also carry a natural disadvantage when it comes to competing with bigger institutions. Truxton does a good job of differentiating itself, especially with its private client and trust services, but scale is always a factor.

Lastly, as with any bank, interest rate movements and credit risk are part of the equation. So far, Truxton has managed these areas well, but they remain core risks in the banking sector.

Final Thoughts

Truxton isn’t flashy. It’s not chasing growth for the sake of growth, and it’s not trying to be all things to all customers. That clarity of mission has worked in its favor, especially during uncertain economic periods. It has consistently grown earnings, expanded its wealth management business, and maintained exceptional asset quality.

What stands out most is the company’s discipline. From how it manages capital to how it treats shareholders through dividends and buybacks, Truxton plays the long game. For investors who value quiet consistency, a strong balance sheet, and a management team that doesn’t lose sight of its core values, this is the kind of stock that earns its place over time.