Updated April 2025

Dividend investors know that reliability is everything. And when it comes to consistency, few names carry the weight that The Toronto-Dominion Bank does. TD isn’t just one of Canada’s largest financial institutions—it’s also carved out a major presence in the U.S., making it a unique hybrid of Canadian stability and American reach.

The bank traces its roots back over 150 years and has built its reputation on conservative lending, a strong retail foundation, and a culture of prudence. That focus has made TD one of the go-to choices for income-focused investors. It doesn’t chase trends. Instead, it sticks to what it knows—managing deposits, issuing loans, and returning capital to shareholders.

Recent Events

TD’s share price has been mostly range-bound over the past year, hovering between $51 and $65. At the moment, it’s trading around $60. That flat performance might not excite growth chasers, but for income seekers, it’s been a relatively smooth ride—especially considering the broader market turbulence in recent quarters.

The latest quarterly results (Q1 of fiscal 2025) showed some familiar patterns in today’s banking environment. Revenues nudged up by 1% year-over-year, but net income dipped slightly, down just over 1%. Margins have been under pressure due to a softer lending environment and tighter interest spreads, which isn’t surprising given the shifting rate landscape.

Meanwhile, TD has opted for restraint on the acquisition front. After deciding not to proceed with the First Horizon deal last year, the bank has turned inward—focusing on optimizing its U.S. operations instead of writing big checks. That decision left more capital on hand, and, importantly for income investors, it supported the bank’s ability to continue paying and growing its dividend.

Key Dividend Metrics

💰 Forward Dividend Yield: 4.94%

📈 5-Year Average Dividend Yield: 4.40%

📆 Next Ex-Dividend Date: April 10, 2025

📬 Dividend Payment Date: April 30, 2025

💸 Trailing Dividend Yield: 6.93%

📊 Payout Ratio: 87.08%

🔁 Recent Dividend Per Share: $2.93

These numbers matter a lot if you’re building a portfolio for income. That near-5% forward yield is substantial—especially when you compare it to treasury yields or other fixed income options. And for a company with TD’s track record, it’s not just a yield—it’s a signal of long-term commitment.

Dividend Overview

TD isn’t flashy when it comes to dividend policy, but that’s part of the appeal. This is a bank that doesn’t cut corners—and it certainly doesn’t cut dividends without a fight. In fact, it hasn’t missed a dividend since the 1800s, which is the kind of consistency that’s hard to find.

The payout today sits at $2.93 annually, which puts the forward yield just under 5%. That’s noticeably higher than the bank’s five-year average of 4.40%, making it appealing for yield-focused investors. It’s also worth noting the stock’s relatively low beta of 0.82, which means it tends to be less volatile than the broader market—a bonus when you’re relying on steady dividends.

The 87% payout ratio might look high at first glance, but it’s not a red flag in this case. Canadian banks often run higher payout ratios, especially during periods of earnings softness or loan-loss provisioning. TD has the balance sheet strength to support this level, and the capital buffers in place provide further cushion.

Dividend Growth and Safety

TD has a long-standing reputation for increasing its dividend over time. Since the early 1990s, the bank has regularly raised its payout, with the only brief pause coming during the 2008 financial crisis—when regulators stepped in across the board.

More recently, the bank bumped up its dividend by 6% in late 2023. It wasn’t a massive leap, but it sent a clear message: the bank remains confident in its fundamentals and committed to shareholders. Over the past decade, TD’s dividend has grown at a compound rate of around 7%. That pace has slowed a bit in recent years, but even 3–4% annual increases are meaningful, especially when you’re starting from a base yield near 5%.

Safety-wise, there’s plenty to like. TD’s size and diversification help protect its earnings. The U.S. business adds a buffer that not every Canadian bank has, and its wealth management and wholesale operations provide additional sources of revenue. Plus, capital levels remain healthy, which means TD has flexibility even if economic conditions tighten further.

And then there’s the trust factor. TD has been through plenty of cycles—tech crashes, financial crises, pandemics—and it’s continued to reward shareholders every step of the way. That kind of consistency makes a difference when you’re investing not just for income today, but for income that can grow with you over time.

Balance Sheet Analysis

TD’s balance sheet is the financial equivalent of a well-built brick house—no flash, but solid where it counts. Total assets have grown steadily, climbing from about $1.73 trillion in 2021 to over $2.06 trillion by the end of 2024. That’s no small feat, and the growth has been matched by a healthy increase in equity, which now sits at $115 billion. While liabilities have grown too (as they naturally do in a bank this size), the rise in total capitalization and tangible book value suggests that the bank is not just bulking up but doing it responsibly.

Debt levels have risen—$460 billion as of 2024 compared to $257 billion in 2021—but in a banking context, this isn’t a red flag. That’s how banks work: they borrow to lend. What stands out here is the disciplined increase in common equity and tangible assets, pointing to a balanced expansion. With net debt now sitting around $278 billion, it’s safe to say TD isn’t maxing out the corporate credit card without keeping cash flow and capital buffers in check. If anything, this is the kind of financial structure that lets a bank sleep at night—even if interest rates toss and turn.

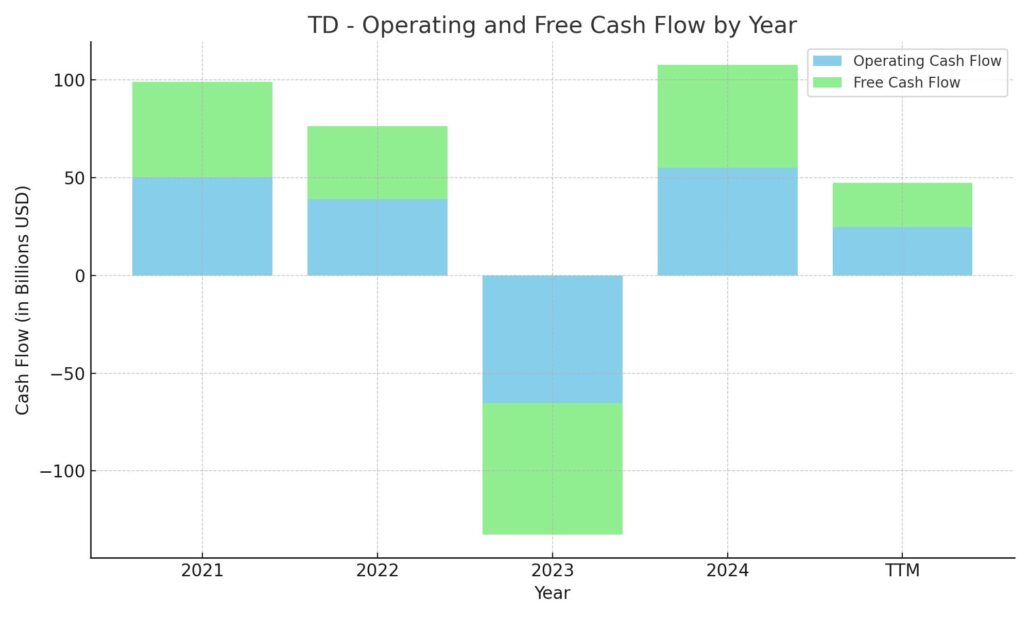

Cash Flow Statement

TD’s cash flow story over the trailing 12 months paints a picture of a bank navigating a complex environment, but with more traction than it had the year before. Operating cash flow rebounded to nearly $25 billion after a volatile swing in 2023 when it dipped into negative territory. That’s a solid sign of stabilization in core banking activities, especially considering the headwinds from interest rate shifts and regulatory capital needs. Free cash flow followed suit, landing at $22.6 billion—comfortably positive and back in the green after a temporary dip in 2023.

On the investing side, outflows narrowed significantly to around $19 billion, a drop from the $45 billion seen the year before. Financing cash flow remains negative as expected, reflecting regular debt repayments and consistent capital returns through share repurchases. In fact, TD spent over $17 billion buying back stock—keeping shareholders well fed. Despite all this activity, the bank still maintains a decent end cash position of over $6 billion. So no, TD’s not hoarding cash in a mattress, but it’s definitely not running low on it either.

Chart Analysis

Price Movement and Trends

Looking at the past year, the price has had its fair share of ups and downs but has shown signs of resilience. After dipping into the low $50s last spring and again in December, the stock has clawed its way back into the $60 range. The price found a base twice below $53, forming a solid support zone. There’s a noticeable shift in momentum since early January, with the stock trending upward and reclaiming both its 50-day and 200-day moving averages. That crossover, where the 50-day MA is climbing toward the 200-day MA, is often seen as a positive signal. It reflects a market slowly leaning toward optimism rather than fear.

Volume Behavior

Volume has been relatively stable with occasional spikes, particularly during turning points in the chart—suggesting interest picks up when the stock makes a move. Notably, higher volume accompanied the recovery phases, which helps reinforce the conviction behind those price gains. There isn’t a dramatic increase or sell-off pressure visible through volume patterns, and that consistency speaks to an investor base that’s steady rather than speculative.

RSI and Momentum

RSI tells a quieter story. There were brief moments in July, October, and again in January where momentum pushed into overbought territory, but those were short-lived. More recently, RSI is nudging upward again but remains well within a healthy range. That’s not a sign of overextension, just an indication that the market may still see room for more upside without flashing warning lights.

Altogether, this chart shows a name regaining its footing. It’s been through a choppy ride, but the signals under the hood—rising averages, stable volume, and moderated momentum—suggest this is a stock moving with purpose, not panic.

Analyst Ratings

📊 In recent months, analysts have adjusted their perspectives on Toronto-Dominion Bank (TD), reflecting a mix of optimism and caution. As of April 2, 2025, TD’s stock is trading at approximately $59.91. The consensus among analysts places the twelve-month price target at $80.50, suggesting a potential upside of about 34% from current levels.

📈 On December 18, 2024, BMO Capital shifted its stance on TD, upgrading the stock from ‘Market Perform’ to ‘Outperform’ and attaching a price target of $90. The move came on the back of stronger-than-expected financial resilience and positive momentum across the bank’s North American operations. Analysts pointed to TD’s strategic recalibration in the U.S. retail space and more disciplined capital deployment as key reasons for the more favorable outlook.

📉 Not all views are bullish, though. Earlier in December, RBC Capital reaffirmed a ‘Sector Perform’ rating but trimmed its price target from $82 to $77. The adjustment reflected macro concerns including potential headwinds in loan growth, regulatory tightening, and some earnings pressure tied to net interest margins. It wasn’t a downgrade in rating, but the revised target suggests tempered expectations moving into mid-2025.

📌 Overall, the analyst community maintains a ‘Hold’ consensus on TD. With price targets ranging from conservative to more bullish, the sentiment reflects a balanced view of TD’s ability to navigate current challenges while still holding long-term potential.

Earning Report Summary

A Mixed Start to the Year

TD’s first-quarter results for 2025 came in with a bit of everything—some solid wins and a few challenges. Net income landed at $2.8 billion, just a touch below where it was this time last year. Adjusted earnings came in stronger at $3.6 billion, showing that underneath some of the noise, the core business is still steady. Earnings per share stayed flat at $1.55, while the adjusted figure ticked up slightly to $2.02 from $2.00. Not a big leap, but not backtracking either.

Canadian Banking Holding Strong

The Canadian banking business did what it usually does—quietly putting up reliable numbers. Net income rose 3% to $1.83 billion, helped along by higher loan and deposit volumes. Revenue grew 5%, reaching $5.15 billion. There were some heavier expenses and higher provisions for credit losses that weighed on results, but overall, the domestic engine is still humming.

U.S. Retail Feeling the Strain

The U.S. side of things, though, had a rougher ride. Net income dropped sharply to $342 million, down 61% on a reported basis. Even after adjusting for a few items, it still showed a 12% drop. Some of that came from restructuring the balance sheet and spending more to tighten internal controls and compliance systems, particularly around U.S. anti-money laundering efforts. It’s a reset of sorts—short-term pain, hopefully for long-term benefit.

Wealth and Insurance Shine

One of the brighter spots was in the Wealth Management and Insurance segment. Net income rose 23% to $680 million. Strong asset growth, higher insurance premiums, and record fee-based revenue all contributed to that jump. It’s a good reminder of how diversified TD’s business really is.

Staying Well-Capitalized

TD’s capital position remains solid with a CET1 ratio of 13.1%. Provisions for credit losses increased to $1.21 billion, up from $1 billion a year ago, showing a cautious stance as the economic backdrop continues to shift. All in all, this quarter tells the story of a bank leaning on its strengths while addressing a few weaker spots with purpose.

Management Team

Toronto-Dominion Bank (TD) has recently made some key leadership changes aimed at guiding the bank through ongoing challenges while positioning it for long-term growth. As of February 1, 2025, Raymond Chun stepped into the role of Group President and CEO, taking over from Bharat Masrani. The leadership handoff came sooner than initially planned, in response to regulatory setbacks in the U.S. Chun, previously the Chief Operating Officer, brings extensive operational experience and a strong track record within the organization, with a clear focus on tightening compliance and driving operational improvements.

In the U.S. division, the bank brought in Allison Robinson as Head of Retail Distribution and Andrew Stuart to lead U.S. Consumer Products, Auto Finance, and Wealth. These shifts reflect an effort to reinvigorate TD’s American operations and address internal gaps in oversight. Meanwhile, Vladimir Shpilsky has taken the reins of Platforms and Technology—a signal that TD plans to lean harder into tech transformation as part of its future-forward strategy. These changes aim to sharpen execution, improve regulatory adherence, and realign the bank for the challenges ahead.

Valuation and Stock Performance

TD’s stock is trading at around $59.91 as of early April 2025. Analysts have set a consensus price target near $80.50, implying room for meaningful upside if the company executes on its operational improvements and resolves current issues. Despite being weighed down by headlines over regulatory settlements and slow U.S. growth, TD’s valuation doesn’t seem stretched. The stock trades at a modest multiple compared to peers, and the dividend yield continues to hover around 5%, which has helped support the share price even in volatile periods.

Financially, TD turned in a stable performance to kick off 2025. Net income came in at $2.8 billion for the quarter, mostly in line with the prior year. Adjusted net income reached $3.6 billion. On the Canadian side, things looked healthy. The Personal and Commercial Banking segment posted a 3% increase in net income to $1.83 billion, benefiting from strong deposit and loan activity. U.S. Retail, however, dragged on the overall results. Net income for that segment dropped by over 60%, hit hard by restructuring and elevated compliance spending.

The bank’s CET1 ratio of 13.1% shows that its capital position remains solid, giving it plenty of cushion to handle uncertainties. Provisions for credit losses ticked up to $1.21 billion, signaling a conservative approach as economic pressures linger. Despite the bumps, TD continues to hold firm on the fundamentals.

Risks and Considerations

There’s no ignoring the elephant in the room—TD’s recent $3.09 billion AML-related penalty in the U.S. It was a big hit, and beyond the financial cost, it also brought some lasting consequences. The agreement came with operational restrictions that limit TD’s ability to grow its U.S. business without additional approvals. That’s a significant hurdle, especially since U.S. expansion had been one of the bank’s long-term growth avenues. To move forward, TD will need to rebuild regulatory trust, and that won’t happen overnight.

Beyond compliance troubles, the broader economic picture adds another layer of uncertainty. Shifting interest rates, inflation pressures, and the chance of a soft landing—or not—could all affect the bank’s earnings power. Loan growth might slow, defaults could rise, and margins might get squeezed. There’s also rising competition from non-traditional players, especially fintechs that offer slicker digital platforms and lower overhead.

Real estate exposure is another factor to watch. Canadian banks have heavy ties to the mortgage market, and while TD is diversified, it still has significant exposure to housing. If home prices were to decline sharply, that could impact asset quality and earnings.

Lastly, reputational recovery will take time. Investors and regulators alike will be watching how TD rebuilds its governance framework. The changes in leadership and internal controls are steps in the right direction, but the market will need to see consistent follow-through.

Final Thoughts

TD remains a heavyweight in North American banking, and its long history of strong fundamentals is not in question. But it’s also clear that the bank is at a crossroads. Leadership changes have brought new energy to the top, and the willingness to confront internal shortcomings head-on is encouraging. The first quarter results weren’t spectacular, but they showed stability where it mattered.

There’s a lot riding on how well TD can restore credibility in the U.S. and demonstrate that its control environment is truly evolving. In parallel, its ability to maintain momentum in Canada and keep its wealth and insurance segments growing will be just as important.

The stock’s current valuation reflects the uncertainty but also presents potential if management executes well. Between the strong dividend yield, solid capital footing, and new leadership direction, TD is working to earn back confidence. Whether it can fully deliver remains to be seen, but it’s certainly not standing still.