Updated April 2025

Terreno Realty isn’t one of those high-profile REITs that grabs headlines, but that’s part of its charm. It’s steady, intentional, and focused—exactly what long-term dividend investors like to see. Terreno specializes in industrial real estate, with properties spread across six major coastal markets in the U.S. These are high-demand, low-supply locations—think warehouses and distribution hubs near ports and dense urban centers.

Since its founding in 2010, the company has stuck to its strategy: go where the goods are flowing and where logistics demand is surging. The result? A streamlined portfolio of over 250 properties with strong occupancy rates and growing rental income. It’s not the biggest REIT, but it plays its hand with precision—and that’s worth taking a closer look at, especially for investors who prize a growing stream of income.

Recent Events

Even as rate hikes and market volatility created headwinds for real estate in general, Terreno pushed through 2023 with strong numbers. The company ended the year with nearly 20% year-over-year revenue growth in the fourth quarter and a 32% bump in earnings over the same period.

Those results came from a few key moves: they kept occupancy high, kept lease spreads wide, and stayed focused on the right kinds of acquisitions. There’s been no shift toward risky development or overextension, which is exactly the kind of discipline income-focused investors should appreciate.

And right on cue, the board declared a fresh dividend of $0.49 per share, payable on April 4, 2025. The ex-dividend date was March 27. Another increase. Another reminder that Terreno’s strategy is working.

Key Dividend Metrics 📊

🟢 Forward Yield: 3.09%

🟡 5-Year Average Yield: 2.33%

🔵 Payout Ratio: 97.92%

🟣 Dividend Growth (5-Year CAGR): ~10%

🔴 Next Dividend Date: April 4, 2025

🟠 Ex-Dividend Date: March 27, 2025

🟤 Trailing Dividend: $1.88

Dividend Overview

Terreno’s current yield of just over 3% doesn’t scream high-yield, but it’s competitive. Especially when you consider the context—this is a REIT that’s growing its payout at a steady clip and backing that up with strong fundamentals.

The nearly 98% payout ratio might look high at first glance, but remember, REITs are built to return most of their income to shareholders. What really matters is whether that dividend is sustainable. And in Terreno’s case, it clearly is. With operating cash flow over $230 million and a lean balance sheet, they’re comfortably funding the dividend from real, recurring earnings.

There’s no gimmick here—just a well-managed REIT doing what it’s supposed to do: generate rent, grow earnings, and return that income to shareholders.

Dividend Growth and Safety

Here’s where Terreno stands out even more. Over the last five years, the company has increased its dividend at an average rate of around 10% annually. That kind of consistent growth is rare in the REIT world, particularly among industrial players.

The most recent increase was modest, about 4.3%, but it marked yet another year of uninterrupted dividend hikes. Since going public, Terreno hasn’t skipped a single increase. That’s a serious track record for anyone who’s trying to build a growing income stream.

And when you look at the structure behind the dividend, the confidence builds. Their properties are nearly full, with occupancy generally hovering around 95% or higher. Lease expirations are staggered, which smooths out risk. No single tenant makes up more than 5% of the rent roll, so the income stream is well-diversified.

Terreno also doesn’t load up on risky debt. Their debt-to-equity ratio is under 23%, and they’ve structured most of their borrowings with fixed rates. That means less vulnerability if rates stay elevated or tick higher from here.

Add it all up, and you’ve got a company that isn’t just paying a dividend—it’s nurturing it. Carefully. Strategically. And with one eye always on the long term.

So while some REITs chase yield or rely on splashy deals to prop up their numbers, Terreno plays the long game. The dividend might not be the biggest, but it’s steady, it’s growing, and it’s backed by a company that understands exactly what it does best.

For income investors looking for something dependable, that’s a formula that works.

Chart Analysis

Price Behavior and Trend Lines

Looking at the price movement over the past year, there’s a clear cyclical pattern to how this stock has traded. The stock began last spring near the $60 mark but quickly lost ground, drifting into the low $50s by May. That stretch marked the beginning of a base-building phase. For several months, the stock was stuck in a tight range between $52 and $56—an accumulation phase in hindsight—where buying interest quietly started to return.

By July, price action broke out convincingly. That move wasn’t just a bounce—it turned into a sustained uptrend that carried the stock all the way to around $69 by early September. During that run, the 50-day moving average (in red) turned sharply upward, crossing over the 200-day moving average (in blue) in what’s often referred to as a golden cross. It was a strong technical confirmation that the tide had shifted.

Then came the usual digestion phase. The price peaked, rolled over in mid-September, and began a choppy but controlled descent. What’s notable is that the 200-day line continued rising even as price dipped—suggesting underlying strength in the longer-term trend.

Moving Averages and Current Position

As of now, both the 50-day and 200-day moving averages are flattening out again, with the shorter-term average attempting to hook back upward. The price has stabilized in the $63–$65 range, which was a support level during the early stages of the previous climb. The stock is essentially retesting this zone, trying to turn prior resistance into a new base.

It’s not an explosive setup, but it’s one that reflects health. The sharp declines seen last spring have given way to higher lows and more orderly pullbacks. Volatility has decreased, and the most recent candles are tight-bodied—suggesting indecision but not weakness.

Volume Behavior

Volume has remained modest throughout most of the year, aside from a spike in December, which corresponded to a sharp upward move in price. That move didn’t result in a long-term breakout, but it signaled that there’s still active interest on the buy side when momentum returns.

Since then, volume has remained light, reflecting a market in wait-and-see mode. What’s more important is that there’s no sign of aggressive distribution. When the stock pulls back, it does so quietly—no volume spikes that would suggest sellers are trying to get out in force.

Relative Strength Index (RSI)

The RSI tells a very balanced story. Back in May and June, RSI dipped well below the 30 mark, showing that the stock was technically oversold. That marked the beginning of the price recovery. By mid-July, RSI climbed back above 70, signaling that momentum was fully back in the stock.

More recently, RSI has cooled off again and now sits just below 50. This middle ground doesn’t scream buy or sell—it just confirms the current state of consolidation. The momentum surge from January has cooled, but it hasn’t turned negative. Buyers haven’t stepped in aggressively yet, but sellers also aren’t taking control.

Candlestick Detail

The last five candlesticks are tightly grouped and mostly feature small bodies with moderate-to-long lower wicks. This kind of price action typically points to buying support on dips. Sellers have tried pushing the stock down intraday, but it keeps recovering by the close. This pattern doesn’t scream breakout, but it does hint at stability and underlying demand.

If those lower wicks continue to appear while price holds or drifts slightly higher, it may set the stage for another leg up, particularly if the 50-day average continues to curl upward.

Overall Read

The chart shows a name that’s in transition—not in a rush to move higher, but also not under pressure to break down. After a strong rebound last year and a short-term correction, the stock is now basing again just above both major moving averages. It’s a technical setup that’s worth watching, especially in environments where slow and steady often wins the race.

Balance Sheet Analysis

Terreno Realty’s balance sheet shows the kind of steady, measured growth you want to see from a real estate investment trust that isn’t trying to sprint its way to scale. Total assets have grown by over $1.8 billion over the past three years, reaching just north of $4.7 billion at the end of 2024. That’s a nearly 52% increase since 2021, mostly driven by property acquisitions in its tightly focused coastal markets. Equity growth has kept pace too, up more than $1.6 billion over the same period, showing that the company isn’t leaning heavily on debt to fund expansion. Speaking of which—debt levels have risen, but not dramatically. Total debt now sits at $823 million, up from $720 million in 2021. Not reckless, not lazy… just responsibly caffeinated.

Now, there are a few quirks in the numbers that are worth a raised eyebrow. Working capital has swung negative in 2024 to the tune of about $185 million, compared to a modest positive balance a year ago. While that might make some investors a little twitchy, it’s not all that unusual for REITs that invest heavily in hard assets and don’t carry a lot of current liabilities. Net tangible assets are up sharply, and the tangible book value has followed a similar path—now sitting at nearly $3.5 billion. Share count has climbed too, rising to about 99 million, which reflects ongoing equity raises, but not at a pace that screams dilution panic. All in all, it’s a solid, asset-heavy balance sheet with modest leverage—like a well-organized garage: not flashy, but everything has its place.

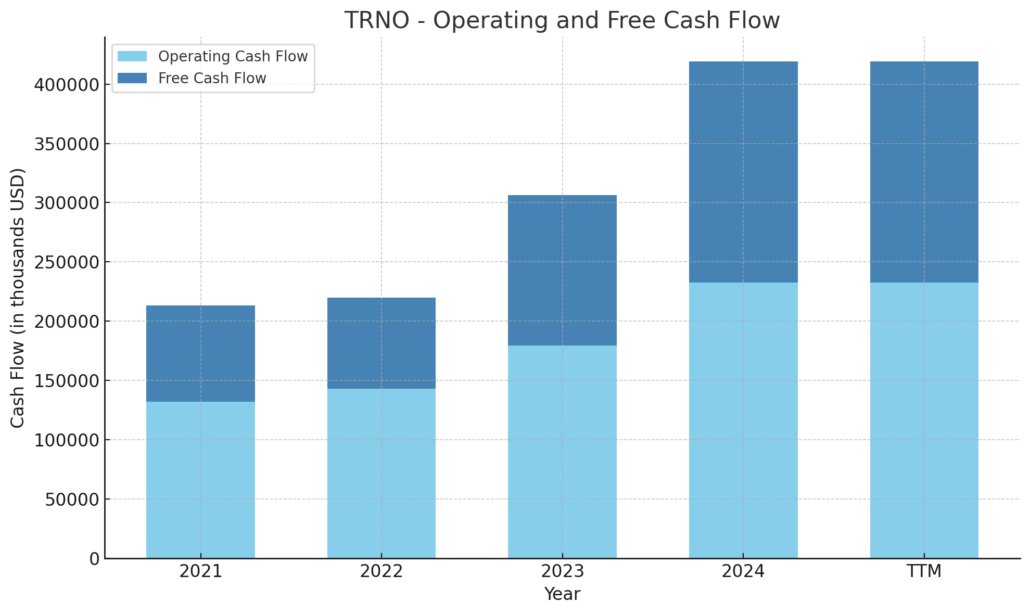

Cash Flow Statement

Terreno’s cash flow story over the trailing twelve months reflects exactly what you’d expect from a growing REIT: strong operations, aggressive investment, and well-managed financing. Operating cash flow came in at just over $232 million—its highest yet—up from $179 million the year prior. That uptick lines up with the company’s expansion and rising rental income. Free cash flow also saw a meaningful jump, rising to $186 million. This is a positive signal that, even after capital expenditures, there’s still a healthy cushion to support dividend payouts and other obligations.

On the investment side, Terreno went full throttle, with over $915 million in cash outflows—more than double the level from two years ago. That’s largely due to property acquisitions, consistent with its urban industrial strategy. Financing activity was robust as well, with over $534 million brought in, primarily from new equity issuance and some modest debt. It’s not shy about raising capital, but it’s doing so to feed cash-producing assets, not to plug holes. The year-end cash balance, while low at $18 million, isn’t unusual for a REIT—it’s a reflection of cash constantly being redeployed, rather than stockpiled.

Analyst Ratings

🟨 Terreno Realty Corporation (TRNO) has recently drawn a mix of analyst opinions, reflecting a cautious but steady outlook. As of early April 2025, 12 analysts are weighing in on the stock with a consensus rating of “Hold.” That breaks down to 4 analysts calling it a “Buy,” 7 suggesting to “Hold,” and just 1 giving it a “Sell.” The average 12-month price target sits at $69.09, which points to some modest upside from its current price around $63.

📈 In February, Goldman Sachs made a bullish move, upgrading TRNO from “Neutral” to “Buy” and bumping the price target from $65 to $77. Their optimism stemmed from the company’s continued investment in high-demand, supply-constrained coastal markets—an area where Terreno has consistently shown strength. With a well-curated portfolio and increasing demand for logistics space, the upgrade was a nod to the company’s forward momentum.

📊 Around the same time, Wedbush nudged its price target higher from $62 to $71 but kept a “Neutral” rating. They liked what they saw in terms of rental growth and management execution, though they weren’t quite ready to move off the sidelines.

🔍 Earlier in the year, Deutsche Bank began coverage with a “Hold” rating and a $60 price target. Their view reflected confidence in the company’s operations but also a note of caution due to macro uncertainties.

🔻 Barclays took a more conservative stance in mid-January, downgrading TRNO from “Overweight” to “Equalweight” and trimming their target to $60. Concerns centered on valuation getting a bit stretched and the potential headwinds from lingering interest rate pressure on the REIT sector.

Together, these updates paint a picture of a company that’s well-positioned but not without scrutiny. Analysts seem to agree it’s a name worth watching, especially if market conditions tip in its favor.

Earning Report Summary

Strong Finish to the Year

Terreno Realty wrapped up 2024 with a solid fourth quarter, showing strong momentum in both earnings and operational performance. Revenue came in at around $103.7 million for the quarter, up nicely from the $86 million range a year ago. That kind of growth doesn’t happen by accident—Terreno’s been steadily expanding in prime coastal markets and managing its properties with a sharp eye on tenant demand.

Net income reached just over $76 million in the quarter, marking a good jump from last year’s $57 million. Earnings per share ticked up to $0.76, compared to $0.67 the year before. It’s not flashy, but it’s steady growth, which is exactly what you’d want to see from a company that plays the long game. They’re not chasing short-term wins—they’re building a platform that keeps producing.

Operational Highlights

Occupancy remained rock solid at 97.4%, a slight bump from the prior quarter. What’s more impressive is the leasing strength—they locked in a nearly 27% increase in cash rents on new and renewed leases during the quarter. For the full year, that number was even stronger at 36.5%. It’s a sign that demand for their properties is still running hot, and they’ve got the locations and timing to capitalize on it.

Terreno ended the year with 299 buildings totaling about 19.3 million square feet, plus nearly 151 acres of land in the pipeline. They’ve also got six projects under development, adding close to a million square feet once completed. Almost half of that is already pre-leased, which says a lot about the strength of their tenant relationships and the markets they’re in.

Capital and Growth Moves

While they didn’t issue any shares in the final quarter, the company raised roughly $747 million over the course of the year through stock offerings. That’s a big chunk of capital going toward new investments and development—fueling long-term growth without overextending on debt.

All in all, it was a strong close to the year. Terreno stayed consistent, kept growing, and positioned itself for more ahead. Nothing flashy, but definitely effective.

Management Team

Terreno Realty Corporation is led by a seasoned team with deep roots in the real estate sector. At the helm is Chairman and Chief Executive Officer W. Blake Baird, who co-founded the company. Before starting Terreno, Baird was President of AMB Property Corporation, now known as Prologis. His extensive experience in industrial real estate has been instrumental in shaping Terreno’s strategic direction.

Serving as President and Director is Michael A. Coke, another co-founder of Terreno. Coke previously held the role of Chief Financial Officer and Executive Vice President at AMB Property Corporation. His expertise in financial management and operations has been vital in steering Terreno’s growth and ensuring its financial health.

The company’s financial operations are overseen by Executive Vice President and Chief Financial Officer Jaime J. Cannon. Cannon joined Terreno in 2010, bringing experience from his tenure at AMB Property Corporation, where he served as Vice President of Treasury. His background in finance and accounting supports Terreno’s fiscal strategies and sustainability initiatives.

Rounding out the executive team is John Tull Meyer, who holds the position of Executive Vice President and Chief Operating Officer. Meyer has been with Terreno since 2010 and previously served as Senior Vice President at AMB Property Corporation. His extensive experience in acquisitions and operations plays a crucial role in managing Terreno’s property portfolio and day-to-day activities.

This leadership team, with its collective experience and strategic vision, has been pivotal in establishing Terreno Realty Corporation as a significant player in the industrial real estate market.

Valuation and Stock Performance

Terreno Realty Corporation has experienced notable growth in its stock performance. As of April 1, 2025, the stock closed at $63.36, reflecting a modest increase from the previous close. Over the past year, the stock has seen fluctuations, reaching a 52-week high of $71.63 and a low of $53.78. This range indicates a degree of volatility, yet the overall trend suggests resilience and investor confidence.

In terms of valuation, Terreno’s market capitalization stands at approximately $6.32 billion, with an enterprise value of around $7.13 billion. The company’s price-to-earnings (P/E) ratio is 40.35, which is relatively high compared to industry averages. This elevated P/E ratio may reflect investor expectations of future earnings growth and the company’s strong position in key coastal markets.

Analyst sentiment towards Terreno is generally positive, with a consensus 12-month price target of $69.09, suggesting potential upside from the current trading price. The stock’s beta of 0.94 indicates that it has slightly less volatility than the overall market, which may appeal to investors seeking stability.

Terreno’s consistent dividend payouts further enhance its attractiveness to income-focused investors. The company has a history of regular dividend increases, reflecting its commitment to returning value to shareholders. The current dividend yield stands at approximately 2.88%, providing a steady income stream in addition to potential capital appreciation.

Overall, Terreno’s stock performance and valuation metrics suggest a company that is well-regarded in the market, with a solid track record and promising outlook.

Risks and Considerations

Investing in Terreno Realty Corporation, like any investment, comes with its set of risks and considerations. One primary concern is the company’s exposure to regional economic conditions and tenant financial health. As Terreno’s portfolio is concentrated in six major coastal U.S. markets, any economic downturns in these regions could impact occupancy rates and rental income.

Interest rate fluctuations present another risk. As a real estate investment trust, Terreno relies on debt financing for property acquisitions and development. Rising interest rates can increase borrowing costs, potentially affecting profitability and the ability to finance new projects.

Market volatility is also a factor to consider. The stock price may experience fluctuations due to broader market trends, investor sentiment, or sector-specific news. While Terreno has demonstrated resilience, external factors beyond the company’s control can influence stock performance.

Additionally, the potential impacts of climate change pose a risk to Terreno’s properties. Properties located in coastal areas may be more susceptible to extreme weather events and rising sea levels, which could lead to increased maintenance costs or property devaluation.

Investors should also be aware of the company’s dividend payout ratio, which indicates the proportion of earnings paid out as dividends. A high payout ratio may limit the company’s ability to reinvest in growth opportunities.

While Terreno has a strong management team and a solid track record, it’s essential for investors to consider these risks and conduct thorough due diligence before making investment decisions.

Final Thoughts

Terreno Realty Corporation stands out in the industrial real estate sector, thanks to its strategic focus on key coastal markets and a leadership team with extensive industry experience. The company’s consistent financial performance, combined with its commitment to shareholder returns through dividends, makes it an attractive option for investors seeking exposure to the real estate market.

However, it’s crucial to balance this optimism with an understanding of the inherent risks, including economic sensitivities, interest rate fluctuations, and environmental considerations. By staying informed and vigilant, investors can better navigate these challenges and make decisions aligned with their financial goals.

In summary, Terreno Realty Corporation presents a compelling investment opportunity, characterized by strategic growth initiatives and prudent management practices. As with any investment, thorough research and consideration of individual risk tolerance are essential to making informed decisions.