10 Highest Yielding Stocks

Get our free list of the highest yielding divdend growth stocks

10 Highest Yielding Stocks

Get our free list of the 10 highest yielding divdend growth stocks

Top 100

Top 100 ranked dividend stocks based on yield, dividend growth, income growth, value and return

Dividend Screener

Screen for stocks and REITS that meet your dividend investment criteria

Dividend Research

The most in depth research service of the best dividend growth stocks for divedend investors

Analyst Rating Reviews

Get the details behind the reason why a dividend paying stock was upgraded or downgraded

Dividend Growth Lists

Get our ratings on the Dividend Kings, Masters, Aristocrats and Contenders

REITs

View the top REITs that are consistently growing dividend payout year after year

8 Safe Dividend Stocks

Stocks with rock-solid dividends you can count on

Dividend Research Reports

Our comprehensive dividend research database encompasses over 600 stocks with at least five consecutive years of dividend increases. Our premium research reports average four pages in length and are updated quarterly to ensure accuracy and timeliness.

Each report provides in-depth analysis of dividend fundamentals, detailed chart analysis, earnings report summaries, analyst ratings, valuation metrics, and forward-looking insights.

Dividend Research Reports

Our comprehensive dividend research database encompasses over 600 stocks with at least five consecutive years of dividend increases. Our premium research reports average four pages in length and are updated quarterly to ensure accuracy and timeliness.

Each report provides in-depth analysis of dividend fundamentals, detailed chart analysis, earnings report summaries, analyst ratings, valuation metrics, and forward-looking insights.

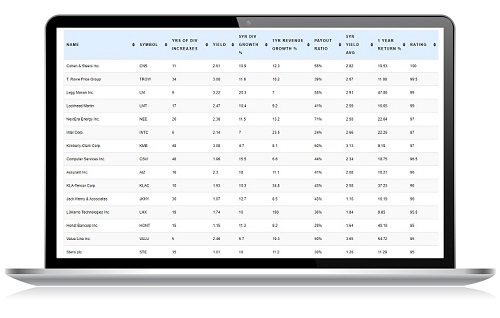

Top 100 Dividend Stocks

We sort through over 800 dividend growth stocks and rank them based on Yield, dividend growth, income growth, payout ratio and return. Our database only includes stocks that have had at least 5 years of consecutive dividend increases.

Dividend Growth Lists

Our lists of dividend growth stocks features the Dividned Kings (50 years), Masters (25 years), Aristocrats (S&P 500 only w/25 years+), and the contenders. We rank each of the dividend growth stocks with our proprietary ranking system.

Analyst Ratings

Go beyond price targets and find the reasons behind each dividend stock upgrade and downgrade.

Dividend Downgrades

Get the details behind each analyst downgrade

A Shift in the Wind at Bath & Body Works

Raymond James recently shifted its view on Bath & Body Works, lowering the stock from Outperform to Market Perform. The firm isn’t calling for a collapse or a major long-term problem, but they do see meaningful near-term challenges that limit the stock’s ability...

☕ Starbucks (SBUX): Downgraded by Jefferies Amid Concerns of Slowing Growth Momentum

Jefferies downgraded Starbucks from Hold to Underperform, lowering its price target to $76, on worries that the coffee giant's growth may be reaching its limits. Analysts are increasingly cautious about Starbucks’ ability to sustain same-store sales growth,...

🧠 ASML: Jefferies Downgrades on Cooling Demand for AI Chip Equipment

Jefferies has shifted its stance on ASML, downgrading the stock from "Buy" to "Hold" as enthusiasm around near-term growth starts to fade. The decision reflects increasing caution around semiconductor capital expenditures, particularly as customers like TSMC and...

Dividend Upgrades

Dividend stock upgrade details and analysis

KeyBanc Upgraded AT&T — Here’s Why They Think the Stock Is Undervalued

AT&T has been a quiet battleground stock for years. Investors love the dividend but have questioned growth, debt levels, and competitive pressures. After a recent pullback in the share price, KeyBanc Capital Markets stepped in with a notable call: they upgraded...

🚂 CSX Powered Ahead: BofA Upgrades Stock from Neutral to Buy on $42 Target

Bank of America Securities recently lifted its rating on CSX from Neutral to Buy, setting a new price target of $42. The upgrade follows reports of potential consolidation in the Eastern U.S. rail market, which could revalue key players like CSX. With Union Pacific...

🚂Canadian Nat’l Rail (CNI) – “Upgraded after being stuck at Market Perform – now poised to outperform”

Raymond James has upgraded Canadian National Railway from Market Perform to Outperform, highlighting a shift in sentiment driven by improving macro conditions and operational stability. The upgrade follows a solid Q1 where CNI posted a 4% increase in revenue and an 8%...

Analyst Ratings

Go beyond price targets and find the reasons behind each dividend stock upgrade and downgrade.

Recent Downgrades

Get the details behind each analyst downgrade

A Shift in the Wind at Bath & Body Works

Raymond James recently shifted its view on Bath & Body Works, lowering the stock from Outperform to Market Perform. The firm isn’t calling for a collapse or a major long-term problem, but they do see meaningful near-term challenges that limit the stock’s ability...

☕ Starbucks (SBUX): Downgraded by Jefferies Amid Concerns of Slowing Growth Momentum

Jefferies downgraded Starbucks from Hold to Underperform, lowering its price target to $76, on worries that the coffee giant's growth may be reaching its limits. Analysts are increasingly cautious about Starbucks’ ability to sustain same-store sales growth,...

🧠 ASML: Jefferies Downgrades on Cooling Demand for AI Chip Equipment

Jefferies has shifted its stance on ASML, downgrading the stock from "Buy" to "Hold" as enthusiasm around near-term growth starts to fade. The decision reflects increasing caution around semiconductor capital expenditures, particularly as customers like TSMC and...

Recent Upgrades

Dividend stock upgrade details and analysis

KeyBanc Upgraded AT&T — Here’s Why They Think the Stock Is Undervalued

AT&T has been a quiet battleground stock for years. Investors love the dividend but have questioned growth, debt levels, and competitive pressures. After a recent pullback in the share price, KeyBanc Capital Markets stepped in with a notable call: they upgraded...

🚂 CSX Powered Ahead: BofA Upgrades Stock from Neutral to Buy on $42 Target

Bank of America Securities recently lifted its rating on CSX from Neutral to Buy, setting a new price target of $42. The upgrade follows reports of potential consolidation in the Eastern U.S. rail market, which could revalue key players like CSX. With Union Pacific...

🚂Canadian Nat’l Rail (CNI) – “Upgraded after being stuck at Market Perform – now poised to outperform”

Raymond James has upgraded Canadian National Railway from Market Perform to Outperform, highlighting a shift in sentiment driven by improving macro conditions and operational stability. The upgrade follows a solid Q1 where CNI posted a 4% increase in revenue and an 8%...

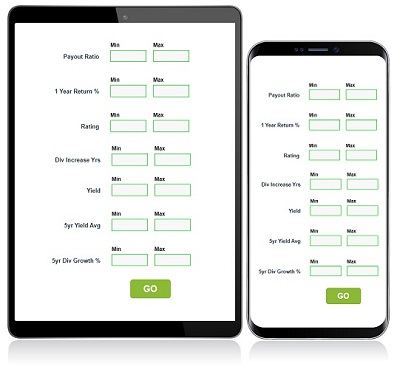

Dividend Screener

Use the power of our high growth dividend database to screen for stocks that meet your criteria. Use any of the functions we use to rank dividend payers to find matches based on your investment criteria.

Dividend Screener

Use the power of our high growth dividend database to screen for stocks that meet your criteria. Use any of the functions we use to rank dividend payers to find matches based on your investment criteria.

REITs

For REITs, we prioritize recent dividend growth, which is why this list highlights the 1-year and 3-year dividend growth rates. The payout ratio is not included since REITs must distribute a minimum of 90% of their earnings to shareholders to maintain their REIT classification.

DivRank

Premium Dividend Stock Research

DivRank

Premium Dividend Stock Research